By the end of the year, JP Morgan expects Greece to receive the investment grade from the other two houses, Standard & Poor’s and Fitch, with Greek bonds included in Bloomberg’s indices, as ot.gr had written on the 23 /9 (see here). Until then, however, JP Morgan recommends waiting and securing profits in Greek bonds, compared to Italian ones, as no further rally is expected until the new assessments.

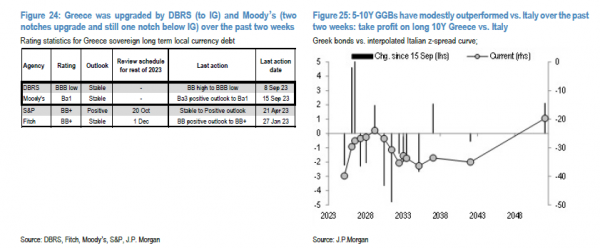

JP Morgan recalls that in the last two weeks, Greece has been upgraded by DBRS (to IG) and Moody’s (two notches upgrade and one more notch below IG), with Greek bonds performing moderately against Italians over the same period. period.

Nevertheless, JP Morgan maintains a generally bullish medium-term outlook on Greek bonds and expects them to trade consistently higher than Italian bonds (with an average spread of 25-50 bp), given strong macroeconomic/fiscal fundamentals, stable political landscape and ongoing rating upgrades.

The Greece-Italy spread on 10-year bonds is around 35 bp is quite reasonable, with JP Morgan expecting the next leg of tightening to happen closer to the next rating review on October 20 (S&P).