According to the recent EY CEO Outlook survey, Greek executives are adjusting their strategic investment agenda to address the impact of the COVID-19 pandemic, as well as ongoing geopolitical and socioeconomic challenges.

As EY explored how Greek CEOs are responding to the pandemic and the recovery, they found that digital transformation, new growth channels and ESG strategies constitute the core objectives in the CEO playbook. Yet, while Greek CEOs identify the ability to manage investor and stakeholder relations as a crucial element in the journey toward decarbonization, some investors and shareholders are not yet convinced of the benefits.

Greek CEOs adapt to a changed socioeconomic landscape

More than half (54%) of Greek CEOs indicate that the COVID-19 pandemic caused short-term disruption to their respective industry, while 28% of respondents observed either fundamental changes for the better or an acceleration of existing trends in their industry.

Global risks and opportunities

54% of Greek CEOs say the COVID-19 pandemic caused short-term disruption to their industry.

As executives strive to understand the new socioeconomic landscape that was fundamentally altered by the pandemic, they are adapting. Nearly two-thirds (62%) of Greek CEOs say they are adjusting their strategic investments to manage the downside risks related to geopolitical tensions. Increasing business uncertainty has prompted just over half (55%) of these executives to delay or halt planned cross-border investments. However, the new, post-pandemic world also provides significant opportunities, with 45% saying they are hedging their bets by accelerating their cross-border investments.

Meanwhile, with labor shortages and a sudden surge in consumer demand creating significant disruptions in global supply chains, CEOs have taken actions to increase operational resilience and reduce logistics costs.

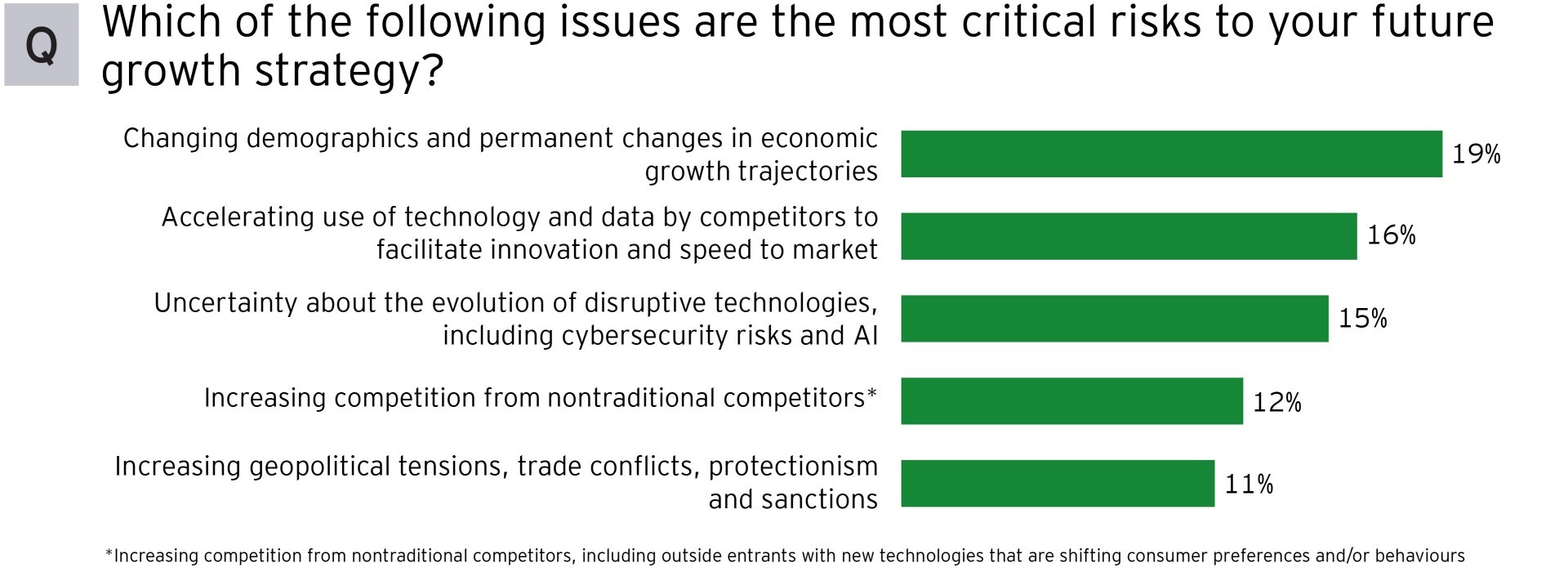

Interestingly, although increasing global tensions are top-of-mind today for Greek CEOs, they see changing demographics and economic growth trajectories, as well as the accelerating use of technology and data by competitors, and the uncertainty around the evolution of disruptive technologies, as the most critical risks to their future growth strategy.

