Morgan Stanley predicts that the Greek economy will maintain the development momentum, estimating that the GDP will continue to grow this year and next year as well. And it emphasizes that the strong performance combined with the continuation of political and fiscal consolidation, will lead Greece to reach investment grade in the first half of next year, or even earlier. In addition, the analysts of the American bank expect a new record of investments in the country.

In particular, in its note, Morgan Stanley recalls that in the first elections held last month, New Democracy won 146 seats, just five seats short of an absolute majority. According to her calculations, if New Democracy puts up a show similar to the one on May 21, it could win around 180 seats in parliament.

Investment grade for sure

“The return to investment grade is almost certain. A New Democracy majority government will continue to lead the country on its path towards fiscal consolidation and the implementation of the RRF. Rating agencies such as Moody’s have commented on the outcome of the election as credit positive, and we believe that economic fundamentals are on track for Greece to be upgraded to investment grade in the coming months. We maintain our view that Greece will be able to reach investment-grade status from three of the major houses in the first half of 2024, but we see the prospect of an earlier upgrade if growth surprises to the upside relative to our expectations,” estimates bank.

Strong growth

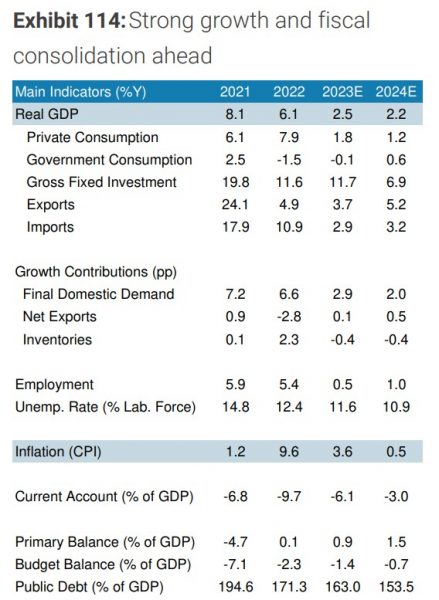

Regarding growth, Morgan Stanley estimates that the Greek economy will run at 2.5% in 2023 and 2.2% for 2024. It points out that it will continue to outperform the Eurozone in 2023 and 2024. , as falling inflation (expected to 3.6% and 0.5% respectively from 9.6% in 2022) and rising real incomes will support private consumption in the second half of 2023.

Core inflation is expected to remain high, driven by prices in leisure services such as hotels and restaurants, in anticipation of another strong tourist season.

Tight monetary policy is expected to have a negative impact on the economy, but investment will continue to be supported by the implementation of the Recovery Fund and record inflows of foreign direct investment.

Surplus

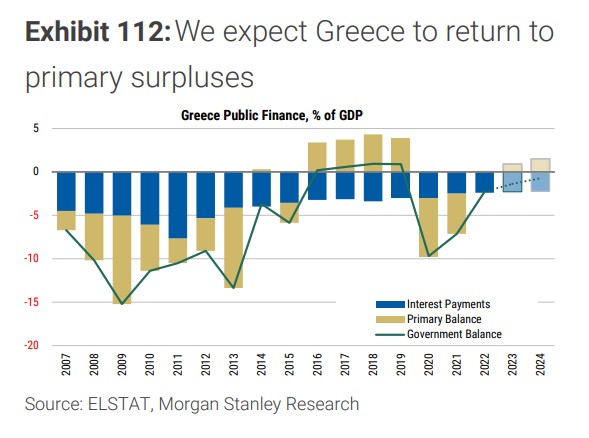

Analysts particularly emphasize that Greece achieved one of the fastest fiscal consolidations in Europe.

The country has managed to return to a primary surplus as early as 2022 and reduce the debt-to-GDP ratio by 35 percentage points from the record high of 206% reached in 2020 due to the pandemic.

It also expects this debt consolidation to continue in the future, albeit at a slower pace, and believes that steady growth and conservative fiscal spending will allow Greece to run a primary surplus of 0.9% in 2022 and up to and 1.5% in 2024. With interest payments remaining subdued, given the structure of Greek debt, it expects the debt-to-GDP ratio to fall to 163% this year and 153.5% next year.