Morgan Stanley upgraded its recommendation for Greek shares to overweight, underlining their very positive outlook and reiterating that Greece remains its favorite choice in the Emerging Europe, Middle East and Africa (EMEA) region.

In particulare, the investment bank cites the high sensitivity of Greek banks to European Central Bank interest rate hikes, the market’s underappreciated significant balance sheet unwinding of the sector and low valuations.

It also makes special mention of Greece’s “resilient macroeconomic picture”.

Morgan Stanley analysts highlight that the macroeconomic recovery in Greece continues, and argue that the Greek economy appears more resilient compared to the rest of Europe.

They also estimate that Greece will eventually be able to avoid a technical recession (unlike the rest of the euro area), and predict GDP growth of 1.1% in 2023 and 1.9% in 2024.

The stock image

In terms of equities, Morgan Stanley “votes” for bank stock, given the relatively strong macroeconomic environment, combined with their high sensitivity to ECB interest rate hikes and reduced asset quality risks after balance sheets are liquidated.

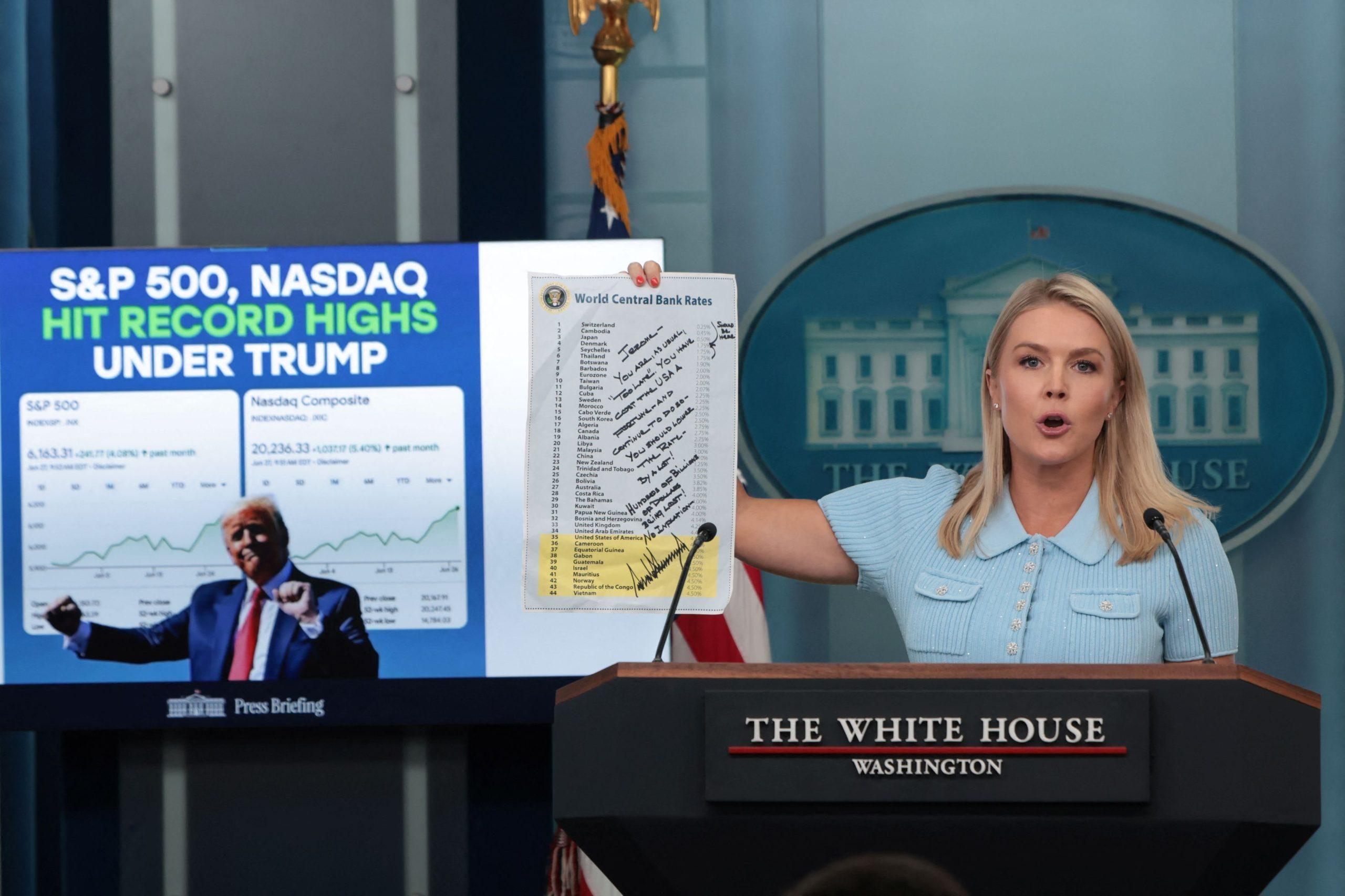

According to analysts, the expansion of Greek banks’ net interest margins has only just begun, and is set to grow, due to ECB interest rate hikes (which will reach 2.5% in 2023), with the benefit exceeding the highest provisions due to weaker asset quality risks. Greece offers the best risk-reward profile among all the regions Morgan Stanley covers.

Positive profitability dynamics, especially for banks, will support the outperformance of Greek stocks. Greek equities have outperformed other developed and emerging European markets this year, supported by a very strong positive earnings revision for 2022.

For the future, the investment bank expects further upgrades. For example, for banks, which make up 41% of the MSCI index, its analysts estimate earnings growth of ~11% on average thanks to NIM expansion when incorporating further ECB hikes in 2023.

Cheap valuations on an absolute and relative basis

Despite Greece’s resilience, deep equity discounts remain. In relation to Europe, the Greek market trades close to historically high discounts: 38% in terms of P/E and 34% in terms of dividend yield.

In relation to emerging markets, the same trend prevails (33% in P/E and 39% in dividend yield). Finally, relative to CEE markets, Greece’s valuation premium has declined recently and now Greek stocks are trading flat on a P/E basis, despite lower regulatory risks in Greece.

The 4 risks for being “overweight”

Political instability: Greece is expected to go to the polls by the summer of 2023, but early elections are not ruled out.

Based on recent opinion polls, New Democracy is still the most popular party, meaning the election is unlikely to result in any substantial change in policy direction. In addition, the Greek prime minister has so far rejected the possibility of his resignation and the main scenario of its economists is the continuation of the current government until the end of its term.

Tourism and impact on GDP growth: One of the major risks stems from Greece’s heavy reliance on tourism – around 15% of its GDP. Higher inflation worldwide will likely lead to a decrease in consumer spending, which will ultimately negatively affect tourism flows and, consequently, Greece’s GDP.

EU capital absorption to be weaker than expected, leading to lower GDP growth.

Deeper risks of a recession in the euro area: More energy supply disruptions would further reduce activity and euro area GDP would contract by 1.0% annually in 2023. However, on a relative basis, Greece could still outperform the other Central and Eastern European countries given its lower dependence on natural gas.