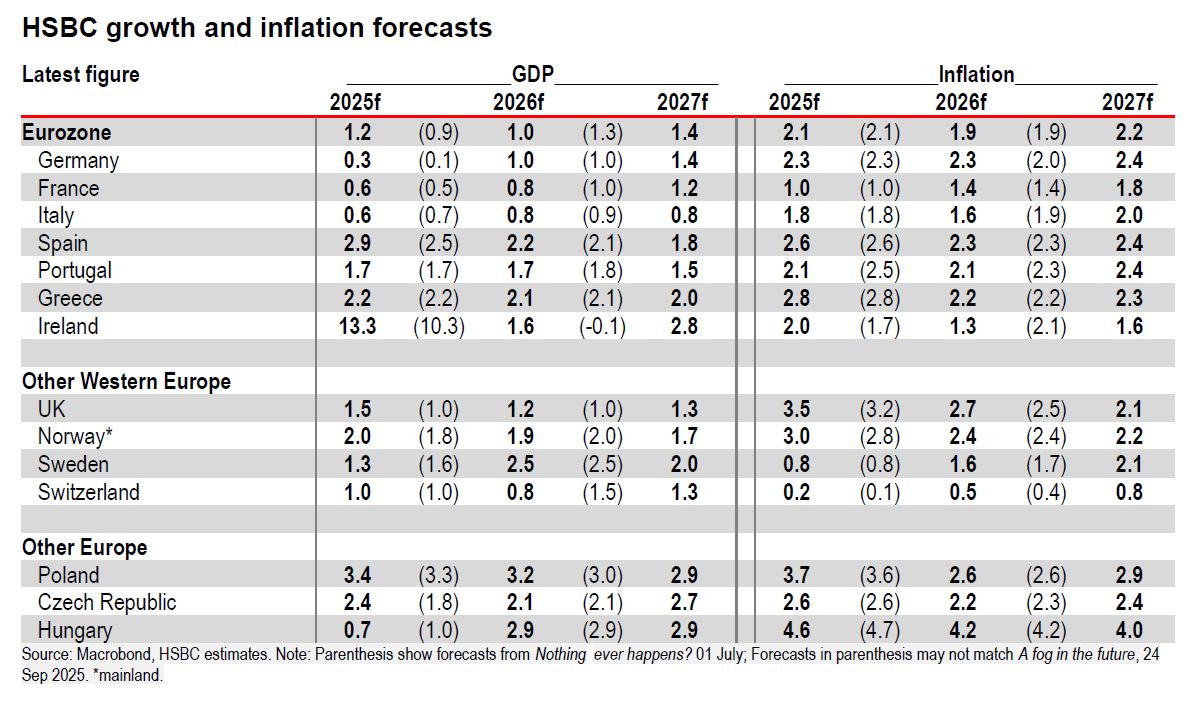

Greece’s economy is expected to maintain steady growth slightly above 2% through 2027, according to HSBC’s latest European outlook. The bank projects GDP expansion of 2.2% in 2025, 2.1% in 2026, and 2% in 2027 — signaling continued but moderate momentum.

Gradual Fall in Inflation

Inflation in Greece is forecast to decline slowly, with HSBC estimating 2.8% in 2025, dropping to 2.2% in 2026 before edging up again to 2.3% in 2027. The country’s debt ratio is expected to fall steadily, from 143.4% of GDP this year to 135.9% in 2026 and 129.4% in 2027. The national budget is projected to maintain a small surplus of 0.8% in 2025 and 0.2% in each of the following two years.

