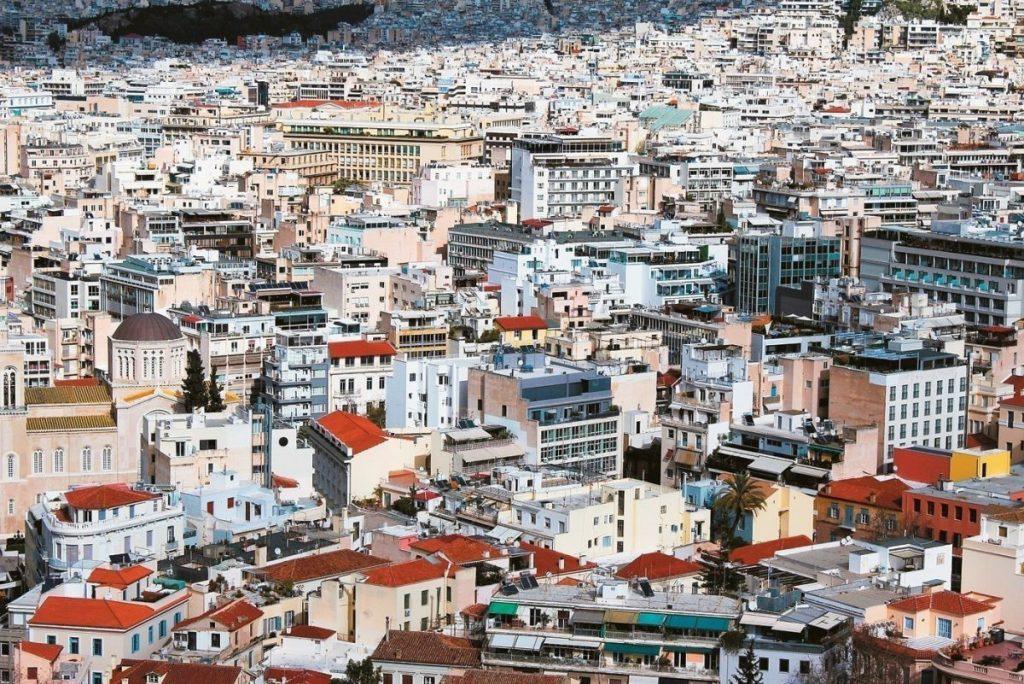

The boom in short-term rentals such as Airbnb has significantly reduced the availability of properties for long-term leasing, while rental prices continue to climb—even for older properties. The problem is compounded by programs like “My Home 2,” which have contributed to further price hikes without addressing the core issue, namely, the limited supply of housing.

The Bank of Greece (BoG) data shows the annual growth rate of apartment prices across the country reached 6.8% in the first quarter of 2025.

Geographically, price growth varied in short-term rentals. In the first quarter of 2025, prices rose by 5.5% in Athens, 10% in Thessaloniki, 7.3% in other major cities, and 8% in the rest of the country. Provisional data suggest that, on average, apartment prices in Q1 2025 were up 6.8% compared to the same period in 2024. For the full year 2024, apartment prices rose by an average of 8.9%, based on revised figures, down from a 13.9% increase in 2023.

A closer look shows that in Q1 2025, new apartments were 8.0% more expensive than a year earlier, while prices for older ones rose by 6.0%.

Regional data further highlights the disparities. In Q1 2025, apartment prices rose by 5.5% in Athens, 10% in Thessaloniki, 7.3% in other large cities, and 8% in the rest of the country compared to the same period in 2024. For the full year 2024, price increases in those regions were 8.4%, 11.4%, 7.4%, and 10.7%, respectively, based on revised data.

Finally, across all urban areas in Greece, apartment prices in Q1 2025 were on average 6.2% higher than in Q1 2024. For 2024 overall, the average annual increase stood at 8.6%, according to the revised figures.

Source: Tovima.com