Greek bankers are optimistic about the future of the Greek economy, predicting continued improvement, with the recent distribution of dividends by Eurobank, the National Bank of Greece, and Alpha Bank seen as a promising sign for the sector.

Fokion Karavias, CEO of Eurobank

Fokion Karavias, CEO of Eurobank, has highlighted that elevating investment levels should be a national priority, underscoring that achieving this goal will be challenging but essential for future progress. To bring Greece’s investment levels in line with the Eurozone average, an annual growth rate of 6.7% is necessary until 2033.

Karavias also noted that the extended delay in dividend distribution underscores the severity of the Greek financial crisis and the difficulties faced by the banking sector. However, the recent approval of dividends by regulatory authorities is seen as a positive sign of the sector’s return to normalcy and reflects growing confidence in the future of Greece’s banking industry and overall economy.

Pavlos Mylonas, CEO of National Bank

Pavlos Mylonas, CEO of the National Bank of Greece (NGB), remains optimistic about the future, expecting a stable and favorable macroeconomic and political environment in the coming years with strong growth prospects. This is likely to boost loan demand, especially for business credit, and Mylonas anticipates that the bank’s performance will continue to align with the positive economic trajectory.

Meanwhile, Gikas Hardouvelis, the bank’s chairman, acknowledged that while global economic growth will persist, it will be at slower rates due to inflationary pressures. However, the Greek economy is on a different path, with GDP projected to grow over 2% this year and in 2025. He also noted that the Recovery and Resilience Fund has seen over 50% of its funds absorbed, with more than 20% having been directed into the real economy.

Vassilios Psaltis, CEO of Alpha Bank

Vassilios Psaltis, CEO of Alpha Bank, highlighted that Greece’s regained investment-grade rating is a testament to the renewed confidence from rating agencies and signifies the end of a prolonged period of crises. He acknowledged, however, that these crises have left lasting challenges for the Greek economy that will require substantial efforts to overcome.

Psaltis pointed out that, at this positive juncture, the Recovery and Resilience Fund and the high caliber of Greece’s human capital, both at home and abroad, could drive new investments and innovative business ventures. He emphasized that strengthening the nation’s human capital is essential for harnessing these opportunities and expanding the country’s productive potential.

He also highlighted Greece’s progress in expanding export market shares but emphasized the need for greater boldness to boost international competitiveness.

Christos Megalou, CEO of Piraeus Bank

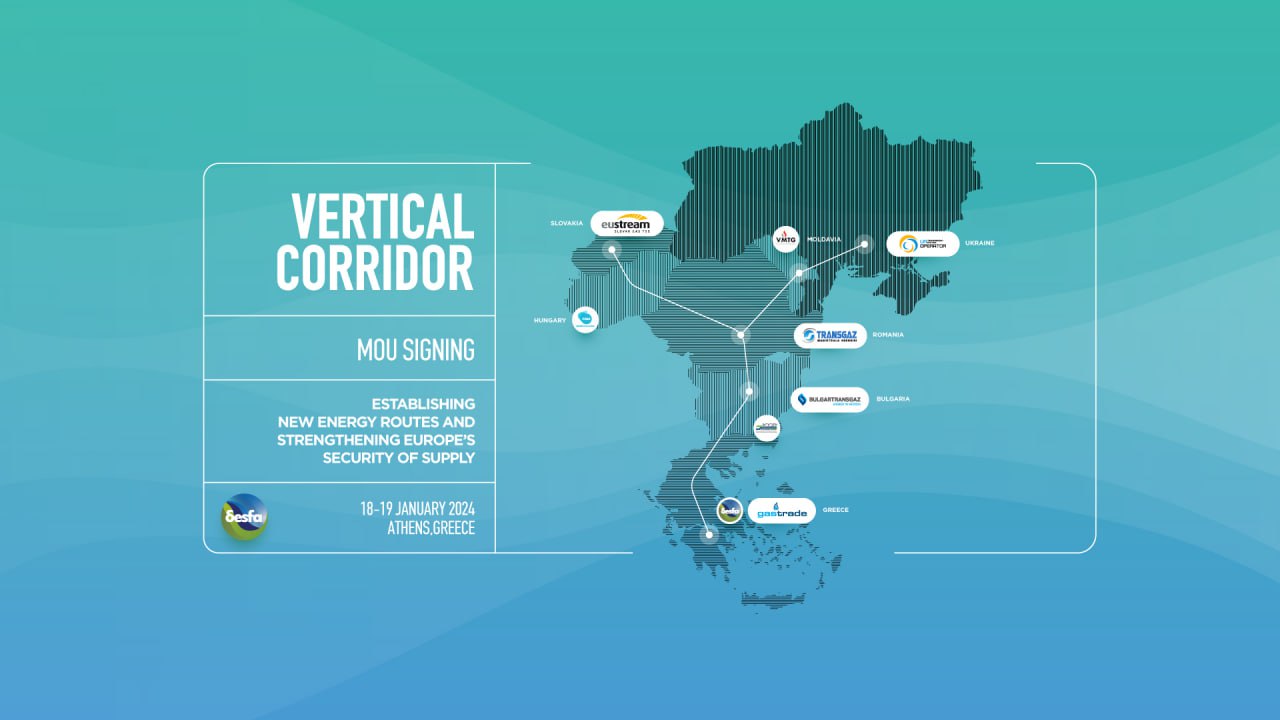

Christos Megalou, CEO of Piraeus Bank, recently underscored the bank’s pivotal role in managing the Recovery and Resilience Fund, emphasizing its impact on accelerating Greek economic growth. With the release of the sixth tranche, total absorbed funds have reached 1.6 billion euros, positioning Piraeus Bank as the market leader in contracted and disbursed loans from the Fund.

The bank’s financing involvement totals 1.2 billion euros, with around 400 million euros already disbursed, half of which has gone to small and medium-sized enterprises. This reflects the bank’s commitment to supporting businesses with growth potential, export orientation, and innovative projects, aligned with Greece’s National Recovery and Resilience Plan, “Greece 2.0.”

Megalou emphasized that the speed of economic recovery and effective use of EU funds will be crucial for the future of the Greek economy, the banking sector, and Piraeus Bank.

Source: tovima.com