The President of the European Bank for Reconstruction and Development (EBRD), Odil Reno-Basso, is confident that more investments will be undertaken by large companies in the world in her interview in the “NEA Weekend”. Emphasizing the “rapidly growing” technological sector in Greece, but also the investment opportunities in renewable sources and the energy sector, the French head of the EBRD stated that the Bank will support such investments, as well as investments aimed at improving the business climate and strengthening private sector involvement. Reno-Basso, who will attend the Delphi Economic Forum April 6-9, also spoke about the effects of the war in Ukraine, saying the EBRD “was the first multilateral development bank to condemn Russia’s invasion.”

How can Europe deal with the new crisis and what role can the EBRD play in helping to do so?

The war in Ukraine is a human and geopolitical disaster that strikes at the heart of Europe and undermines the EBRD ‘s core values of peaceful and sustainable economic cooperation. From the beginning, the EBRD took a clear stand and was the first multilateral development bank to condemn Russia’s invasion. It was also proposed to our board of directors that Russia and Belarus be suspended from all access to the Bank’s resources. We know that war has many serious economic consequences for Europe. That is why we have decided to use EBRD know-how to help Ukraine and neighboring countries directly affected by the crisis through a € 2 billion resilience package.

How do you plan to adjust the Bank’s activities, in the short and long term, to deal with this crisis?

The Bank’s first reaction to this crisis lies in the € 2 billion resilience package. It includes measures to secure energy supply, provide assistance to municipalities and refugee management, and provide liquidity to small and medium-sized enterprises. This package is the EBRD’s initial response and we rely on our partners and donors for its rapid growth.

What worries you most in this environment of heightened economic uncertainty, high inflation, skyrocketing energy prices, high commodity prices?

The prospects for the economy of Ukraine and neighboring countries are impossible to predict at present, but in any case it is clear that the ongoing invasion of Ukraine is causing enormous economic damage both in the country and globally, and especially in the poorest countries that will suffer. again the biggest consequences. Disturbance in trade is possible and high energy prices will keep inflation high. Food prices are also expected to rise. The huge influx of refugees will weigh on neighboring countries in the short term, suggesting that labor shortages could make it difficult for any possible resumption of business in the medium term.

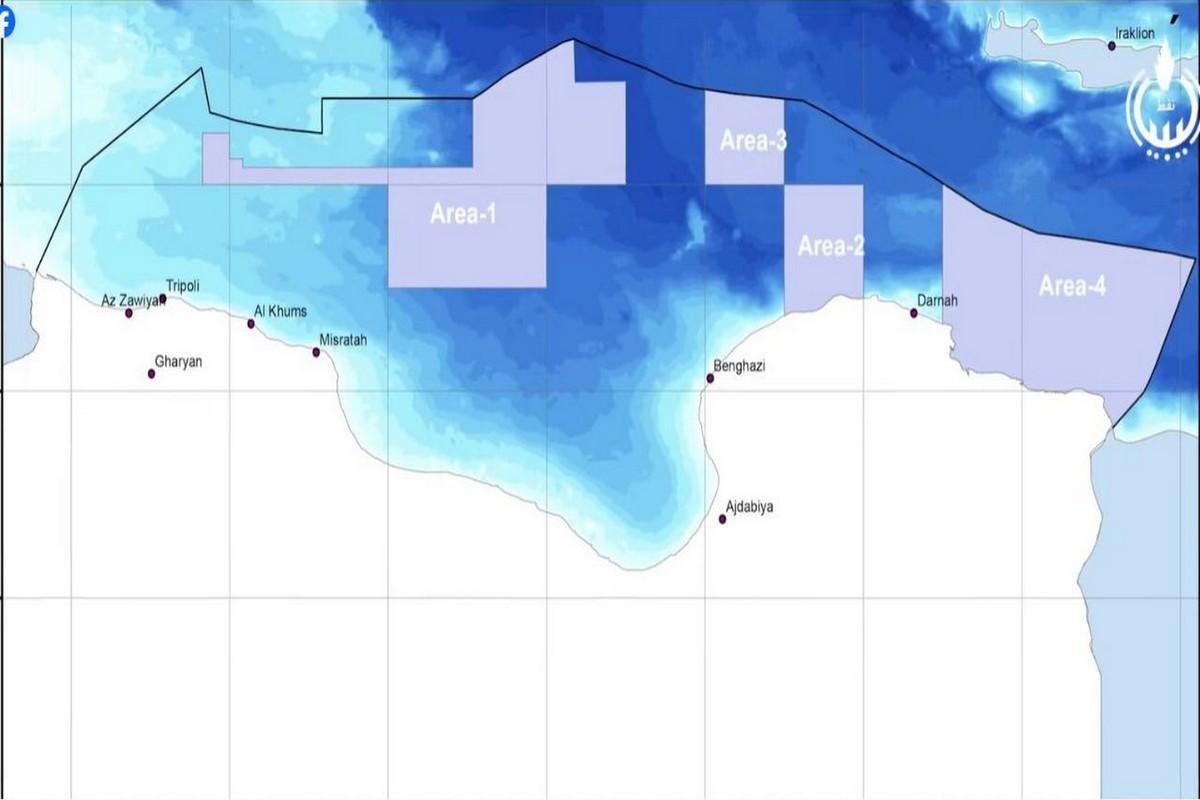

Regarding the search for new energy resources from EU countries, and from Greece, what impact do you foresee on green investments and the effort to move away from fossil fuels?

