The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) on Thursday sanctioned a network led by Kurdish Iraqi-British businessman Salim Ahmed Said, exposing a long-running oil smuggling operation that disguised Iranian oil as Iraqi in order to circumvent international sanctions.

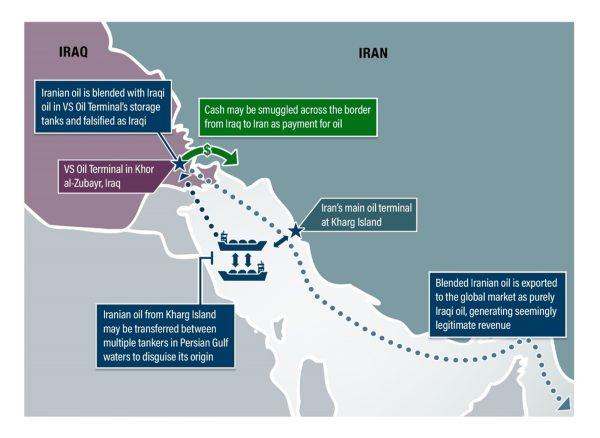

According to OFAC, Said covertly controls UAE-based VS Tankers FZE, formerly known as Al-Iraqia Shipping Services & Oil Trading FZE (AISSOT)—a company central to the smuggling scheme. OFAC notes that VS Tankers has been instrumental in facilitating ship-to-ship (STS) transfers and blending Iranian oil to misrepresent it as Iraqi crude.

Moreover, the Treasury’s announcement also confirms the sanctioning of several tankers engaged in covert Iranian oil deliveries. Among them is the Marshall Islands-flagged crude oil tanker DIJILAH (IMO 9829629), described as operated, managed, and beneficially owned by VS Tankers since 2019. The vessel reportedly engaged in multiple STS transfers with the U.S.-sanctioned tanker CASINOVA in April 2024, near the Iran-Iraq maritime boundary.

VS Tankers is one of several companies now sanctioned under Executive Order (E.O.) 13902, targeting the Iranian petroleum sector. Additional companies controlled by Said include VS Oil Terminal FZE, VS Petroleum DMCC (formerly Ikon Petroleum), Rhine Shipping DMCC, as well as UK-based The Willett Hotel Limited and Robinbest Limited.

OFAC also detailed the role of VS Oil, which manages storage tanks in Khor al-Zubayr, Iraq, where Iranian oil is blended before being exported under Iraqi cover. Satellite and tracking data further show VS Oil’s links to tankers operating on behalf of Iranian entities Triliance Petrochemical Co. Ltd. and Sahara Thunder, both previously sanctioned for supporting the IRGC and Iran’s military.

According to OFAC, Said’s network relied on bribery of Iraqi officials—including members of parliament—to obtain forged certificates enabling Iranian oil to be passed off as Iraqi-origin. The proceeds from these schemes have partly funded the Islamic Revolutionary Guard Corps-Quds Force (IRGC-QF), a U.S.-designated Foreign Terrorist Organization.

This latest round of sanctions marks the eighth action under OFAC’s enhanced pressure campaign on Iran’s oil trade, following the President’s directive via National Security Presidential Memorandum 2. The U.S. Department of State concurrently designated six additional entities and four vessels under E.O. 13846 for knowingly facilitating Iranian petroleum transactions.

There are indications of ties of Greek shipping companies to this Iranian oil smuggling network. Evalend Shipping, controlled by Kriton Lentoudis, and Petrochem General Management, controlled by Ioannis (John) Perogiannakis, were key commercial counterparties of AISSOT and VS Tankers for nearly ten years. Ioannis Perogiannakis has reportedly acted as ship broker and representative of AISSOT (having a corporate AISSOT email YGP@aissot.com ) and for the Salim organization, procuring vessels which were chartered to the various Salim Said outfits including AISSOT and Rhine Shipping, which both have been sanctioned by OFAC. Kriton Lentoudis’s Evalend Shipping is to known to have an extensive relationship with Salim Said, as a number of Lentoudis controlled vessels were chartered out to AISSOT and VS Tankers, including the MT “Najaf” and the MT “Dijilah” as well as other smaller tankers, which acted for years as a floating oil storage where most of the the blending and laundering of Iranian oil into international markets took place, as well as their distribution. Lentoudis was known to have also owned certain of these vessels in joint ventures with Salim Said.

