Inflation in the euro area reached 10% in September, from 9.1% in August, according to the preliminary data released on the last of September by Eurostat.

As stated in the relevant announcement, looking at the main components of inflation in the euro area, energy is expected to have the highest annual growth rate (40.8%, compared to 38.6% in August), followed by food, alcohol and tobacco (11.8%, compared to 10.6% in August), non-energy manufactured goods (5.6%, compared to 5.1% in August) and services (4.3%, compared to 3.8% in August.

For Greece, it is estimated that inflation in September will be at 12.1%.

Oxford Economics

Preliminary estimates for September consumer prices showed a new record high in more than three decades of eurozone inflation data, Oxford Economics said in a commentary, citing data released today by Eurostat.

“With the ECB fully focused on inflation measures at present, we believe today’s rise in eurozone inflation will prompt another hawkish response, with the ECB meeting at the end of October expected to lead to a further increase by 75 basis points. ECB members are also likely to be relieved by today’s unemployment figures which showed unchanged rates in the eurozone and Germany and a slight decline in Italy, despite a deterioration in real employment trends in Italy and Germany.”

A 70-year record in Germany

Yesterday, Germany announced that inflation reached 10%, recording its highest value in the last 70 years. Similar figures were recorded only for West Germany, during the oil crisis of the 70s.

This increase is the largest since the day the euro was introduced more than 20 years ago, and it exceeded all forecasts, as temporary government measures ended and as the energy crisis worsened in Europe.

Only hawks in the ECB

Record inflation in the eurozone is adding to pressure on the European Central Bank (ECB) to further tighten monetary policy, with more members backing another big interest rate hike at its October meeting.

The ECB has raised interest rates by a total of 125 basis points (1.25 percentage points) at its last two meetings and has signaled further increases as inflation creeps towards 10%.

“My preference would be 75 basis points,” Lithuania’s central bank governor Gendiminas Simkus told Bloomberg TV on the sidelines of a conference in Vilnius. “I understand that there should be two options on the table, but a 50 bp increase is the minimum,” he added.

Ongoing discussions

The Lithuanian governor said the ECB should also start discussions as soon as possible to reduce its balance sheet, a view echoed by his Estonian counterpart Madis Müller at the same event.

The reduction of the balance sheet could be done by not reinvesting the amounts from the maturities of some bonds that the ECB has in its portfolio, worth several trillion euros.

Portugal’s central banker, Mario Centeno, and his Spanish counterpart, Pablo Hernandez de Cos, opposed the idea, fearing it would destabilize the bond market.

“Quantitative tightening could potentially cause market turmoil,” de Cos said in a speech in Bilbao. “This could jeopardize the course of policy normalization at a time when all our efforts should be focused on it.”

De Cos said the models show that the final level of ECB interest rates is lower than what markets now expect. “Based on current information, the median of the final interest rate across all models is at 2 .25%- 2.50%,” he added.

Sign for multiple increments

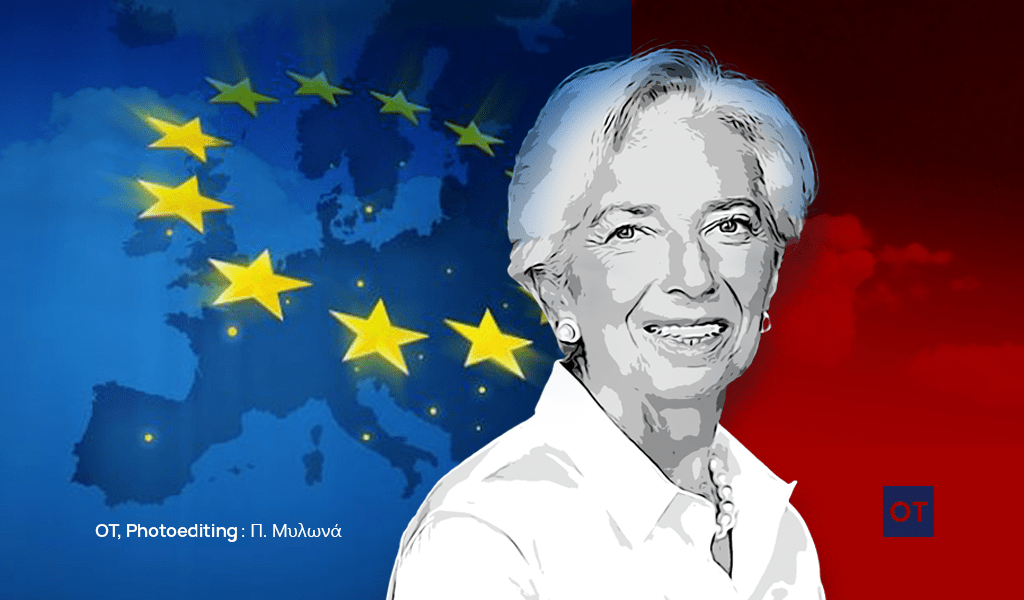

Christine Lagarde signaled multiple interest rate hikes for the board to ensure that the inflation outlook has calmed down and price levels are back close to targets.

Speaking at the Atlantic Council forum in Frankfurt, the president of the European Central Bank made it clear that the main mission of the Bank is to return inflation close to the 2% target, despite growing concerns about a possible recession in Germany and the wider Eurozone.

The primary goal is to reduce inflation

“We’re going to do what we have to do, which is to keep raising rates over the next, multiple councils. Our primary goal is not to create a recession. But our primary goal is price stability and that’s what we have to do. If we don’t do it, we will damage the economy even more,” he said.

The ECB has set a safety limit of 2% to ensure price stability, i.e. well below the levels at which inflation is “running” today. In fact, forecasts want the price index announced on Friday to show a new jump in the index to record levels, at 9.7%!

We remind you that the ECB has increased interest rates during its last two meetings, from -0.5% to 0.75%. However, at these levels they remain far, far below neutral levels, as Mrs. Lagarde explained. Analysts place neutral levels between 1% and 2%.

In today’s interview with the Reuters agency, the European central banker, Olli Rehn, predicted that the ECB will reach neutral interest rates by Christmas, which presupposes a rapid and dynamic increase in the meantime. He also spoke of an increase of 50 or even 75 basis points during the upcoming October meeting.