The Greek banking system has now turned the page. It is able to look to the future and focus its efforts on growth and no longer on survival, said the CEO of Eurobank speaking today at a panel at the Delphi Economic Forum:

“To look to the future, we first had to get rid of the past. Eurobank pioneered and contributed substantially to pave the way for Greek banks to remove the great burden that the crisis bequeathed to us from their balance sheets , namely the volume of non-performing loans.

We are aiming for a single-digit NPE index as early as this year, while in 2022 we will fulfill our other major commitment, that of double-digit return on equity. Low single-digit NRE index and significant profitability, double-digit return on capital are one of the elements that make up the day after for Eurobank and the banking system. A prerequisite for strong banks that can finance the economy is their profitability and their ability to create capital.

The next day is connected with two more important goals:

First, our need and ability to finance the development process prudently and responsibly. I emphasize the words prudence and responsibility, because we must direct our resources to sustainable investment projects and sustainable businesses. And sustainability now includes one more parameter besides economic, that of the environment.

We are proving this on every scale. For small and medium-sized businesses, we supported our customers with liquidity when the pandemic broke out. From EAT programs, we channeled 70% of the resources to SMEs (5.7 billion euros). At Eurobank, as early as 2020, we immediately took a major initiative for the tourism sector, amounting to 750m euros. Major development projects are financed over time by the Greek banking system: highways, energy, telecommunications. The same happens today with the large infrastructure that the country needs. For Eurobank they are a strategic and business priority: RES, the landmark project of Elliniko, in which our Bank has a central role, as well as with our exclusive financing the electricity interconnection of Crete with Attica – all projects that are the definition of ESG funding.

The second big goal for Greek banks: not to lag behind the international developments of the sector. We make large investments in state-of-the-art technological infrastructure, contributing to the country’s wider digitization effort. In total, we invest over 300 million annually in this effort.

We provide digital services comparable to any foreign bank. And we are gradually integrating artificial intelligence and new forms of flexible work into our work model.

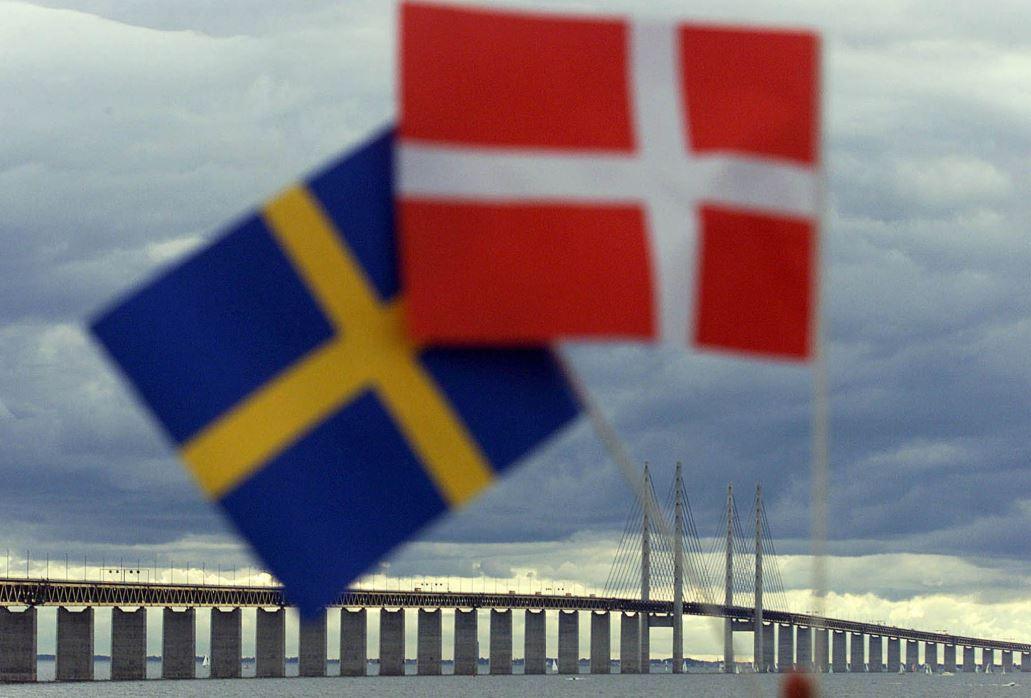

We have put all this in a single plan for Eurobank 2030. Not the bank we will have in 2030, but the bank we are building today so that in ten years from today it is in a strong competitive position, in Greece and in the region, because we are present in six countries.

The big changes come from technology and the energy transition. In the age of industry and fossil fuels, Greece had a natural handicap. In the phase of the fourth industrial revolution and renewable energy sources we have an advantage. First, because the country has highly trained human resources. Secondly, because new technologies favor a smaller size, which has always been the country’s competitive disadvantage – this is about the country and not the companies where we should pursue a larger average size to increase international competitiveness, investment opportunities, and the creation of quality employment. With strategic investments and appropriate policies, we can create good jobs and bring back to the country many of the young people who have left in recent years, giving a really strong boost to the economy and the labor market.

Thirdly, in energy, Greece has an abundance of natural renewable resources and investments in each relevant sector are already proceeding rapidly.

Sure, there is a window of opportunity. Today in the markets we see an oversupply of funds and at the same time interest in Greece, which re-entered the focus of investors after years. For tourism, but no longer just for tourism. Investments in logistics, real estate, such as Elliniko, or organized holiday homes, or new office buildings that can now attract foreign capital are indicative, as well as in internationally competitive sectors – I mention only data storage centers, because we now live in a time when data is a valuable asset, or the pharmaceutical industry, noting that an Israeli company leading the research in the treatment of Covid-19 has chosen a Greek pharmaceutical company as its first international partner for its development and testing.

We have the people, we have the funds available, including a banking system that envisages the day after, and I believe that with the experience of the crisis, and of those who led us to the crisis, we now have the knowledge not to miss the opportunity.