For years, limited international visibility was the Achilles’ heel of the Greek stock market. Combined with a lack of depth that risked trapping investors in illiquid positions, Athens often struggled to attract sustained global interest.

In 2026, that narrative is changing.

The Athens Stock Exchange is starting to reap the benefits from growing coverage of Greek equities by major foreign investment houses. The presence of global names such as S&P and Intesa Sanpaolo is increasing the market’s visibility and opening new liquidity channels for the Greek investment story.

Euronext Boost Strengthens Market Profile

The importance of visibility has been repeatedly highlighted by Yianos Kontopoulos, CEO of ATHEX, who has pointed to the benefits stemming from the Athens Stock Exchange’s inclusion in the Euronext group.

Strong January Performance for Greek Stocks

The positive momentum was clearly reflected in January’s performance. The benchmark General Index posted strong gains, with blue chips in the FTSE 25 leading the rally, particularly stocks already on the radar of international investors.

Infrastructure and energy companies played a starring role.

GEK TERNA topped the performance table, surging 30.8% in a single month, underscoring the central role of infrastructure and energy in Greece’s equity narrative.

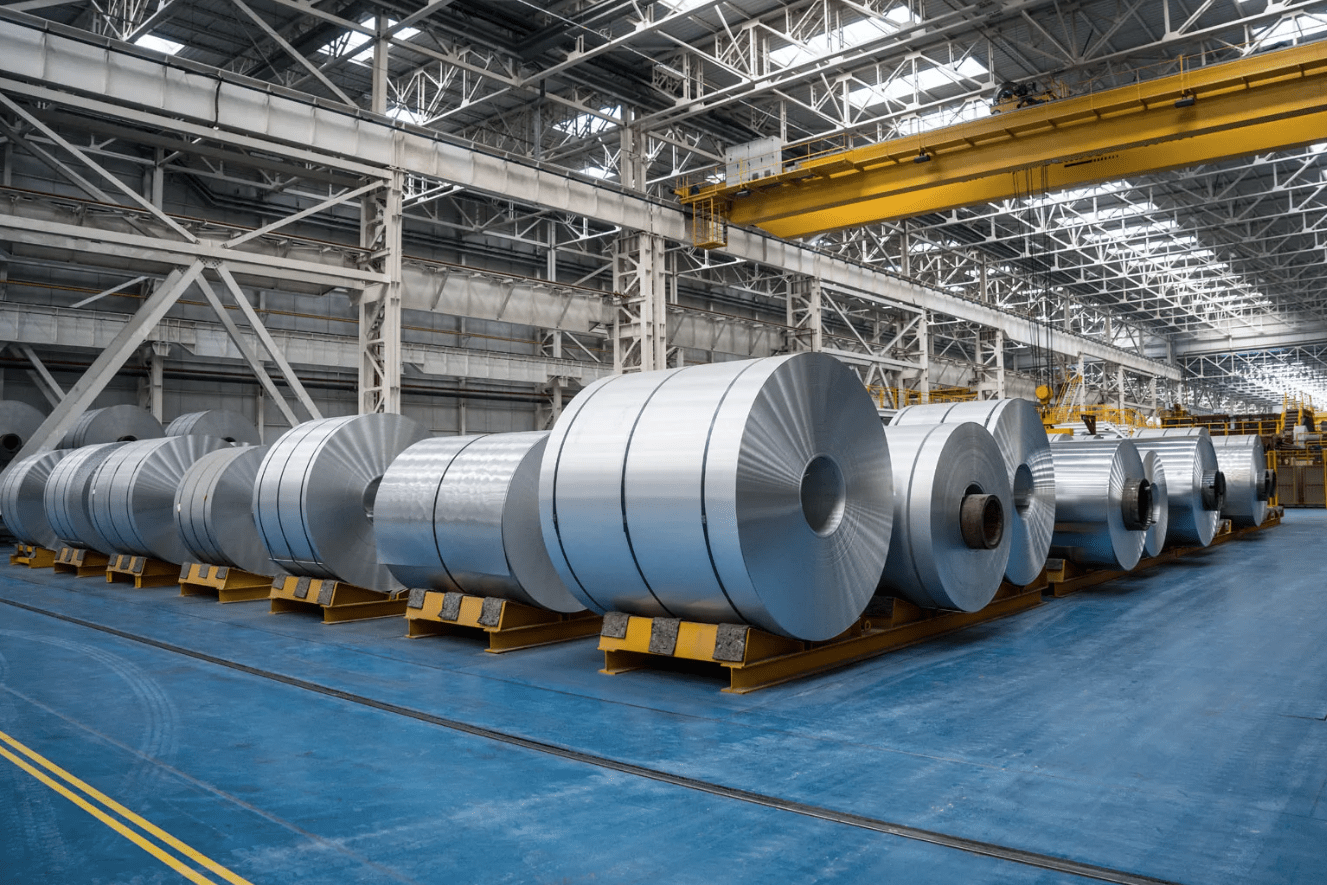

Industrial exporters also delivered impressive gains. Cenergy Holdings rose 29.3%, followed by ElvalHalcor at 23.1% and Viohalco at 9.2%, reinforcing the industrial sector’s status as one of the market’s most outward-facing segments.

Greek Banks Rally as Confidence Builds

The banking sector was another pillar of strength.

Piraeus Bank jumped 25.3%, while Eurobank gained 20.7%. Bank of Cyprus rose 17.6%, followed by National Bank of Greece at 14.7%, Alpha Bank at 13.1% and Optima Bank at 12.3%.

Energy and heavy industry stocks also participated in the rally. PPC advanced 9.7%, Helleniq Energy gained 8.5% and Motor Oil rose 8.2%, while TITAN closed the month up 8%.

Not all stocks shared in the gains. Retailer Jumbo declined 10.3% during the month.

Record Liquidity in 2026

Alongside price performance, liquidity has surged.

Average daily trading value has soared over the past decade: from €55 million in 2018 to €218 million in 2025 and to €413.2 million in 2026. In the past year alone, trading activity has increased by 89.5%.

Experienced market analysts say the rise in trading volumes is not merely cyclical. It is closely linked to increased institutional participation, stronger investor confidence and, crucially, the growing inclusion of Greek stocks in international watchlists and research reports.

“When a stock is covered by a major house, it stops being a local story,” market participants note.

Source: tovima.com