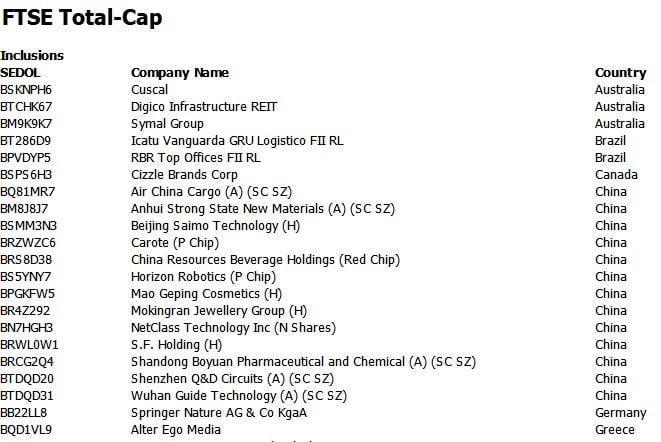

Alter Ego Media have been listed in the FTSE Russell indices Micro Cap and Total Cap, after the latter’s three-month indicator reconstitution.

The final reconstitution of FTSE Russell’s indicators for 2025 will be finalized on June 27, 2025, following the closing of markets in the United States. Until then, updated preliminary lists, replete with additions or removals, will be published.

During the previous reconstitution, GEK Terna’s share had been upgraded on the Emerging Europe Large Cap. Additionally, Alumil, Austriacard, AVAX, Dimand, Evropi Holdings, Lavipharm, Noval Property, Performance and Trade Estates were added to FTSE Russell’s Micro Cap and Total Cap indices, during the last reconstitution.

A spike in interest

It is also noteworthy that in the few months since its listing on the Athens Stock Exchange (ATHEX), Alter Ego Media has not only attracted the interest from institutional investors’ portfolios, but its inclusion on the FTSE Russell indices confirms that interest is now gaining significant momentum. The development may lead to increased visibility, attracting more investors and greater liquidity for its share.

Participation in the specific indices, which are formulated and managed by FTSE Russell, one of the world’s largest providers of stock market indices, is, in practice, equivalent to an international recognition and increased investment demand for the share.

At the same time, the development confirms that the company meets strict criteria, such as capitalization, liquidity and transparency – elements that render it as particularly attractive for institutional investors. At the same time, a large number of institutional investors and passive management funds (ETFs and index funds) automatically invest in shares included in such indices.

Alter Ego Media conducted its initial public offering (IPO) in January 2025, with the commencement of trading of its shares on the Athens Stock Exchange coming on January 27, 2025. The public offering was oversubscribed by 11.9 times, with the issue price set at four (04) euros per share, while raising a total of 57 million euros.

Source: tovima.com