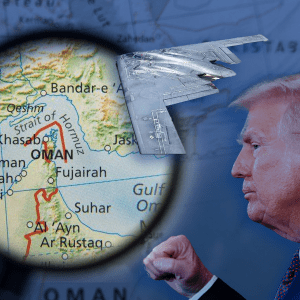

The United States has officially enacted sweeping new tariffs today, marking a historic turning point in global trade policy. The decision, spearheaded by the Trump administration, signals a departure from decades of global economic integration and ushers in a new era of protectionism driven by power rather than partnership.

The Broadest Tariff Expansion in Decades

Effective from August 7, the US has implemented increased tariffs on imports from over 90 countries, in what is being described as the most extensive trade offensive since the 1930s. These duties cover a wide range of goods — from automobiles and electronics to clothing, food, and high-tech products.

In some cases, tariffs reach up to 50%, including on goods from Brazil and India. Southeast Asian nations like Laos and Myanmar face tariffs of up to 40%. Even key US allies such as the European Union, Japan, and South Korea are now subject to 15% tariffs on most of their exports to the US. The average tariff rate now exceeds 17% — the highest since 1935.

These measures replaced a previous blanket 10% tariff that had been in place since April. The new “retaliatory” tariffs came into force at 07:01 Greek time.

Just moments before implementation, former President Donald Trump celebrated online, declaring: “It’s midnight! Billions in tariffs are now flowing into the United States of America!”

A Tool of Geopolitical Pressure

The new tariffs go beyond traditional economic protectionism. They are being used as leverage in global politics. For instance, India faces a 50% tariff unless it halts oil imports from Russia. Brazil is being penalised due to legal actions taken against former president Bolsonaro.

Even close US allies have not been spared. Taiwan, despite its strategic alignment with Washington, is subject to a 20% tariff on high-tech exports. Its leadership, however, has described the move as “temporary” pending further negotiations.

Meanwhile, the EU, Japan, South Korea, and the UK managed to negotiate lower tariffs, but not without significant concessions. The EU, for example, accepted a compromise that includes a permanent 15% tariff on key European goods.

Domestic Impact: Gains and Growing Costs

The Trump administration touts the surge in government revenue — over $100 billion to date — as a win. However, the economic impact on American households and businesses tells a more complex story.

On average, US households are expected to spend an additional $2,400 in 2025 due to rising prices on essential goods. The steepest increases are expected in clothing, footwear, and household electronics. These rising costs add to inflationary pressures, eroding purchasing power and dampening consumer spending.

Industries are also feeling the strain. Increased import costs and anticipated retaliatory tariffs are pushing up production expenses, particularly in manufacturing and agriculture. This is reducing the competitiveness of American products abroad.

Economists estimate that these tariffs will reduce US GDP growth by 0.9 percentage points in 2025. Over the long term, the annual GDP loss is projected at around 0.6%, or approximately $160 billion. Exports are also expected to fall, and employment is already being affected in globally exposed sectors.

Global Repercussions: Uncertainty and Economic Risk

Internationally, the ripple effects are mounting. The tariffs are disrupting global supply chains, particularly in Southeast Asia, and raising concerns about a potential global economic slowdown — or even recession.

Developing nations like Laos and Myanmar are among the most exposed, while established partners such as Canada and Mexico are also facing economic headwinds despite existing trade agreements like the USMCA.

The broader investment climate is deteriorating, as geopolitical tensions and trade instability lead many companies to delay or cancel investment plans. The escalating rivalry between the US and China, which now includes economic pressure on Chinese allies, is adding to global uncertainty.

Governments worldwide are under pressure to revise fiscal and monetary policies as tariff-driven inflation limits their ability to respond to economic shocks.

This moment marks a significant reorientation of global trade. The US appears to be embracing a model of economic nationalism, prioritising domestic strength over international cooperation.

Source: Tovima.com