The European Central Bank (ECB) announced on Thursday a 25-basis point cut to its three key interest rates, marking the institution’s seventh consecutive reduction. The move, which was expected, brings borrowing costs in the eurozone to their lowest level in more than two years.

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

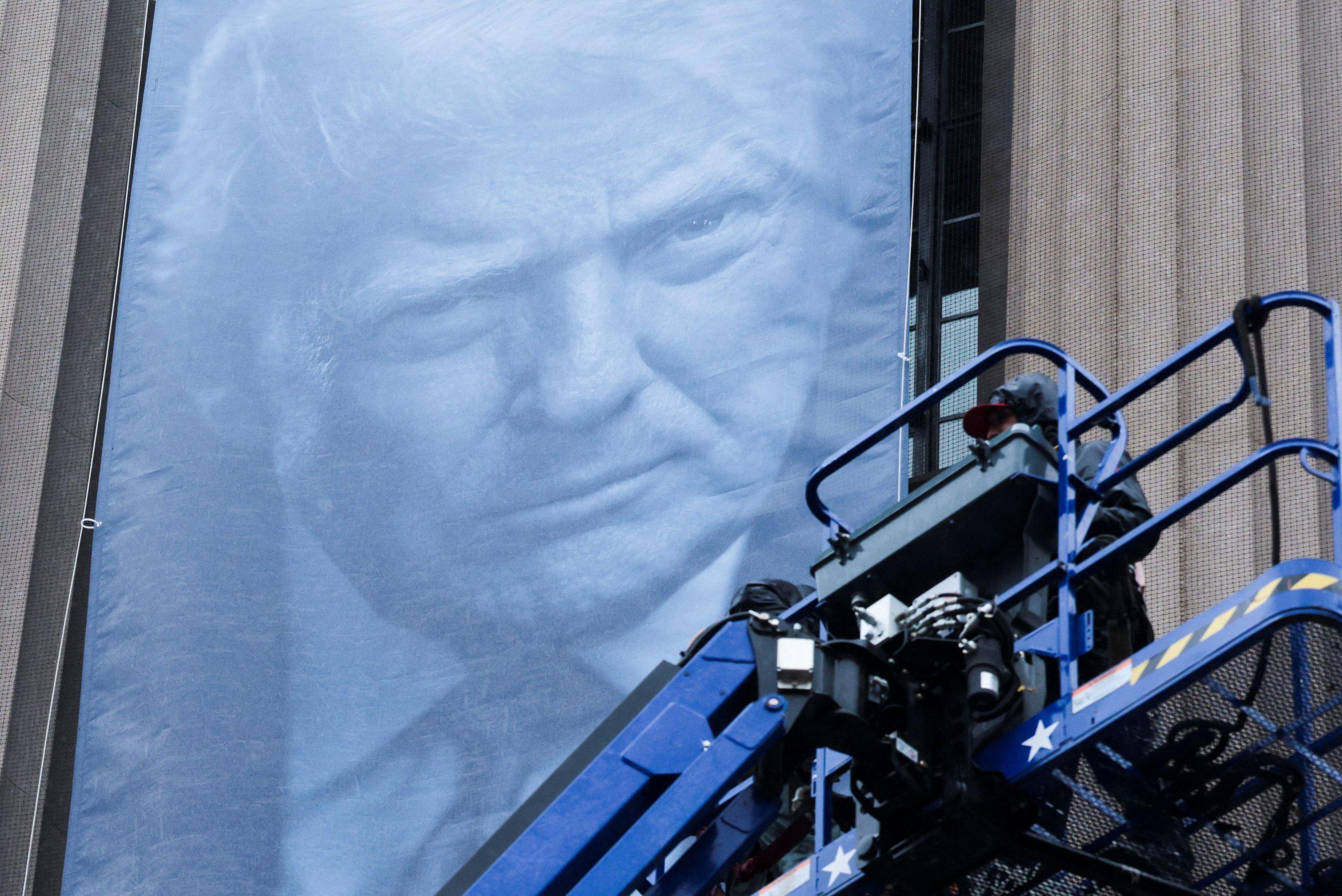

Thursday’s decision followed mounting global economic uncertainty, particularly in the wake of former U.S. President Donald Trump’s sweeping tariff announcement on most of America’s key trading partners earlier this month, on April 2. The ECB’s response aims to safeguard growth momentum and maintain inflation on a path toward its medium-term target amid rising external pressures.

