The annual objective cost (presumption of subsistence) based on yachts for private use, ownership or possession of the taxpayer, his spouse or persons charged to them, is estimated based on the cost of docking fees, insurance premiums, fuel, maintenance and agency, and also depends on the overall length of the vessel.

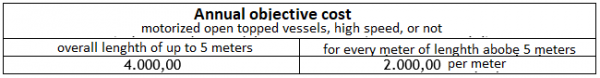

In particular, the annual objective cost for open type motor boats is determined as follows:

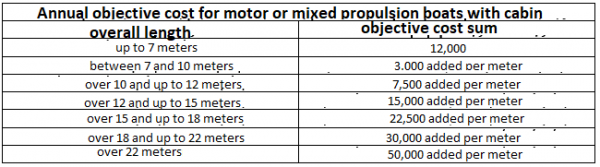

The annual objective cost for motor or mixed vessels with accommodation is determined as follows:

The objective cost is reduced:

a) At a rate of 50% for sailboats and pleasure boats that have been built or are made in Greece entirely of wood, types “trehantiri”, “boats”, “perama”, “tserniki” and “eleftheria”, which come from from the Greek naval tradition.

b) Depending on its age, ie from the year it was first registered:

aa) At a rate of 15% if a period of more than 5 and up to 10 years has elapsed

bb) At a rate of 30% if a period of more than 10 years has elapsed.

Highlights

i) The objective cost for yachts is borne by the owner or holder who is a resident of Greece regardless of the nationality of the country in whose register it is registered. Therefore, if a natural person is a permanent resident of Greece and owns or owns a boat with a foreign flag which either sails in Greek waters or is moored, or performs normal voyages abroad, he is charged with the objective cost.

ii) The objective cost of living also applies to recreational fishing vessels as well as jet skis.

iii) For vessels with a permanent crew signed for the whole or part of the year, the crew’s fee is added to the resulting objective cost.

iv) Boats for commercial use are not taken into account for the objective cost as long as they meet the conditions for their classification as commercial.

v) Immobility is recognized for private yachts. In order to prove the time of immobility, the income tax return must be accompanied by a certificate from the competent Port Authority for the exact time period (start and end time of immobility or continuation of immobility on December 31 of the year), which will result from the respective entries. relevant book to be kept by her.

vi) In boat rental companies, for the determination of the objective cost, only the boat with the highest objective cost is taken into account and only during the time that it is not leased to third parties.

vii) The objective cost of living for the cases in which the use of a yacht has been granted with a loan, is borne entirely by the user.

viii) Objective cost of yachts is not calculated, in the case of yachts owned by non-profit legal entities.