The risk of property bubbles across the world’s major cities has receded for the third year in a row, according to UBS’s latest Global Real Estate Bubble Index. Yet the 2025 report warns that global housing affordability has deteriorated further, leaving buyers with smaller living space and heavier financial burdens.

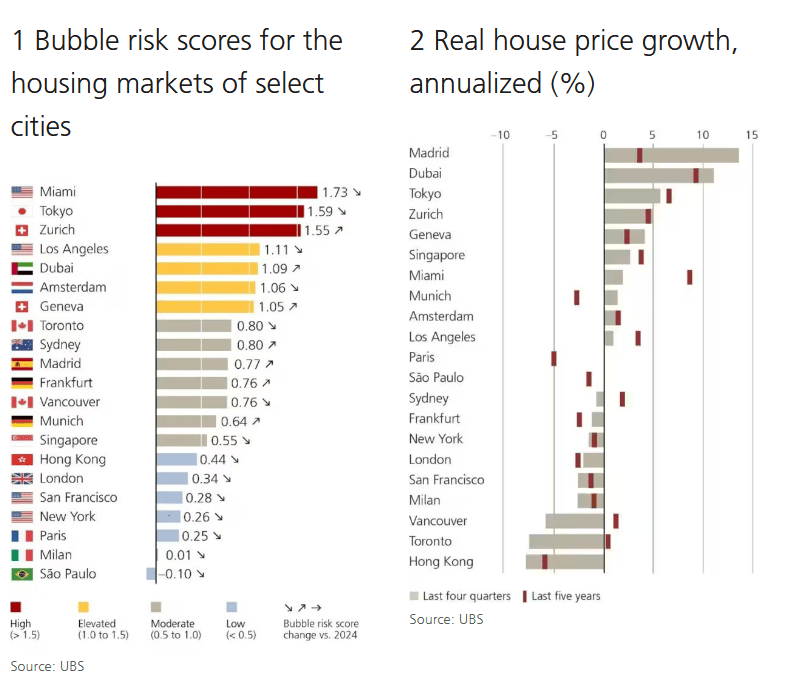

UBS analysed 21 global housing markets and found that Miami now tops the list for bubble risk, followed by Tokyo and Zurich. Dubai and Madrid also stand out, with the strongest increases in risk over the past year as home prices continue to climb sharply. In contrast, bubble risk in European cities such as Frankfurt, Paris, and Vancouver has declined significantly since 2021, reflecting a roughly 20% drop in real home prices after years of rising interest rates.

Overall, inflation-adjusted housing prices stabilised in 2024, with average prices flat across major cities. But beneath the surface, disparities are growing. In the past year, Madrid recorded the sharpest real price growth globally at 14%, while Dubai (11%) and Tokyo (5%) also posted strong gains. By contrast, values in Hong Kong, Paris, London, Munich, and Frankfurt have fallen by double-digit rates in recent years.

Housing affordability squeezed

Affordability remains the report’s central theme. In Hong Kong, buying a 60-square-meter apartment requires about 14 years of average income, making it the least affordable city worldwide. Other global hubs such as Tokyo, Paris, and London also register price-to-income ratios above 10, while in cities from Zurich to São Paulo, wages are insufficient to keep up with property values.

Since 2021, the amount of living space an average skilled service worker can afford has shrunk by about 30%, UBS notes. With mortgage rates still roughly twice the levels seen between 2020 and 2022, affordability is under strain even in markets with relatively low price-to-income multiples, such as parts of the United States.

A cooling market, but risks remain

According to Matthias Holzhey, lead author of the UBS study, the “euphoria” in global housing markets is fading, with bubble risks steadily easing. But affordability pressures remain acute, and the gap between prices, rents, and local incomes continues to widen in overheated markets, conditions that have historically preceded housing crises.

From a macroeconomic perspective, UBS sees housing as a potential financial shelter in an over-indebted world. With global public debt expected to approach 100% of GDP by decade’s end, central banks may eventually lower rates, potentially giving fresh momentum to real estate. But for now, affordability constraints keep demand in check and highlight the fragility of urban housing markets.

Source: tovima.com

![e-ΕΦΚΑ: Πώς θα παραμείνουν ασφαλιστικά «καλυμμένοι» οι αγρότες [πίνακας]](https://www.ot.gr/wp-content/uploads/2024/12/ot_agrotis_sitari-300x300.png)

![e-ΕΦΚΑ: Πώς θα παραμείνουν ασφαλιστικά «καλυμμένοι» οι αγρότες [πίνακας]](https://www.ot.gr/wp-content/uploads/2024/12/ot_agrotis_sitari.png)