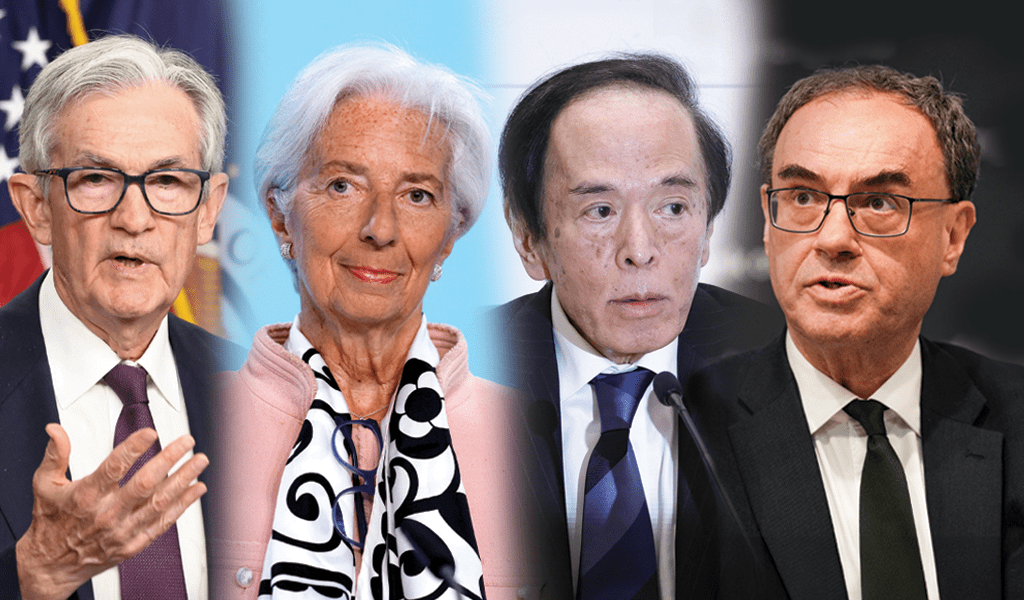

Bank of Greece (BoG) Governor Yannis Stournaras again urged restraint by his fellow central bankers on the European Central Bank’s governing council in taking measures to counter and overturn unprecedented – by Euro zone standards – inflation, saying the risk of recession should be more prominently factored into monetary policy decisions.

The influential Greek central banker, considered a “dove” on the ECB governing council, made the statement in a recent interview given to the German financial daily Handelsbatt and financial reporter Gerd Höhler, where he also downplayed the prospect of another debt crisis engulfing Greece due to rising interest rates.

In repeating a leitmotif of Greek central bankers dating back decades, he also urged prudence in fiscal policy and continued structural reforms.

The interview reads:

Mr. Stournaras, inflation is holding up more stubbornly than most economists expected. Does that surprise you?

Inflation readings have repeatedly surprised central bankers in a negative way. No one could have predicted the unfortunate combination of supply-side shocks that hit the economy in successive waves: the pandemic, the war in Ukraine, and the rise in fuel and commodity prices. Nevertheless, several factors will contribute to easing inflationary pressures in the coming months, despite ongoing geopolitical uncertainty.

What are the reasons?

Supply distortions are gradually easing. At the same time, the rise in energy and commodity prices is weakening. Slowing growth is reducing inflationary pressure. The ongoing normalization of monetary policy will bring inflation back to our target.

Should the ECB counteract with further interest rate hikes, in order to achieve the inflation target of 2%?

Monetary policy is not particularly adept at dealing with supply shocks, but it can help – and has helped – to ease the adjustment to such shocks through appropriate normalization steps. Further rate increases will need to be gradual, depending on the inflation outlook and taking into account recession risks and financial stability implications.

What other tools do we have to contain inflation?

Energy policy, with targeted fiscal measures, should complement monetary policy in containing inflation, at least for the period when energy prices are being weaponized by Russia and energy markets remain volatile, uncertain, and dysfunctional. I am thinking of measures to diversify energy supplies, promote efficient energy consumption, and address excessive energy prices.

How do you assess the EU’s policy in dealing with the energy crisis?

The EU has taken concrete steps with the REPowerEU plan and specific emergency measures to strengthen the Union’s resilience and autonomy in relation to the current and future energy crises. However, we need to further intensify the coordination of national policies to jointly achieve affordable and competitive energy prices for our citizens and businesses.

Greece has just been released from tighter supervision by the EU Commission. Does the energy crisis threaten your country with new turbulence?

No. Greece is much more resilient today than it was ten years ago. Fiscal imbalances have been corrected, the country’s gross financing needs will remain the lowest in the euro zone for several years to come, and prudent use of funds from the EU’s RRF reconstruction fund will boost potential output. Nonetheless, we must remain vigilant, especially with regard to the impact of inflation on competitiveness and the current account balance.

What are the consequences of higher key interest rates for refinancing?

The normalization of monetary policy is likely to have a negative impact on debt servicing costs. But the consequences are limited because of the special characteristics of Greek government debt. Greek government debt has an extremely long average maturity and a high proportion of fixed-rate debt with low interest rates.

So you don’t see any threat to debt sustainability?

No, not immediately. But in the longer term, containing sustainability risks will depend on continuing prudent fiscal policies and implementing structural reforms.

What structural reforms are you thinking of?

Three examples: First, delays in the administration of justice should be eliminated by digitizing the judiciary. Second, we need to improve efficiency in the public sector through performance evaluations. And third, we should promote the labor force participation of women. It is very low in our country compared to the rest of Europe. One way to change that is to create more daycare places. Furthermore, action needs to be taken in education and healthcare. Reforms in state education and health do not only contribute to efficiency but also to social justice

Do you fear that private households and companies will have payment difficulties due to rising interest rates on loans?

So far, our banks have raised lending rates in Greece only to a limited extent, by 50 to 100 basis points compared with the average for the previous year. Given the tightening of monetary policy, there might be a bit more to come. But I think only some borrowers will be in trouble, namely those that are still recovering from the pandemic and have to service floating-rate loans.

What would new loan defaults mean for Greek banks?

The combined shock of rising interest rates and high inflation and energy prices could affect the asset quality of Greek lenders, especially in 2023. Importantly, the measures taken by the Greek government will shore up the balance sheets of vulnerable households and companies. This should stem the inflow of new defaults. We expect the impact to be limited and manageable.

Do you see a risk of recession in Greece?

Gross domestic product is growing robustly. This year, we expect growth of 6.2 percent. GDP will continue to grow next year, albeit at a slower pace. Business profits and compensation of employees have increased. We expect a 1.5 percent increase, but no recession. The main reasons for the slowdown in growth are the expected decline in economic activity in the rest of the euro area and the normalization of private consumption at home, as fiscal support for households is expected to come to an end following the pandemic and the energy crisis.

Greek government bonds are still rated below investment grade by rating agencies. When will Greece regain an investment-grade rating?

In recent years, the Greek economy has proven resilient to numerous shocks. The overall asset quality of the banking sector has improved significantly following the sharp reduction in non-performing loans. Public debt is declining steeply, and we expect primary budget surpluses from 2023 onward. If Greece continues its positive fiscal performance and pushes ahead with the implementation of structural reforms, we could see it upgraded to investment grade in 2023, despite the general global uncertainty.