Pierrakakis said he was briefed about the company’s plan to create a technology support center in Athens as part of Euronext’s bid to buy out the ATHEXGroup.

Posting on his Facebook page, the Greek minister extolled the initiative, stressing it demonstrated Greece’s progress in its digital transformation, adding the move was an investment in the country’s human capital.

Stéphane Boujnah clarified he did not intend to come back with a new bid for the buyout of the Greek Stock Exchange if the current talks were unsuccessful during a press conference earlier on Monday.

“The offer on the table is very lucrative,” he said, pointing out that the valuation was based on realistic data and assumptions present in other European markets in Euronext’s portfolio.

The head of Euronext responded “no comment” to a question regarding the content of the amendment submitted by the Greek government about public offers and delistings of companies from the Athens Stock Exchange. He added only that it was a European directive that had to be adopted into Greek law.

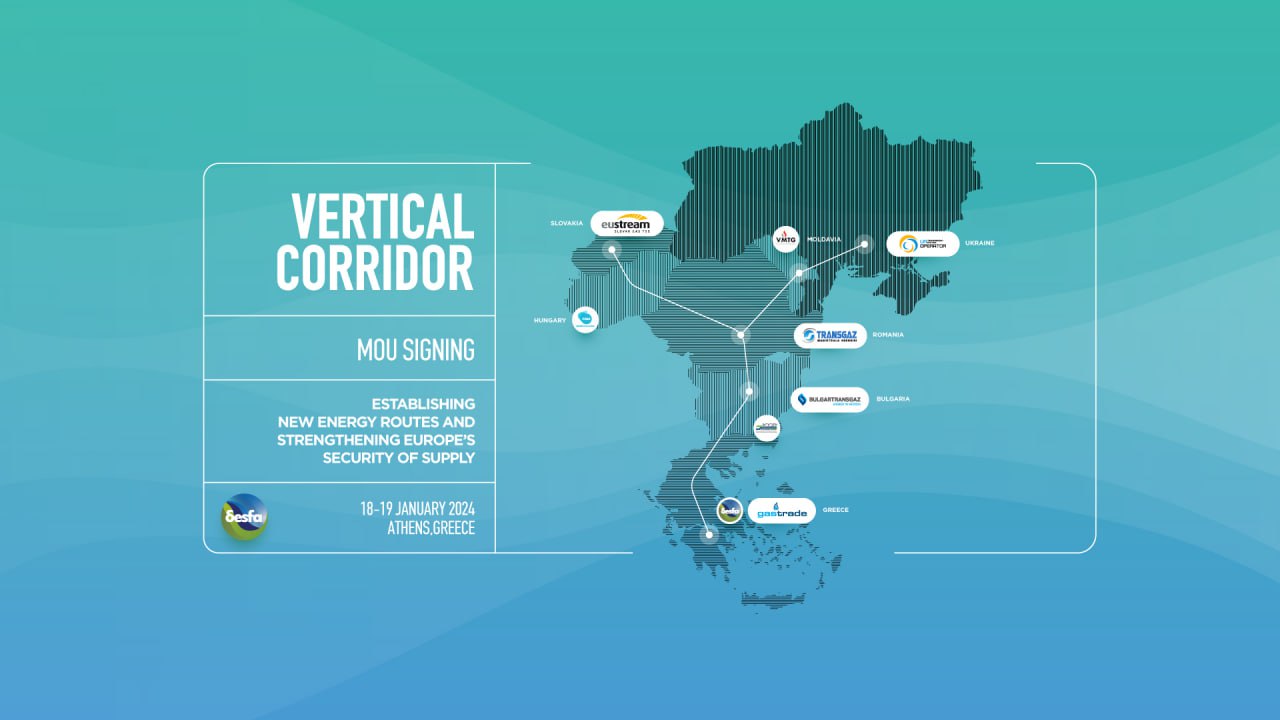

In the event the deal with the ATHEXGroup fell through, Boujnah stated it was “not an existential issue” for his company. “If it does not succeed, we will look for other ways to expand in Southeastern Europe,” he said.

Responding to another question about how much new listings have increased on the exchanges Euronext has already acquired, he emphasized the significant rise in trading volume and the reduction in transaction costs but did not address the “inflation” in the number of listed companies on those markets.

Euronext representatives met with representatives of the Greek stock exchange last Friday to assuage the employees’ concerns about potential layoffs.