Implications for Greek Shipping

While neither Evalend Shipping nor Petrochem General Management have been directly sanctioned, their historical and ongoing commercial links to AISSOT and VS Tankers—now designated entities—raise compliance and reputational concerns. Under OFAC regulations, non-U.S. persons may be exposed to secondary sanctions if they continue engaging in significant transactions with sanctioned entities or networks.

Greek shipowners, particularly those active in Middle East crude trades, may come under increased scrutiny from financial institutions, insurers, and charterers who are tightening due diligence on counterparties with exposure to sanctioned parties. Legal analysts also caution that transactions post-2020—when Said’s illicit network became more active—could face retrospective review by regulators if tied to sanctioned oil flows or documentation irregularities.

Full text of the press release by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC)

Read below the full text of the press release by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) which lists all entities that were sanctioned and vessels used in oil smuggling, including and explicit reference to the Marshall Islands-flagged crude oil tanker DIJILAH (IMO 9829629) which originally was one of Kriton Lentoudis’s Evalend Shipping vessels chartered out to AISSOT and VS Tankers.

WASHINGTON — Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) is taking action against networks that have collectively transported and purchased billions of dollars’ worth of Iranian oil, some of which has benefited Iran’s Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF), a designated Foreign Terrorist Organization. Among the entities sanctioned today is a network of companies run by Iraqi businessman Salim Ahmed Said (Said) that has profited from smuggling Iranian oil disguised as, or blended with, Iraqi oil. Treasury is also sanctioning several vessels engaged in the covert delivery of Iranian oil, intensifying pressure on Iran’s “shadow fleet.”

“As President Trump has made clear, Iran’s behavior has left it decimated. While it has had every opportunity to choose peace, its leaders have chosen extremism,” said Secretary of the Treasury Scott Bessent. “Treasury will continue to target Tehran’s revenue sources and intensify economic pressure to disrupt the regime’s access to the financial resources that fuel its destabilizing activities.”

Today’s action is being taken pursuant to Executive Order (E.O.) 13902, which targets those operating in certain sectors of the Iranian economy, including Iran’s petroleum and petrochemical sectors, as well as the counterterrorism authority E.O. 13224, as amended. It marks the eighth round of sanctions targeting Iran’s oil trade since the President issued National Security Presidential Memorandum 2, directing a campaign of maximum pressure on Iran.

Concurrently, the Department of State is designating six entities and identifying four vessels pursuant to E.O. 13846 for having knowingly engaged in a significant transaction for the purchase, acquisition, sale, transport, or marketing of petroleum or petroleum products from Iran.

IRAN-IRAQ OIL SMUGGLING NETWORK

Iraqi-British national Salim Ahmed Said (Said) runs a network of companies that have been selling Iranian oil falsely declared as Iraqi oil since at least 2020. Said’s companies use ship-to-ship transfers and other obfuscation techniques to hide their activities. Said’s companies and vessels blend Iranian oil with Iraqi oil, which is then sold to Western buyers via Iraq or the United Arab Emirates (UAE) as purely Iraqi oil using forged documentation to avoid sanctions. This allows the oil to be sold on the legitimate market and helps Iran evade international sanctions on its oil exports.

Said has bribed many members of key Iraqi government bodies, including parliament. He has reportedly paid millions of dollars in kickbacks to these officials in exchange for forged vouchers allowing him to sell Iranian oil as if it originated from Iraq.

Said is being designated pursuant to E.O. 13902 for operating in the petroleum sector of the Iranian economy.

Said controls UAE-based company VS Tankers FZE (VS Tankers), despite avoiding formal association with the company. Formerly known as Al-Iraqia Shipping Services & Oil Trading FZE (AISSOT), VS Tankers has smuggled oil for the benefit of the Iranian government and the Islamic Revolutionary Guard Corps (IRGC). For example, in 2020, AISSOT reportedly brokered a deal to transport Iranian oil via Iraqi pipelines to be blended and sold as Iraqi oil.

VS Tankers-affiliated ships have assisted Iranian oil exporters in blending Iranian oil with Iraqi to obscure the oil’s origins by engaging in ship-to-ship transfers with vessels known to be affiliated with Iranian oil activities. VS Tankers currently claims several oil tankers as part of its fleet, one of which recorded four ship-to-ship transfers with the U.S. sanctioned, Barbados-flagged CASINOVA (IMO 9280366) in April 2024 while located in the Persian Gulf near the mouth of the Shatt al-Arab river, which marks the border between Iraq and Iran. VS Tankers has served as the operator, manager, and beneficial owner of the Marshall Islands-flagged crude oil tanker DIJILAH (IMO 9829629) since 2019.

