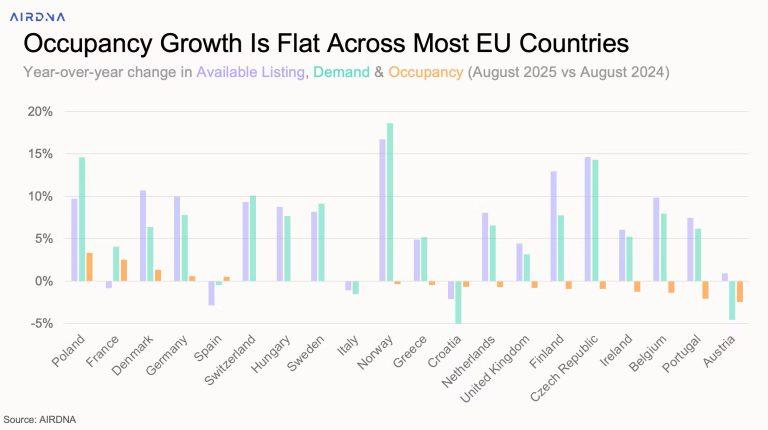

Greece remains one of Europe’s most dynamic short-term rental markets, according to AirDNA’s European review for August 2025. The data show that accommodation supply in Greece rose 4.9% year-on-year in August, while demand increased by 5.2%. However, the faster rise in available stays caused a slight drop in occupancy, down 0.5% compared with last year.

Athens Market Trends

Athens followed a similar pattern. Listings climbed 11% year-on-year while demand rose 5%, creating a temporary imbalance that reduced occupancy. Yet, looking at the entire summer season, the outlook is stronger: overnight stays increased by 6.4%, supply by 5.2%, and occupancy still managed to edge up 0.6%, highlighting Greece’s resilience as a top European destination.

Average Rates and Revenue

For the June–August quarter, Greece recorded an average daily rate (ADR) of €201, average occupancy of 70%, and revenue per available room (RevPAR) of €142.

Athens, however, trailed both the national and European averages, with ADR at €110, occupancy at 65%, and RevPAR at €72.

European Market Performance

Across Europe, the short-term rental market hit record highs in August 2025, with 4.16 million listings and 66.2 million overnight stays. Occupancy held steady at 73.5%, underscoring resilient demand even as average daily rates dipped slightly.

Northern and Central European countries such as Norway, Poland, and the Czech Republic posted double-digit growth. Coastal destinations including Marbella in Spain and Dubrovnik in Croatia achieved the highest RevPAR in Europe. Demand for Munich’s Oktoberfest was 9.5% higher than last year, reflecting continued strength in major event-driven tourism despite travelers’ growing preference for budget accommodation.

In August, Europe’s average ADR declined 0.3% year-on-year to €171.12, while occupancy rose 0.3% to 73.5%. RevPAR remained steady at €125.85.

Source: tovima.com

![Ρωσία: Αυξάνει τις επιθέσεις με drones [γράφημα]](https://www.ot.gr/wp-content/uploads/2026/02/UKRAINE-DRONE-ATTACK-300x300.jpg)

![Ρωσία: Αυξάνει τις επιθέσεις με drones [γράφημα]](https://www.ot.gr/wp-content/uploads/2026/02/UKRAINE-DRONE-ATTACK.jpg)