In analysis by the Financial Times showed that the sale of bank shares by European governments has surged over the past 12 months, generating over 16 billion euros. However, these governments are recovering only a fraction of the taxpayer money they invested in domestic banks about 15 years ago to save them from collapse.

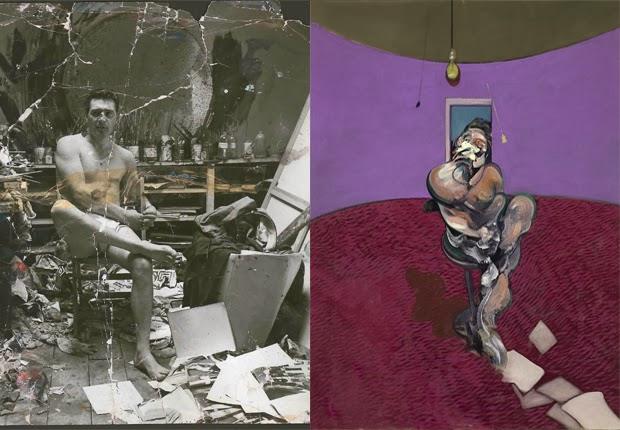

The Greek government, as noted by the Financial Times, provided 50 billion euros to the country’s four largest banks during its prolonged debt crisis.

Over the past year, it has collected more than 1.7 billion euros from the sale of bank shares in Alpha Bank, Eurobank, and Piraeus Bank. Additionally, it has sold 1 billion euros worth of shares in the National Bank of Greece and is expected to sell its remaining 18% stake in the coming weeks.

However, the largest seller over the past year has been the UK Treasury, which sold 5.5 billion pounds worth of shares in NatWest, reducing its stake from 38.5% to just under 18% since December.

The UK government had injected 45.5 billion pounds into NatWest – the then Royal Bank of Scotland – during two bailout programs in 2008 and 2009, gaining an 84% stake in the company. It has since been gradually selling its bank shares and receiving dividends.

Last week, the Dutch government sold 1.2 euros billion worth of shares in ABN Amro, though it still retains a 40.5% stake in the bank, which it bailed out with 22 billion euros in 2008.

Ireland’s government also raised 2.6 billion euros in the past 12 months by reducing its stake in AIB, which received 21 billion euros in taxpayer support, from 46% to 22%.

Andrea Orcel, known as a dealmaker, made his first major acquisition as UniCredit’s CEO last year, agreeing to purchase the Greek state’s stake in Alpha Bank and acquiring its Romanian unit. In July, UniCredit also agreed to buy the Polish banking provider Vodeno and the Belgian digital bank Aion Bank SA.

European banks have seen their profits skyrocket over the past three years due to soaring interest rates. Banks make profits from the difference between the interest they charge borrowers and the interest they pay depositors, and these profits rise when interest rates increase.

Source: tovima.gr

![BRICS: Διεκδικούν το κενό που αφήνει ο Τραμπ [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/07/BRICS3-scaled.jpg)