The management of the Jumbo Group expects a 2% – 5% increase in sales in 2022 while the pre-tax profits are estimated to range between 210 and 240 million euros. Net profit is estimated at between € 175 million and € 195 million.

Investment plan

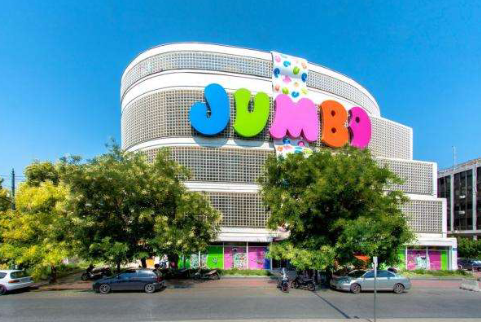

As noted in a relevant announcement, despite the particular difficulties and the extremely high cost of raw materials, the Group continues its investment program smoothly. As early as March 18, 2022, the new branch of the Group in Mytilene started operating. The Jumbo Group operates 82 stores. The 53 are located in Greece, 5 in Cyprus, 9 in Bulgaria, 15 in Romania, while by the end of the year another store will be open in Romania.

“Despite the excellent results of 2021 and the high growth rate of sales already recorded in the first quarter of 2022, the challenges for the new year as well as the climate of uncertainty remain. The situation in the supply chain shows no signs of improvement while the cost of transporting products remains at prohibitive levels. In addition, the trend in demand is not clear as it continues to be affected by epidemic outbreaks mainly during the winter months but also by inflationary pressures. In this environment of intense uncertainty, the primary goal of the management of the JUMBO Group was and remains, to preserve the Jumbo consumer model, in terms of price-quality relationship concerning the quality of services and the product offered,” the same announcement points out.

The results of 2021

2021, according to the Group, was another year in which the operation of the stores was affected by the restrictive measures due to the pandemic imposed by the governments in the countries where Jumbo operates. The Group’s sales increased by 19.87% compared to 2020 and amounted to 831.92 million euros. The gross profit margin amounted to 55.66% from 51.78% in 2020. The Group’s profit before taxes, interest and depreciation (EBITDA) amounted to 304.99 million euros from 209.06 million euros in 2020, showing an increase 46%, exceeding the figures of 2019. The Group’s net profits amounted to 216.59 million euros from 138.67 million euros, increased by 56.19% As at 31 December 2021, cash and cash equivalents and other Current financial assets of the Group were higher than the total amount of loan and lease liabilities, by € 549.14 million compared to € 359.32 million as at 31.12.2020.

Per country

Regarding the course of the first quarter 2022, the Group’s sales in March 2022 increased by 71% compared to the corresponding month last year as the network in Greece and Cyprus remained open while there was a relaxation of the measures imposed in Bulgaria and Romania. As a result, the Group’s sales, for the first quarter of 2022, increased by 22%.

In Greece, in March 2022, all stores in Greece remained open, without the imposition of new restrictions except, of course, those concerning the unvaccinated. For March 2022, the net sales of the parent company and excluding intra-company transactions, more than doubled compared to March 2021 when almost all stores in Greece remained closed. Overall for the first quarter of 2022, the parent company’s net sales – excluding intra-corporate transactions – increased by about 48% compared to the same quarter last year.

In Cyprus, all stores continued to operate without the imposition of new restrictions. Sales in March 2022 appear reduced by about 2%, compared to the corresponding month last year. Overall, sales in Cyprus for the first quarter of 2022 increased by about 27%, compared to the corresponding quarter last year.

In Bulgaria, certification checks imposed on shops ceased at the end of February. The network’s sales increased by about 42% in March 2022, compared to the corresponding month last year when the stores remained closed, by about 1/3 of March 2021. Overall sales in Bulgaria for the first quarter of 2022 are reduced by about 12% compared to the corresponding quarter last year.

In Romania, in early March, the certification checks imposed on stores ceased. The network sales recorded an increase of about 3% in March 2022, compared to the corresponding month last year. Overall sales in Romania for the first quarter of 2022 are down by about 12% compared to the corresponding last quarter.

Dividend policy

Regarding the dividend policy, as of now, the intention of the Group’s management is to maintain the dividend policy of 2021, for 2022 in its entirety. In the first stage, at the recent extraordinary general meeting, the shareholders approved the management proposal for the payment of an extraordinary financial distribution for 2022 of a gross amount of 0.3850 euros per share, ie an amount equal to 50% of the total amount distributed for 2021.