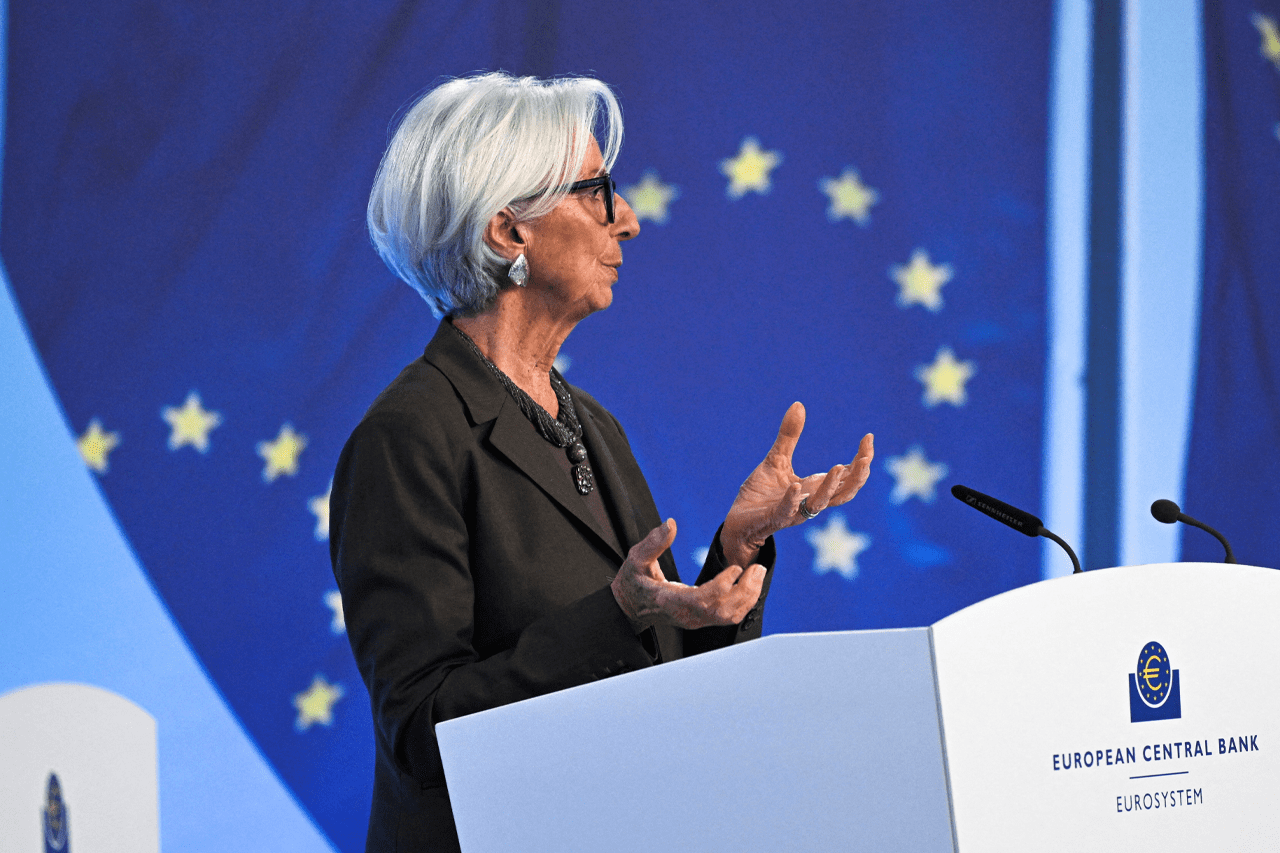

Eurozone Inflation Under Control

Across the Eurozone, HSBC sees inflation broadly contained, staying within 0.2 percentage points of the European Central Bank’s (ECB) 2% target since March. The bank notes the ECB is in a “good position,” with inflation expected to dip slightly below target through much of 2026. However, factors such as a stronger euro, new U.S. tariffs, or shifts in Chinese trade flows could renew price pressures.

Although HSBC foresees inflation remaining near or below target, it expects the ECB has likely ended its cycle of rate cuts. The central bank now appears willing to tolerate minor, temporary deviations from its inflation goal. Still, short-term risks leave open the possibility of one last 25-basis-point reduction.

The ECB’s ability to bring inflation down from 10.6% three years ago to near target levels — without sparking higher unemployment or economic contraction — marks a stark contrast to previous inflation-fighting eras marked by deep recessions and job losses.