VS Tankers is being designated pursuant to E.O. 13902 for operating in the petroleum sector of the Iranian economy. DIJILAH is being identified pursuant to E.O. 13902 as property in which VS Tankers has an interest.

In 2023, Said expanded his business holdings to include VS Oil Terminal FZE (VS Oil), which, though registered in the UAE, has its physical presence in Khor al-Zubayr, Iraq. VS Oil manages six oil storage tanks where Iranian oil is dropped off to be mixed with Iraqi oil. Vessels carrying Iranian oil also conduct ship-to-ship transfers with vessels carrying Iraqi oil in the vicinity of VS Oil’s terminal facilities, and the blended oil is ultimately authenticated by complicit Iraqi government officials. Vessel tracking data shows that multiple oil tankers known to transport Iranian petroleum products on behalf of U.S.-sanctioned Iranian oil and petrochemical broker Triliance Petrochemical Co. Ltd. and Iranian military front company Sahara Thunder have visited VS Oil. VS Oil employees smuggle hard currency into Iran via cars and trucks, some of which carry millions of dollars each, as payment for oil.

VS Oil is being designated pursuant to E.O. 13902 for operating in the petroleum sector of the Iranian economy.

Said also owns UAE-based VS Petroleum DMCC, formerly Ikon Petroleum DMCC, and Rhine Shipping DMCC (Rhine Shipping) which, in 2022, were implicated in blending Iranian oil to sell as Iraqi oil. Rhine Shipping was also previously exposed as the manager of the U.S.-sanctioned oil tanker MOLECULE, formerly named BABEL, which loaded oil in the Persian Gulf from an Iranian tanker that had turned off its location transponder to obfuscate the transaction. OFAC subsequently sanctioned the MOLECULE for its role in shipping Iranian oil as part of the network of Iran-backed Houthi financial official Sa’id al-Jamal.

Said also owns United Kingdom-based companies The Willett Hotel Limited and Robinbest Limited.

VS Petroleum DMCC, Rhine Shipping, The Willett Hotel Limited, and Robinbest Limited are being designated pursuant to E.O. 13902 for being owned or controlled by, directly or indirectly, Said.

Shadow fleet actors

Iran’s shadow fleet enables the regime to transport its petroleum to generate revenue. Iran relies on non-sanctioned vessels to conduct ship-to-ship transfers and receive Iranian oil from sanctioned vessels before shipping the Iranian-origin cargo to buyers in Asia.

The National Iranian Tanker Company (NITC) uses Singapore-based Trans Arctic Global Marine Services PTE. LTD. (Trans Arctic Global) to arrange piloting services for NITC vessels transiting through the Strait of Malacca. Trans Arctic Global has enabled NITC to transport tens of millions of barrels of Iranian oil through the Strait of Malacca for eventual ship-to-ship transfers to vessels waiting in the Singapore Eastern Outer Port Limits.

Trans Arctic Global is being designated pursuant to E.O. 13902 for operating in the petroleum sector of the Iranian economy.

The Cameroon-flagged VIZURI (IMO 9197909), Comoros-flagged FOTIS (IMO 9306548), and Panama-flagged THEMIS (IMO 9264570) and BIANCA JOYSEL (IMO 9196632), have collectively shipped tens of millions of barrels of Iranian oil and other petroleum worth billions of dollars.

Since mid-2023, the VIZURI has completed multiple shipments of Iranian oil and transported millions of barrels of Iranian oil. Panama-flagged liquified petroleum gas carrier (LPG) FOTIS has transported millions of barrels of Iranian LPG and other petroleum to multiple locations. Panama-flagged THEMIS, which was sanctioned by the United Kingdom on May 9, 2025 for transporting Russian oil, has also transported Iranian oil.

Seychelles-based Egir Shipping Ltd, and Marshall Islands-based Fotis Lines Incorporated and Themis Limited are the respective owners of the VIZURI, FOTIS, and THEMIS. Egir Shipping Limited, Fotis Lines Incorporated, and Themis Limited are being designated pursuant to E.O. 13902 for operating in the petroleum sector of the Iranian economy. VIZURI, FOTIS, and THEMIS are being identified as blocked property in which Egir Shipping Ltd, Fotis Lines Incorporated, and Themis Limited, respectively, have an interest.

Panama-flagged BIANCA JOYSEL has transported more than ten million barrels of Iranian oil since mid-2024, conducting ship-to-ship transfers with sanctioned vessels owned by the U.S.-designated NITC, including the AMOR and STARLA.

