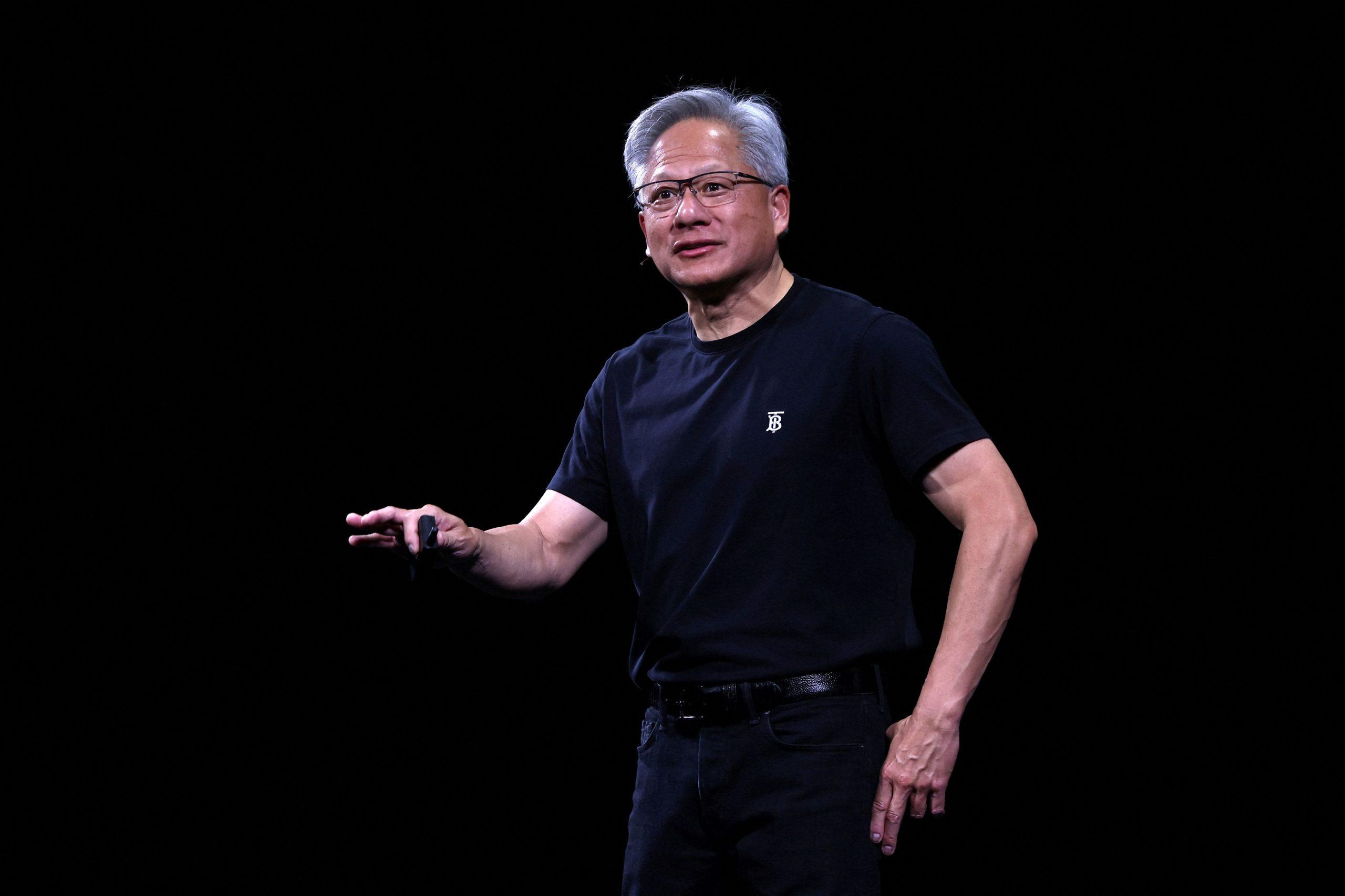

“Investing is like flying a plane – you better be properly prepared before you take off.” With this simple phrase, investment guru John Calamos, used to explain how proper preparation can lead a business – and a person – to the achievement of its goal.

