By Cheryl Novak

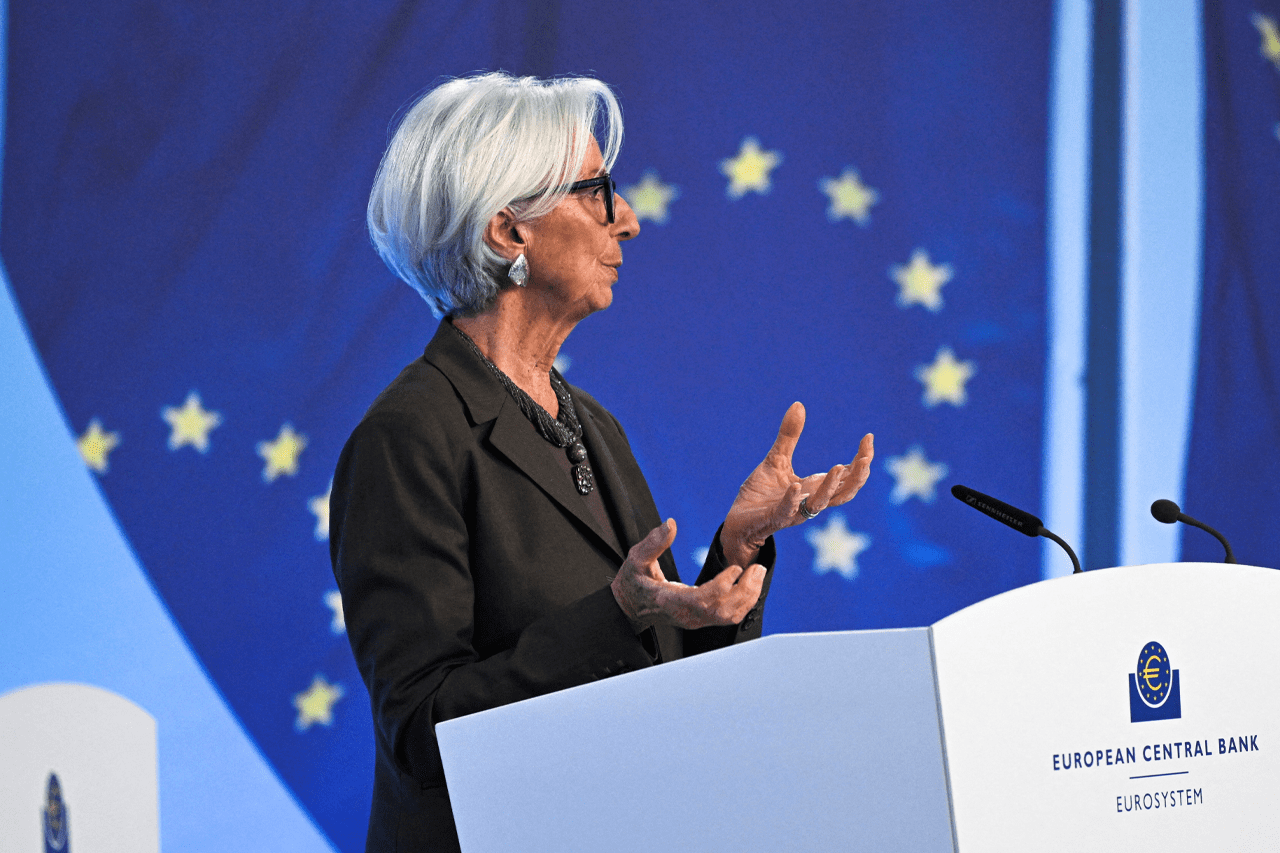

On Thursday the European Parliament (EP) voted through the so-called “Omnibus Simplification Package,” which aims to reduce the sustainability reporting obligations of EU and non-EU companies.

The vote was passed with 382 votes in favor, 249 against, and 13 abstentions, due primarily to an alliance of center-right and far-right groups, signaling a broader rightward shift in EU climate and regulatory policy. That being said, an estimated 12-13% of Social Democrats also supported the revisions.

Speaking on the vote, EPP Rapporteur Jörgen Warborn says, “Europe has a huge growth problem. We are falling behind more or less all of the big economies throughout the world…We have been too bureaucratic, we need to realize it and we need to fix this for businesses in order to come back to growth.”

Warborn also claims that the changes will save companies an estimated 5 billion euros per year from reduced costs related to reporting obligations.

The vote came after months of pressure by the United States and other third countries which argue that the existing rules are too bureaucratic and impediments to trade and competition. During a press conference on the matter, Warborn defended the EU, however, saying that the decision considered concerns of third countries, but that Omnibus simplification is first and foremost about EU competitiveness.

