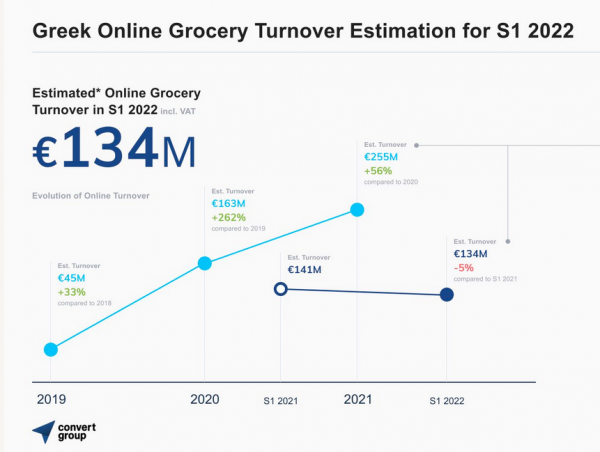

Households, seeing incomes dwindle due to inflationary pressures, are also cutting back on online supermarket purchases.

Despite a 5% increase in the average price of products in the first half of 2022 compared to the same period last year, the value of online shopping fell to €134m, down 5%. During the first half of 2021, due to the pandemic, online consumption had jumped to 141 million euros from 56.3 million euros in 2020.

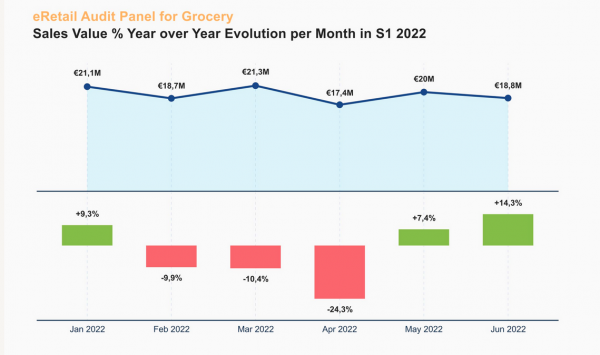

April was the worst performing month for the online supermarket industry as online sales fell by 24.3%, according to Convert Group’s six-month report.

However, the months of May and June 2022 show increasing trends with +7% and +14% respectively, possibly foreshadowing better times ahead.

Household basket emptying

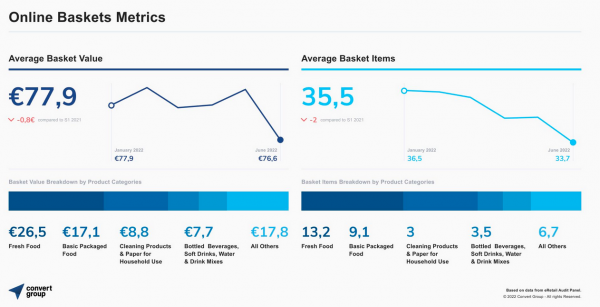

The decrease in purchases in the online supermarket sector is reflected in the average value of the shopping basket.

Although prices rose, from 77.9 euros which was the average value of the shopping basket in January this year, to 77.90 euros in the first half of 2022.

And this is because a 6% decrease is recorded in the number of products in the electronic baskets. From 36.5 items in January they “fell” to 33.7 in June.

Which items are dropped from the list?

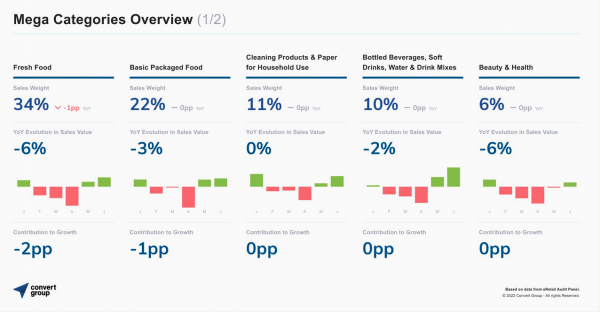

High inflation, in addition to its negative effect on overall consumption, also affects consumption habits in many product categories.

Online shoppers have reduced their spending, compared to the first half of 2021, on some non-essential items such as wines (-30%) and snacks (-7%) and more expensive fresh food such as packaged meats (-12%) and cheeses (-6%).

On the other hand, they tend to spend more on lower-cost foods such as frozen ready meals (+14%) and pasta (+14%).

Special offers have disappeared

The average discount across all product categories in the first half of 2022 was 37.9%, according to Convert Group research.

However, the percentage of products sold under any type of promotion was 16.5 percentage points lower compared to the corresponding period last year, reaching only 35.9% of the total units sold.

This indicates that fewer products or for shorter periods of time were on sale, resulting in fewer impulse purchases.

Pet products still selling

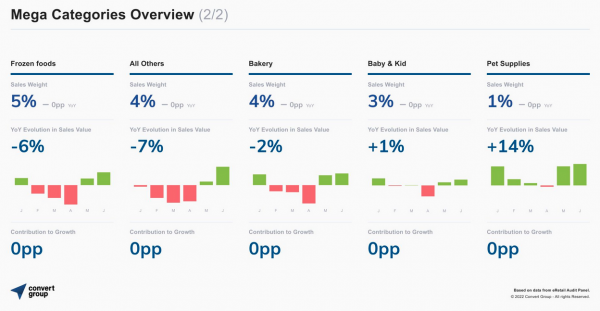

In terms of products, pet products were the only category that was substantially saved during the first six months of this year, while the category of care products and food for babies and children also showed a marginal increase.

Specifically, the value of pet product online shopping increased by 14%, while the category of care products and food for babies and children moved 1% higher.

In contrast, frozen goods and bakery products declined.

Additionally, the fresh food category continues to drive 34% of the industry’s half-year sales, followed by the packaged food category at 22% of the industry’s half-year sales.