Borrowing the expressions, discipline and sometimes jargon he learned when he enlisted in the US Air Force in the 1960s and in the height of the Vietnam War as a fighter pilot, John Calamos, now a major, easily detects investment opportunities. chances.

Learning risk management

Something that he also admits himself. “I am often asked how I became interested in convertibles. In fact, my history in this part predates the founding of Calamos Investments. Before starting my investment career, I served as a military pilot in the United States Air Force. During my free time, I studied markets, which I have been interested in since I was a teenager. As I studied convertible bonds, I was fascinated by their ability to manage risk and enhance returns, concepts essential to both flight and investing. Eventually, I dedicated my career to the latter and with the company and writing two books on convertibles.’

With 50 years of industry experience, Calamos is often cited as an authority on risk management investment strategies, markets and economics, and received his BA in Economics and MS in Finance from the Illinois Institute of Technology. The Chicago-born son of immigrants from Tegea, Tripoli, has come an awful long way from working at the family grocery store in Austin to creating the top investment firm that bears his name and building a personal fortune that exceeds 2.7 billion dollars.

His relationship with Greece

His name came back into the news regarding the billionaire investor’s relationship with Greece due to his collaboration with Giannis Antetokounmpo and his family to create the ESG Calamos Antetokounmpo Global Sustainable Equity Funds, which last March was listed on the stock exchange New York.

While years before, in June 2017, it had partnered with Exin Group and Kanellopoulos-Adamantiadis for the acquisition of National Insurance. A move that never came to fruition due to the lawsuit against Dutch Exin Financial Services Holdings for defaulting on loans.

The members of the Board of Directors of CGAM from left to right: Member – Yiannis Antetokounmpo, Chairman – Yiannis Koudounis, Member – Dylan Wondra, minority owner of CGAM – Thanasis Antetokounmpo, Member – Yiannis Sianis

The vanguard of convertibles

When he founded Calamos Investments in 1977, his goal was simple: “I wanted to help my clients navigate the difficult financial markets of the 1970s – a time of high inflation, high interest rates and volatile stock markets. Convertibles were not widely used in investment portfolios, but it was during this period that my belief in the asset class was forged.”

As hybrid securities, convertibles can provide the opportunity for upside participation in the stock market with potentially less exposure to downside equity movements and less vulnerability to interest rate risk. However, it is not simply the use of convertibles that makes a strategy work, but the value of alternation that Calamos discovered. “I realized that I could choose convertible bonds that could serve as alternatives to stocks, and that approach provided opportunities in a market environment where stocks and bonds were in question.”

The next step

The company where he now holds the position of president and global CIO – John Koudounis took over as CEO in 2016 – has grown into a global asset management company. Calamos has established research and investment processes centered around a team approach designed to deliver superior risk-adjusted performance over full market cycles.

He mainly starred at a time when his investment company was able to play such an important role in democratization and the amount of the asset class to investors and industry professionals.

The company’s next step, however, comes from his own belief: “We put our people, our customers first, and that requires constantly evaluating the asset class to find new ways for the best potential results.”

![ΗΠΑ: Γιατί η επενδυτική τραπεζική…φυτοζωεί; [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/07/ot_banks_USA-768x450-1-300x300.png)

![Ακτοπλοϊα: Αυξημένη η κίνηση τον Ιούλιο παρά τα υψηλές τιμές στα εισιτήρια [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/07/EV_BR_030918_APERGIA_PNO11-1024x683-1.jpg)

![ΗΠΑ: Γιατί η επενδυτική τραπεζική…φυτοζωεί; [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/07/ot_banks_USA-768x450-1.png)