The Athens Stock Exchange is on track to become part of the Euronext network following a revised €413 million acquisition offer from the European exchange group. The deal marks a strategic step toward deeper integration of Greek financial markets into the wider European capital market landscape.

Euronext, which operates exchanges in major cities such as Paris, Milan, Amsterdam, and Dublin, upped its previous offer to €7.14 per share—up 3.5% from its initial bid of €6.90. The acquisition, if approved, is expected to close by the end of 2025.

What the Deal Means for Greece

By joining Euronext, the Athens Stock Exchange (ATHEX) will gain access to a network of over 1,800 listed companies with a combined market capitalization exceeding €6 trillion. This move is seen as a strong vote of confidence in Greece’s economic trajectory and will enable local companies—big and small—to tap into international funding more easily.

According to Greece’s finance minister, the merger opens a new chapter of financing and growth for Greek businesses, providing them with access to a much broader pool of global investors and a well-integrated European financial ecosystem.

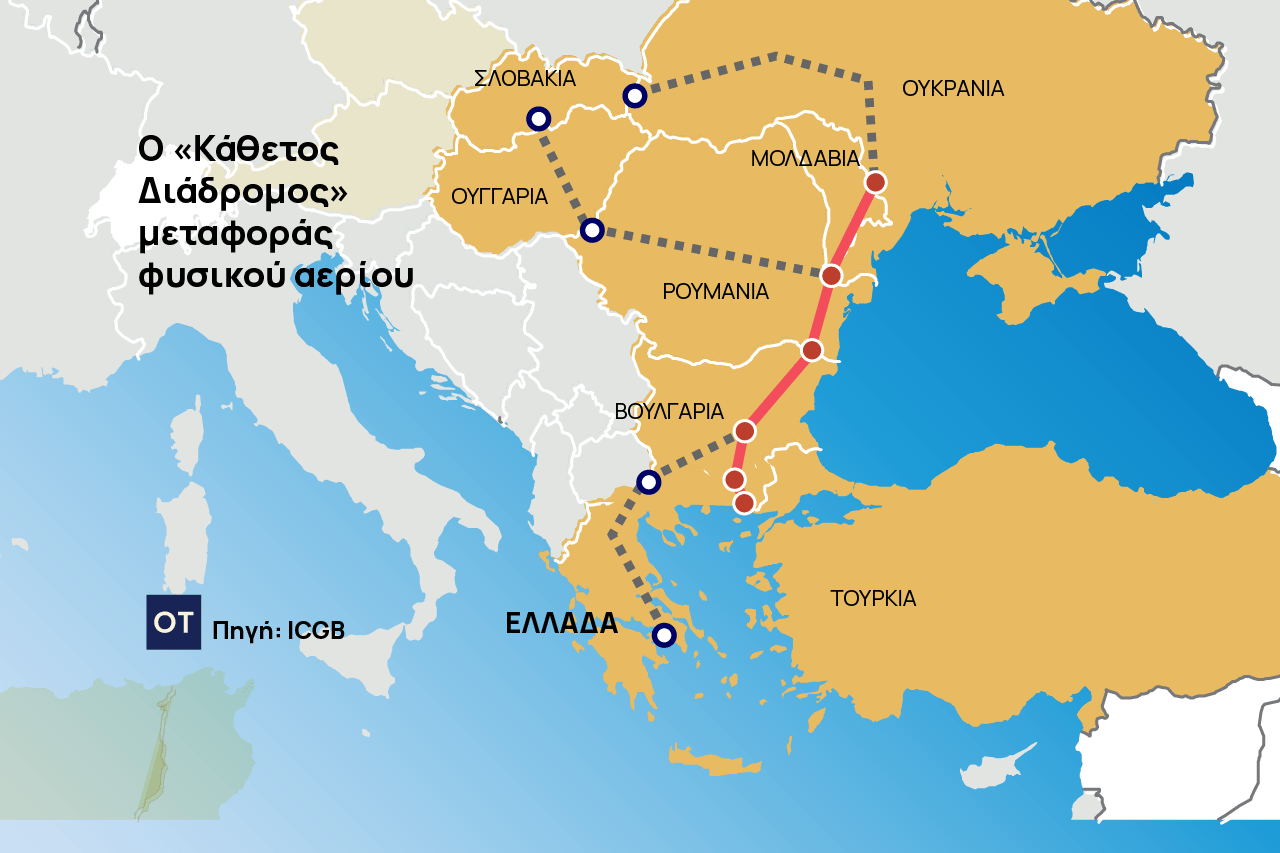

Euronext’s CEO, Stéphane Boujnah, echoed this optimism, noting that Greece’s economic recovery and investor appeal make it the right time to establish a funding hub for Southeast Europe. Integrating ATHEX into Euronext’s advanced trading and post-trade systems is expected to improve visibility, liquidity, and efficiency across the Greek market.

Operational and Strategic Benefits

Euronext estimates annual operating synergies of €12 million by 2028, with implementation costs of around €25 million. The Athens exchange will remain legally and operationally headquartered in Greece, maintaining its local presence, tax commitments, and regulatory responsibilities.

Additionally, the deal includes commitments to:

- Keep ATHEX’s legal and operational base in Greece.

- Maintain its tax residency and meet Greek fiscal obligations.

- Operate as a regional hub for Southeast Europe within the Euronext group.

- Explore creating a new Euronext tech center in Greece.

- Include Greek representation in Euronext’s group-level governance, with a Greek financial expert set to join the Supervisory Board in 2026.

- Impact on Staff and Market Structure

The current workforce and leadership of the Athens Stock Exchange will play a key role in the integration process. Their expertise is expected to drive the success of the transition. While the deal may lead to restructuring, Euronext is encouraged to consider voluntary exit programs if workforce changes are deemed necessary.

Past transitions of exchanges such as those in Dublin, Oslo, and Milan into Euronext’s unified trading platform have led to increased daily trading volumes and improved market quality—results the Greek market hopes to replicate.

![Ελβετικό φράγκο: Τα SOS για να ρυθμίσετε το δάνειο – Τα κριτήρια [πίνακες]](https://www.ot.gr/wp-content/uploads/2026/02/ot_elvetiko_fragko2-1-300x300.jpg)

![Ελβετικό φράγκο: Τα SOS για να ρυθμίσετε το δάνειο – Τα κριτήρια [πίνακες]](https://www.ot.gr/wp-content/uploads/2026/02/ot_elvetiko_fragko2-1.jpg)