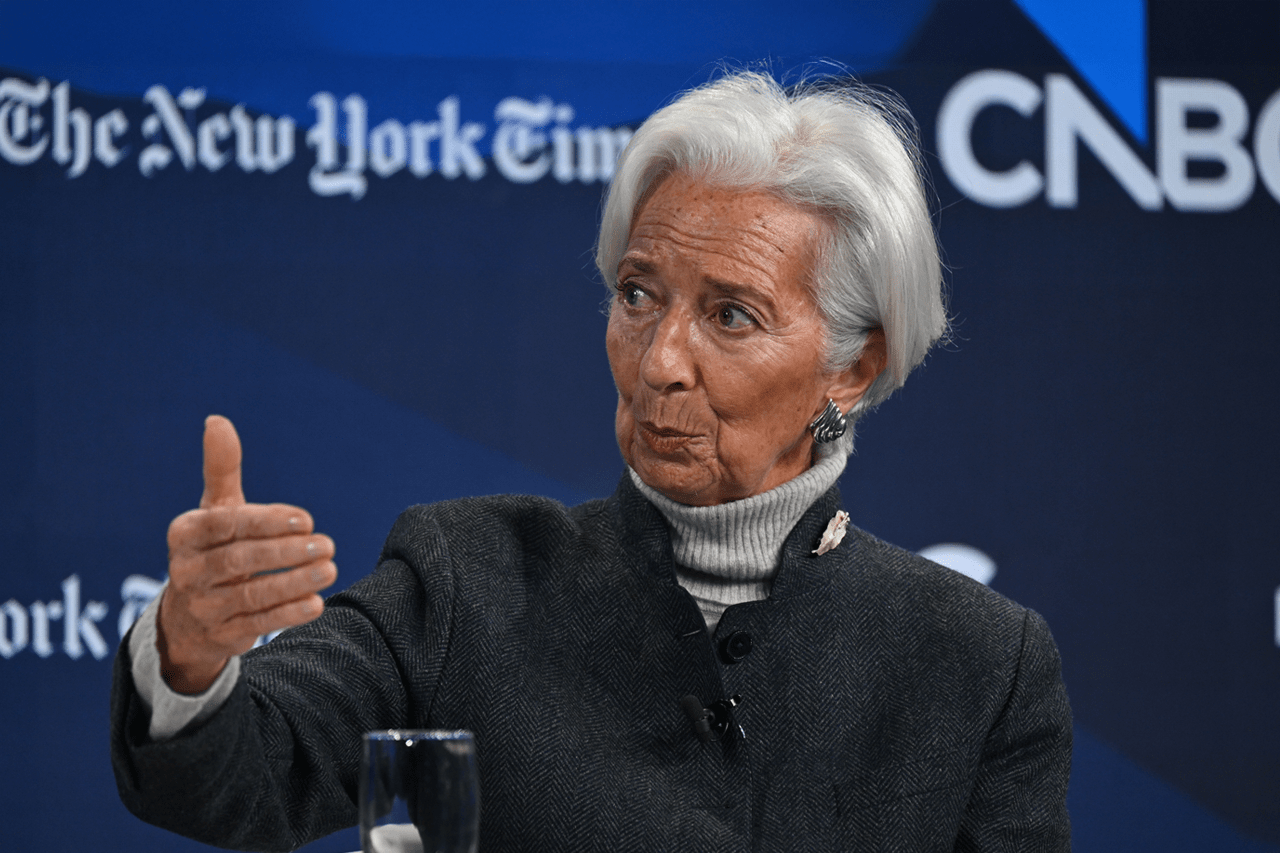

“The economic outlook is clouded by exceptional uncertainty,” ECB President Christine Lagarde said on Thursday. “It will be a question of agility in the face of what we are seeing. More than ever now we need to be data-dependent.”

“I cannot tell you if we are at peak uncertainty,” Lagarde said. “We have to stand ready for the unpredictable,” she told a press conference.

The European Central Bank said in a statement that the disinflation process remains on track as inflation continued to bear out expert forecasts, with both headline and core inflation easing in March.

Most indicators of underlying inflation suggest that price growth is stabilizing toward the ECB’s medium-term target of 2% in a sustainable manner. Wage growth has started to slow, and corporate profits are partly absorbing the impact of still-elevated wage increases on inflation.

While the euro area economy has shown some resilience to global shocks, following Trump’s tariffs, the outlook for growth has deteriorated amid escalating trade tensions. The rise in uncertainty is likely to weigh on household and business confidence, and volatile market reactions to trade developments may tighten financing conditions. These factors pose additional downside risks to the eurozone’s economic prospects.

Source: tovima.com

![Ελαιόλαδο: Σε φάση προσαρμογής η παγκόσμια αγορά [πίνακας]](https://www.ot.gr/wp-content/uploads/2025/09/elaiolado.olive-oil-83255-1.jpg)