The government seems to be considering reducing the cash limit to 200 euros, from 500 euros today.

According to information, the government’s goal is to further strengthen e-transactions, which have been on the rise in recent years.

It is worth noting that in 2019, electronic transactions reached 40.6 billion euros, 44.7 billion euros in 2020, and 53 billion euros in 2021, while calculations for 2022 speak of an amount that reaches 66 billion euros

The Ministry of Finance reasonably estimates that the increase in electronic transactions will to a certain extent deal with tax evasion, which is a chronic plague for the Greek economy. Within the Finance Ministry’s corridors there is the thought of obliging businesses to spend a greater part of their daily turnover through POS or other electronic transactions programs.

Plan

In particular, the reduction of the limit up to which the use of cash is allowed to carry out a financial transaction concerning the purchase of products or the provision of services is being considered.

This limit is expected to be reduced from 500 to 200 euros for each transaction. Thus, amounts above the new limit of 200 euros related to the sale of goods or the provision of services to individuals should be paid exclusively electronically. Essentially, the use of payment means by card (or any other electronic means), bank transfer, payment through a payment account, but also the use of e-Wallet is expected to qualify.

The next move

The success of the new application “appodixi”, in which taxpayers scan and send problematic receipts to the tax administration, as well as the increase in electronic transactions, leads the Ministry of Finance to take further measures. The government plans to extend the mandatory acceptance of debit or credit card payments, through POS machines, to all business activities.

At the same time, within the next few months, it is expected that the plan for the new type of cash registers and POS that will transfer real-time information on the receipts issued by shops and businesses will finally move forward.

According to the design of Independent Authority for Public REvenue-AADE, cash registers and POS essentially become an instrument for the complete recording of all data in real time and there is the possibility of direct cross-checking by the control mechanisms.

Cash registers and POS will not work autonomously for debit transactions, i.e. for card payments, the payment amount will not be allowed to be typed into the POS. The amount will come out of the cash register.

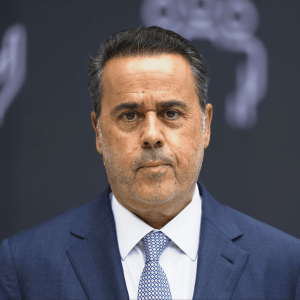

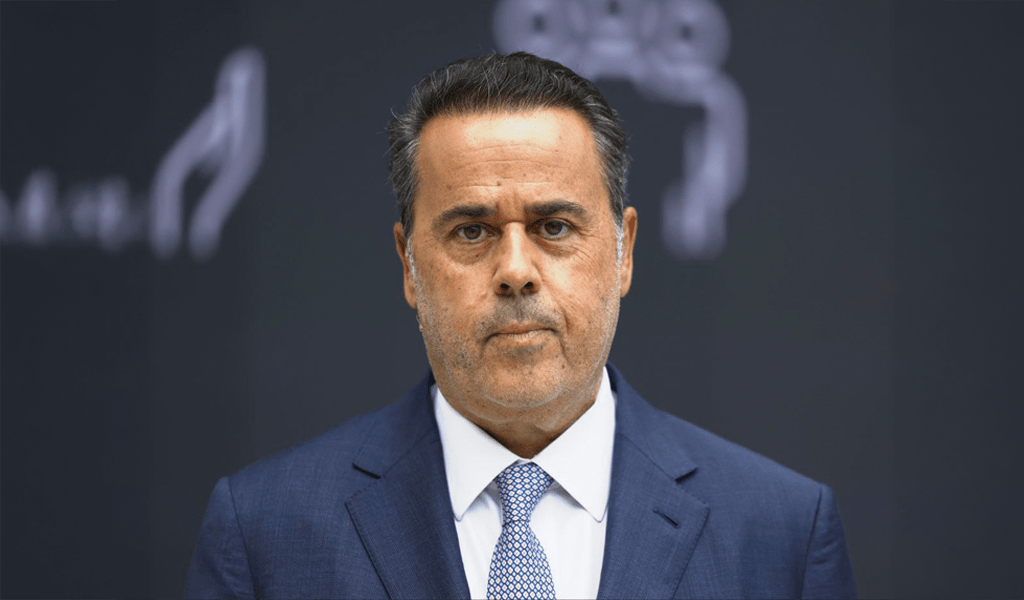

It should be noted that with two decisions signed by the governor of AADE Giorgos Pitsilis at the end of 2022, technical specifications for two new types of Tax Electronic Mechanism are defined, while at the same time the interface specifications between cash registers and POS are improved.

Target

The tax authorities will have insight into the amount and time of issuance of retail sales receipts and the method of payment by the customer. Cases of income concealment and VAT theft by those who do not issue receipts will be detected.

From the checks so far it has been found that many businesses in their transactions with customers, although they use credit or debit cards, do not issue the retail receipt.