Digital transformation and ESG strategies are key to value creation

Many Greek CEOs recognize the need to invest now to ensure future opportunities. With the pandemic accelerating the prevalence of the digital world, leading executives cite investments in digital transformation and existing businesses to accelerate organic growth and value creation, as key priorities.

Greek executives anticipate that effective data usage to develop new products and services will constitute the key source of company growth over the next five years. Additionally, with the rapid advances observed in technology (AI, automation, IoT, etc.), Greek CEOs see technology and automation as strategic drivers to improving profit margins. Automation, in particular, offers tremendous potential for CEOs looking to drive transformation in their organization and pivot employees to higher-value activities.

Investments in sustainability are also on the radar, a nod to the relative importance a majority of Greek CEOs are placing on ESG as a value driver over the next few years. They see their sustainability strategy as both a key competitive advantage and an enabler for other companies and customers to transform. However, while 75% of Greek executives say that their investors are extremely supportive of well-articulated investments, 65% say they have encountered resistance regarding their sustainability transition strategy, citing costs and potential longer-term returns, as key concerns for investors.

Greek CEOs take a conservative approach to M&A

Rapid and simultaneous changes across business and geopolitical landscapes have Greek CEOs taking a more conservative stance when it comes to dealmaking, with only 41% (versus 59% of global CEOs) saying they will actively pursue M&A in the next 12 months. Instead, Greek executives seem content reshaping their portfolios through organic investment — if they make any changes to their portfolios at all.

M&A outlook

41% of Greek CEOs say they expect to actively pursue M&A in the next 12 months.

Greek CEOs considering M&A are either looking to acquire in an adjacent sector or strengthen their ESG performance through technology, talent, new production capabilities or innovative start-ups. However, they expect an increase in hostile and competitive bidding for the assets they target, with a significant portion of that competition coming from private equity.

Bold steps are necessary for market-leading growth

Balancing stakeholder needs with creating long-term value constitutes the biggest challenge for Greek CEOs. In a rapidly changing environment, executives must help their companies survive, grow and thrive, by maintaining a balance with an ever-widening ecosystem of stakeholders, such as investors, shareholders, regulators, and several social and political entities, among others. Digital transformation and technology adoption, as well as talent attraction and retention, and a focus on ESG-related issues, also contribute to the changing role of the CEO.

While Greek CEOs seem content taking a more conservative approach in the year ahead, early and bold choices on portfolio-transforming investments, particularly acquisitions and divestments, could prove decisive. Greek CEOs unwilling to take bold steps could face intensifying headwinds in the race to capture emerging opportunities. The time to act is now. Greek CEOs who stand still could fall behind in the race for market-leading growth.

Commenting on the findings of the research, Mr. Tassos Iosifidis, Partner and Chief Consultant of Corporate Strategy and Transactions of EY Greece, said: “In this rapidly changing environment, Greek CEOs, along with the survival and growth of their businesses, ensure a balance with an ever-expanding stakeholder ecosystem. Digital transformation, attracting and retaining talent, as well as focusing on ESG issues, will be key priorities. At the same time, while a conservative approach may seem like a safe choice in today’s environment, bold investment options that are transforming the portfolio could prove to be crucial for future growth. ”

![Ακτοπλοϊα: Αυξημένη η κίνηση τον Ιούλιο παρά τα υψηλές τιμές στα εισιτήρια [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/07/EV_BR_030918_APERGIA_PNO11-1024x683-1.jpg)

![ΕΒΕΠ: Οι επιπτώσεις από μια δυσμενή εξέλιξη του «δασμολογικού πολέμου» μεταξύ ΗΠΑ – ΕΕ [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/07/ot_trump_EE25-1200x703-1-1024x600-1.jpg)