British Virgin Islands-based Betensh Global Investment Limited And Dong Dong Shipping Limited owns the BIANCA JOYSEL. Betensh Global Investment Limited And Dong Dong Shipping Limited is being designated pursuant to E.O. 13902 for operating in the petroleum sector of the Iranian economy. BIANCA JOYSEL is being identified as blocked property in which Betensh Global Investment Limited And Dong Dong Shipping Limited has an interest.

IRGC-QF oil Sales

The IRGC-QF has used the Al-Qatirji Company to facilitate oil sales to customers around the world, generating hundreds of millions of dollars of revenue for the IRGC-QF. The Cameroon-flagged ELIZABET (IMO 9216717), which has impersonated a separate vessel, the S TINOS, loaded a cargo of Iranian oil off the coast of Malaysia in August 2024 via ship-to-ship transfer. The cargo had originally been loaded at Kharg Island, Iran, by the ROMINA (IMO 9114608), a vessel previously identified for its role in transporting Iranian petroleum for the Al-Qatirji Company. Seychelles-based White Sands Shipmanagement Corp. is the ship manager, operator, and technical manager of the ELIZABET.

The AI-Qatirji Company transported approximately two million barrels of Iranian oil on the Cameroon-flagged ATILA (IMO 9262754) in support of the U.S.-sanctioned Sa’id al-Jamal network. The ATILA received the oil in a ship-to-ship transfer with the sanctioned vessel ARMAN 114. The Iranian oil carried by the ATILA was disguised as Malaysian oil. Seychelles-based Grat Shipping Co Ltd is the manager, operator, and owner of the ATILA. OFAC designated Sa’id al-Jamal pursuant to E.O. 13224, as amended, on June 10, 2021, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, the IRGC-QF.

The Al-Qatirji Company has also used the Palauan-flagged GAS MARYAM (IMO 9108099) to transport Iranian petroleum products in support of the IRGC-QF. Liberia-based Dima Shipping & Trading Company is the manager, operator, and owner of the GAS MARYAM.

White Sands Shipmanagement Corp, Grat Shipping Co Ltd, and Dima Shipping & Trading Company are being designated pursuant to E.O. 13224, as amended, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of the Al-Qatirji Company. The ELIZABET is being identified as blocked property in which White Sands Shipmanagement Corp. has an interest, the ATILA as blocked property in which Grat Shipping Co Ltd has an interest, and the GAS MARYAM as blocked property in which Dima Shipping & Trading Company has an interest.

SANCTIONS IMPLICATIONS

As a result of today’s action, all property and interests in property of the designated or blocked persons described above that are in the United States or in the possession or control of U.S. persons are blocked and must be reported to OFAC. In addition, any entities that are owned, directly or indirectly, individually or in the aggregate, 50 percent or more by one or more blocked persons are also blocked. Unless authorized by a general or specific license issued by OFAC, or exempt, OFAC’s regulations generally prohibit all transactions by U.S. persons or within (or transiting) the United States that involve any property or interests in property of blocked persons.

Violations of U.S. sanctions may result in the imposition of civil or criminal penalties on U.S. and foreign persons. OFAC may impose civil penalties for sanctions violations on a strict liability basis. OFAC’s Economic Sanctions Enforcement Guidelines provide more information regarding OFAC’s enforcement of U.S. economic sanctions. In addition, financial institutions and other persons may risk exposure to sanctions for engaging in certain transactions or activities involving designated or otherwise blocked persons. The prohibitions include the making of any contribution or provision of funds, goods, or services by, to, or for the benefit of any designated or blocked person, or the receipt of any contribution or provision of funds, goods, or services from any such person.

Furthermore, engaging in certain transactions involving the persons designated today may risk the imposition of secondary sanctions on participating foreign financial institutions. OFAC can prohibit or impose strict conditions on opening or maintaining, in the United States, a correspondent account or a payable-through account of a foreign financial institution that knowingly conducts or facilitates any significant transaction on behalf of a person who is designated pursuant to the relevant authority.

The power and integrity of OFAC sanctions derive not only from OFAC’s ability to designate and add persons to the Specially Designated Nationals and Blocked Persons List (SDN List), but also from its willingness to remove persons from the SDN List consistent with the law. The ultimate goal of sanctions is not to punish, but to bring about a positive change in behavior. For information concerning the process for seeking removal from an OFAC list, including the SDN List, or to submit a request, please refer to OFAC’s guidance on Filing a Petition for Removal from an OFAC List.