A recent study by European Central Bank (ECB) officials warned of the risk of thousands of jobs being lost in Europe as a collateral consequence of Trump’s tariffs. According to European economists, the threat to employment also comes indirectly from China, due to increased competition.

The harsh U.S. sanctions are expected to push the world’s second-largest economy to redirect more of its exports toward Europe. Rising Chinese competition has direct consequences for Eurozone jobs and threatens an ever-widening range of industries. “While the impact is currently concentrated in sectors such as vehicles and chemicals, the broader effects could extend to nearly one-third of employment in the euro area,” ECB economists noted.

New research on jobs in the EU

The ECB’s warnings are reinforced by a new study from European Commission economists on risks to the European labor market stemming from declining exports to the U.S.

The study is co-signed by two senior experts of the Commission’s Directorate-General for Employment: Loriz Moreau, head of the statistics unit, and socio-economic analyst Eva Sonvald.

Although they try to avoid alarmism, their conclusions raise understandable concern. About 5.2 million jobs across the EU are supported by exports to the U.S. Changes in U.S. trade policy could disproportionately affect certain sectors and regions more than others. In particular, manufacturing (pharmaceuticals, machinery, and equipment) would be hardest hit, along with regions in Ireland, Northern Italy, and Germany.

According to Commission calculations, Greece ranks second-to-last, with just 1.1% of total jobs dependent on exports to the U.S.

The good and bad news for Greece

The good news is that countries like Greece, with a weak manufacturing base, are less vulnerable to direct trade disruptions. But that does not make them “bulletproof.” The negative impact on jobs could still come through broader macroeconomic pressures. A prolonged deterioration in global trade relations could reduce investment and growth worldwide, indirectly affecting employment across Europe.

How tariffs hit or spare jobs

Tariffs can affect EU employment by increasing the cost of EU goods in the U.S. market, undermining their price competitiveness, and potentially lowering demand. This, in turn, could reduce export-linked jobs in the EU. The scale of the impact depends on several factors:

- Trade diversion: If EU companies can redirect exports elsewhere, including within the EU, job losses may be reduced. But this is neither guaranteed nor easy, especially given competition from countries like China.

- Cost pass-through: The effect of tariffs on EU jobs depends on whether EU firms and U.S. retailers can or will pass on higher tariff costs to consumers. This will influence overall export demand.

- Substitution: For the EU, the extent of the damage depends on how easily EU products can be replaced with goods from other countries. This largely hinges on the substitutability of EU goods.

- A silver lining: In some cases, if other countries face higher tariffs, EU exporters could even gain market share.

Which countries are most vulnerable

In 2022, around 5.2 million EU jobs (2.4% of total employment) were supported by exports to the U.S. Exposure varies significantly across member states: 6.7% of total jobs in Ireland are tied to U.S. exports, compared with just 1% in Croatia. Greece is at the lower end, with 1.1%.