The further dilution of sustainability reporting standards is viewed as a loss by staunch supporters of the EU’s flagship Green Deal and transparency architecture, which was previously a key pillar of EC President Ursula von der Leyen’s EPP party. The simplification package has also raised concerns about the availability of comparable data, necessary for banks, and also whether violators of Omnibus-related laws will be punished adequately.

On the point of punishment, particularly in relation to victims’ compensation and civil liberties, Warborn says that the matter is no longer an EU-wide issue, but rather the responsibility of individual Member States to determine what is adequate punishment, adding that it is time for Europe to approach sustainability in European companies with a “carrot, rather than a stick.”

What was decided

The EP voted to limit the Corporate Sustainability Due Diligence Directive (CSDDD) obligation and scrap the obligation for companies to adopt climate transition plans.

With the new vote, only companies with at least 5,000 employees and €1.5 billion in turnover will now have to comply with the CSDDD reporting process.

Voted into law in July 2024, CSDDD obligations aim to “foster sustainable and responsible corporate behavior in companies’ operations and across their global value chains,” and initially applied to all EU companies with more than 1,000 employees, or €450 million net worldwide turnover, as well as all non-EU companies with over €450 million turnover in the EU.

The change means that well over half of the companies originally in scope (around 6,000 EU companies plus about 900 non-EU companies), will no longer be captured by the obligation, relieving mid-sized groups and many listed companies in smaller Member States from the obligation.

In parallel to the decision on CSDDD, MEPs backed changes to the Corporate Sustainability Reporting Directive (CSRD) that will reduce the number of companies required to publish detailed ESG reports and simplify the European Sustainability Reporting Standards (ESRS) through a series of measures, including the reduction of data points.

Moreover, large companies will not longer be able to demand granular reporting information from smaller companies in their supply chains. This is expected to reduce the indirect burden of sustainability reporting on small companies as well, although this could expose larger companies captured by CSDDD to more supply chain risk as they will no longer have the data needed for assessment and risk reduction decision-making processes.

What happens next? Ratification path and timeline

This vote does not yet change the law on the ground and the process is far from over. However, it does three things: sets the Parliament’s official position on how to amend CSDDD and CSRD through the Omnibus package; opens the way for trilogue negotiations with the European Parliament, Council of the EU (Member States) and the European Commission; puts political pressure on the Council to accept higher thresholds and lighter reporting.

The base of the CSDDD text is already law and, under the original directive, Member States must transpose CSDDD by July 2027, with company obligations phasing in from 2027–2030, depending on their size.

The Omnibus amendments will move into trilogue on Tuesday. The pressure is on EU bodies to come to an agreeement as the negotiations are part of what is known as a “stop the clock” procedure, and must be completed before already-voted-in timelines start.

On account of the high priority placed on Omnibus, but also the complications around arriving at an agreement in trilogue due to different positions of the European Commission and Council on various points of the simplification package, observers expect final agreement only in late 2025 or even 2026.

What does this mean for Greek companies?

Under the new simplification rules, if passed, very few Greek companies will be captured by the reporting obligations. Some key examples of the few Greek companies with over 5,000 employees and 1.5bln eur of turnover include Public Power Corporation (PPC), Hellenic Telecommunications Organization (OTE), Sklavenitis Group (known for their supermarket chain in Greece), and banks such as the National Bank of Greece (NBG), Alpha Bank, Eurobank Group and Piraeus Bank.

By contrast, several large Greek energy and industrial groups with very high turnover but fewer than 5,000 direct employees, such as HELLENiQ Energy, Motor Oil Hellas and Metlen (Mytilineos), could drop out of scope under the Parliament’s preferred thresholds, even though their environmental footprint and is significant.

Nevertheless, even if formal obligations are eased, Greek SMEs and mid-caps could still face indirect pressure from big EU clients and banks asking for ESG-related information, due to the due diligence obligations faced by large EU companies to identify and address human rights abuses and serious environmental harm in their own operations and supply chains.

Source: tovima.com

![Στεγαστική κρίση: Γονατίζει ένα στα τρία νοικοκυριά [πίνακας]](https://www.ot.gr/wp-content/uploads/2026/02/akinita26-4-300x300.jpg)

![Ελλάδα: Υποχώρηση της προσφοράς καταλυμάτων βραχυχρόνιας μίσθωσης [πίνακας]](https://www.ot.gr/wp-content/uploads/2026/02/airbnb-1.jpg)

![Στεγαστική κρίση: Γονατίζει ένα στα τρία νοικοκυριά [πίνακας]](https://www.ot.gr/wp-content/uploads/2026/02/akinita26-4.jpg)