The rise in energy prices since the start of the war is a sign of the high dependence of some European countries on fossil fuels, especially gas, much of which comes from Russia. Since its inception, the EBRD has taken an ambitious approach to environmental issues. This crisis clearly shows how important this approach is. The development of renewable energy sources and energy efficiency plans will not only reduce the carbon footprint, but, strategically, will also help reduce the energy dependence of some countries where the Bank operates.

It has not been long since the approval of the new strategy for Greece. Now that Europe is experiencing a geopolitical and economic shock, how will Greece be affected and how can the EBRD contribute?

Greece is one of our top investment countries and last year was a record year as we invested 838 million euros in 20 projects. Our new strategy for Greece was adopted in 2020 and focuses heavily on private sector development, sustainable energy, infrastructure development and financial sector resilience. Like many other European countries, Greece will be affected by the war in Ukraine. Greece has great potential for renewable energy sources and we see many opportunities in the energy sector. The EBRD supports the Greek government’s plans to get rid of carbon emissions. We will also support investments aimed at improving the business climate, as well as strengthening private sector involvement.

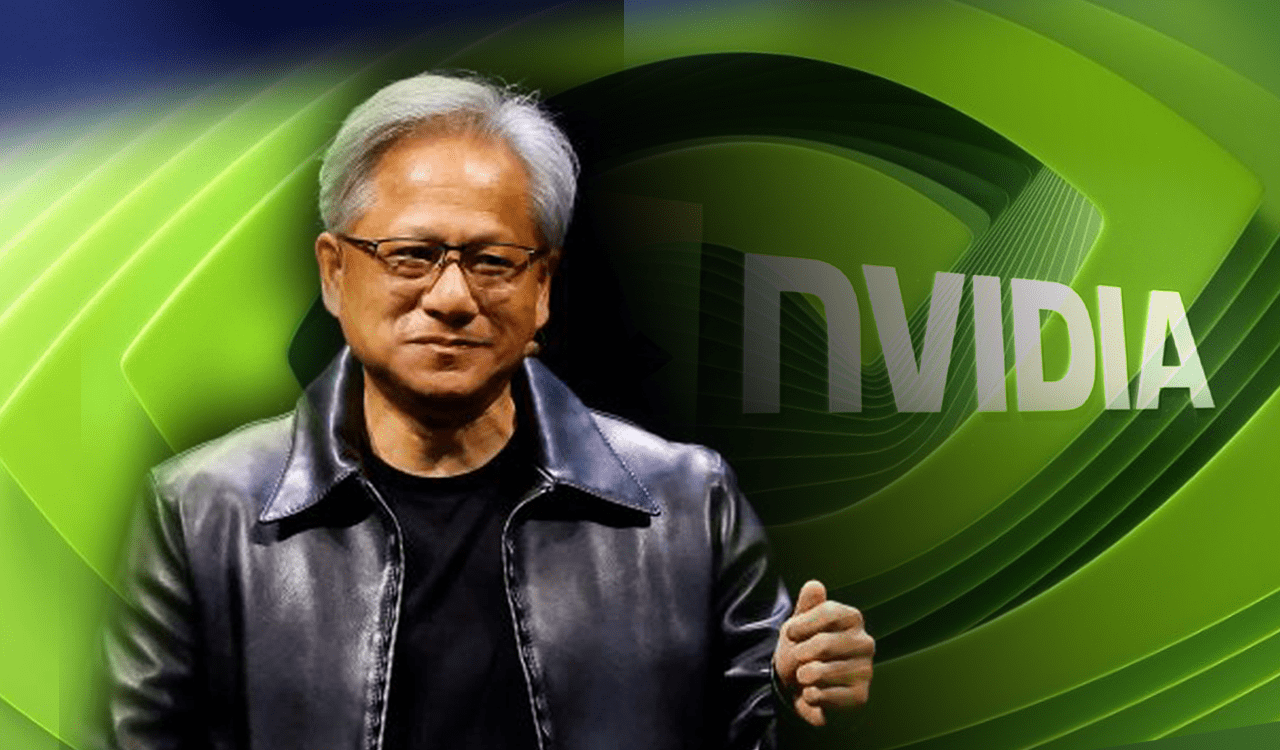

Before the war broke out in Ukraine, investments in Greece by large companies made headlines. Do you think this might stop due to the war and how could Greece attract investment?

We are pleased to see large companies worldwide, such as Pfizer, Volkswagen and Amazon, give a vote of confidence to Greece. This is very promising and a proof of the country’s potential. I am sure that this trend will continue and soon more investments will be made in various fields. Greece has already made significant efforts to reshape its economy and turn the country into an attractive investment destination. The country’s technology sector is growing rapidly. We are proud to have supported some very successful and innovative companies, such as Pollfish, Viva Wallet and Hellas Direct, as well as projects in the fields of energy, infrastructure and tourism, and the great work of Ellinikon.

![Εξοχικές κατοικίες: Πόσο κοστίζει το τ.μ. σε Μύκονο, Σαντορίνη και Πάρο [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/07/14_07_ot_exoxika_EXO.png)

![Ζάκερμπεργκ: «Κυνηγός κεφαλών» για το δικό του εργαστήριο τεχνητής νοημοσύνης [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/07/MARCK-ZUCKBRG.jpg)