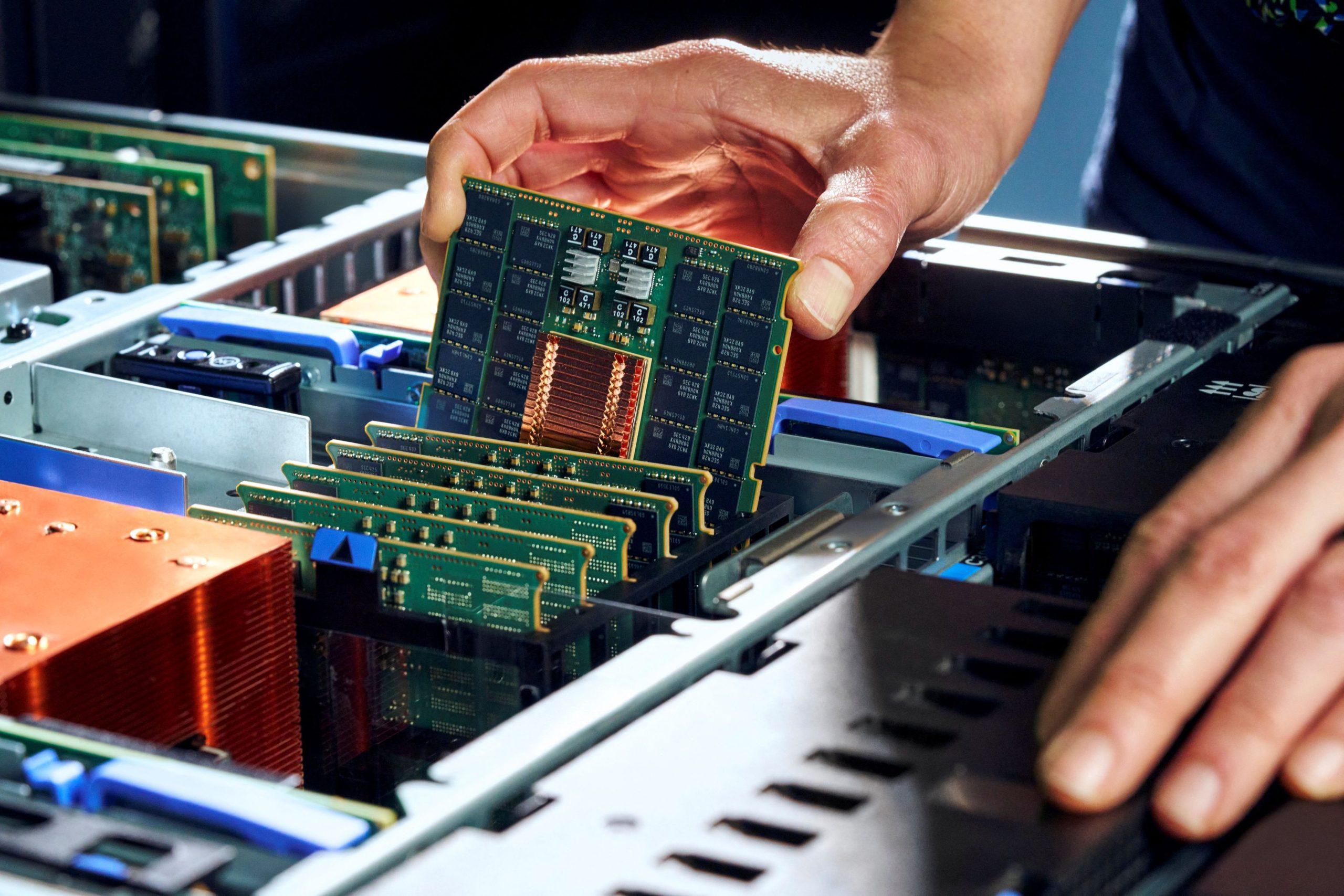

Pharmaceuticals, machinery, metals

Manufacturing plays a central role in EU–U.S. trade, accounting for nearly one-third of all jobs linked to U.S. exports.

In 2022, about 1.61 million jobs—or 31% of export-dependent employment—were in manufacturing. Other key sectors include wholesale and retail trade (14%), professional, scientific and technical activities (12%), and administrative and support services (10%).

In pharmaceuticals, nearly 14% of jobs depend on U.S. demand, making it the most exposed subsector. Machinery and equipment (including automotive) and basic metals (e.g. steel, aluminum) also show high exposure, with 7.4% and 7.1% of jobs linked to U.S. exports, respectively.

Regional impacts

Even within countries, employment effects are uneven. Regions with a high concentration of industry will be hit harder. Seven of the ten regions most exposed to U.S. trade are in Ireland and Northern Italy (notably Veneto, Marche, Emilia-Romagna, and Piedmont).

Other high-exposure regions include parts of Germany (Tübingen), the Czech Republic, Austria, and Hungary. These areas are closely integrated into global supply chains and have a larger share of jobs in manufacturing, making them more vulnerable to trade disruptions.

Source: Tovima.com