Greeks are ranked among the most financially illiterate in the EU, according to a new study by the European Commission. The disappointing finding revealed Greece was among the countries where the population had rudimentary financial knowledge.

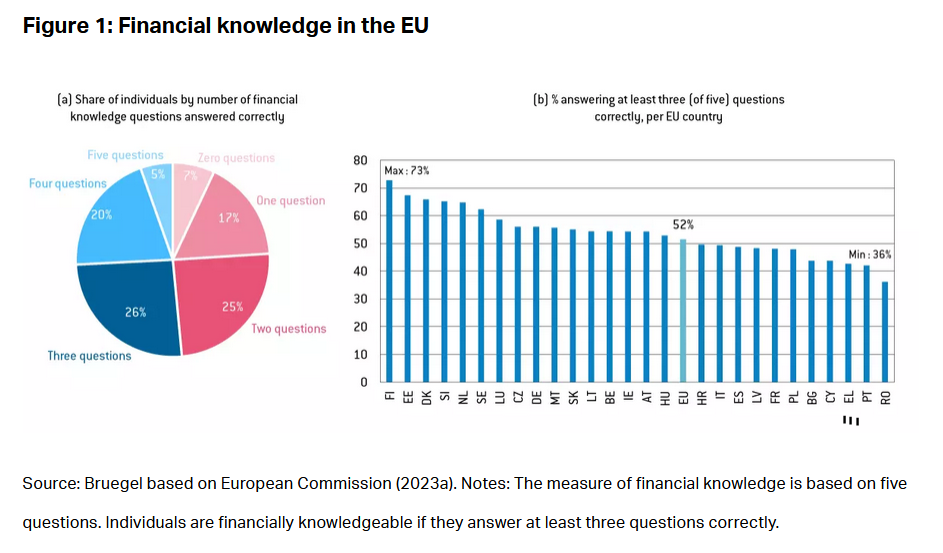

Commenting on the study, the Bruegel Institute said only one in two individuals in the European Union, on average, was financially knowledgeable.

The questions that were most frequently answered correctly by participants measured their understanding of inflation and the correlation between risk and return. In contrast, only one in five participants answered a question about the relationship between interest rates and bond prices correctly.

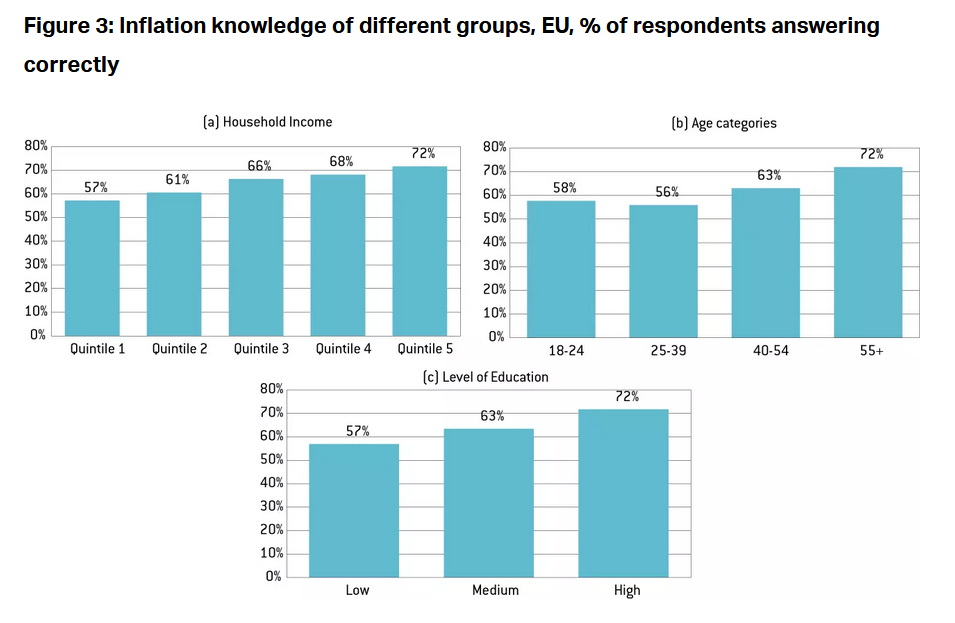

When it comes to inflation, there is a notable disparity in the responses to this question between the least and most educated participants. Gaps in understanding the concept of inflation were also observed between the youngest (aged 18-24) and oldest (aged 55+) participants, as well as between the poorest and wealthiest households.

The questions most frequently answered correctly by respondents measured understanding of inflation and the relationship between risk and return. Conversely, only one in five respondents answered correctly to a question about the relationship between interest rates and bond prices.

Disappointing Findings on Financial Illiteracy

The purpose of the study was to answer the question of whether households have sufficient knowledge and skills to manage their financial well-being.

The study posed five questions to measure knowledge about inflation, compound interest, pricing of basic assets, the relationship between risk and return, and risk diversification. Just over 50% of respondents, on average in the EU, could correctly answer at least three out of the five knowledge questions. Thus, financial literacy remains low, given that the questions measure basic economic concepts used in daily financial decision-making.

Out of the five concepts, respondents understood better the relationship between risk and return and inflation, with approximately 65% correctly answering related questions.

However, focusing solely on inflation also means that 35% of respondents do not understand that inflation reduces purchasing power. As inflation has been unusually high since 2022, these results show the difficulty many households face in adjusting consumption and savings behavior to such high price increases

Source: tovima.com

![Ακτοπλοϊα: Αυξημένη η κίνηση τον Ιούλιο παρά τα υψηλές τιμές στα εισιτήρια [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/07/EV_BR_030918_APERGIA_PNO11-1024x683-1.jpg)