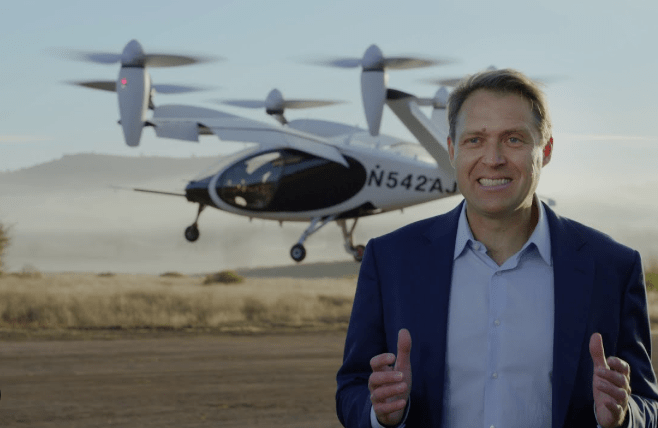

Alpha Bank’s business plan to boost its profitability in the coming years will be supported in the online channels and the automation of the request processing procedures it receives, using robotic methods.

In this context, its digital transformation program, codenamed “the alpha blueprint”, has been in progress for a year now, with a total budget of around 430 million euros, which is expected to be completed in 2023.

As Alpha Bank CEO Vassilis Psaltis said during yesterday’s event on the subject, his coordinated actions aim at “a Bank that is more functional, more innovative and ultimately more durable and more profitable.”

With its progress and successful completion, according to Mr. Psaltis, the systemic group will enhance the return on equity at the level of 10%, as provided by the business plan “Project Tomorrow” that is already being implemented.

The financial goals

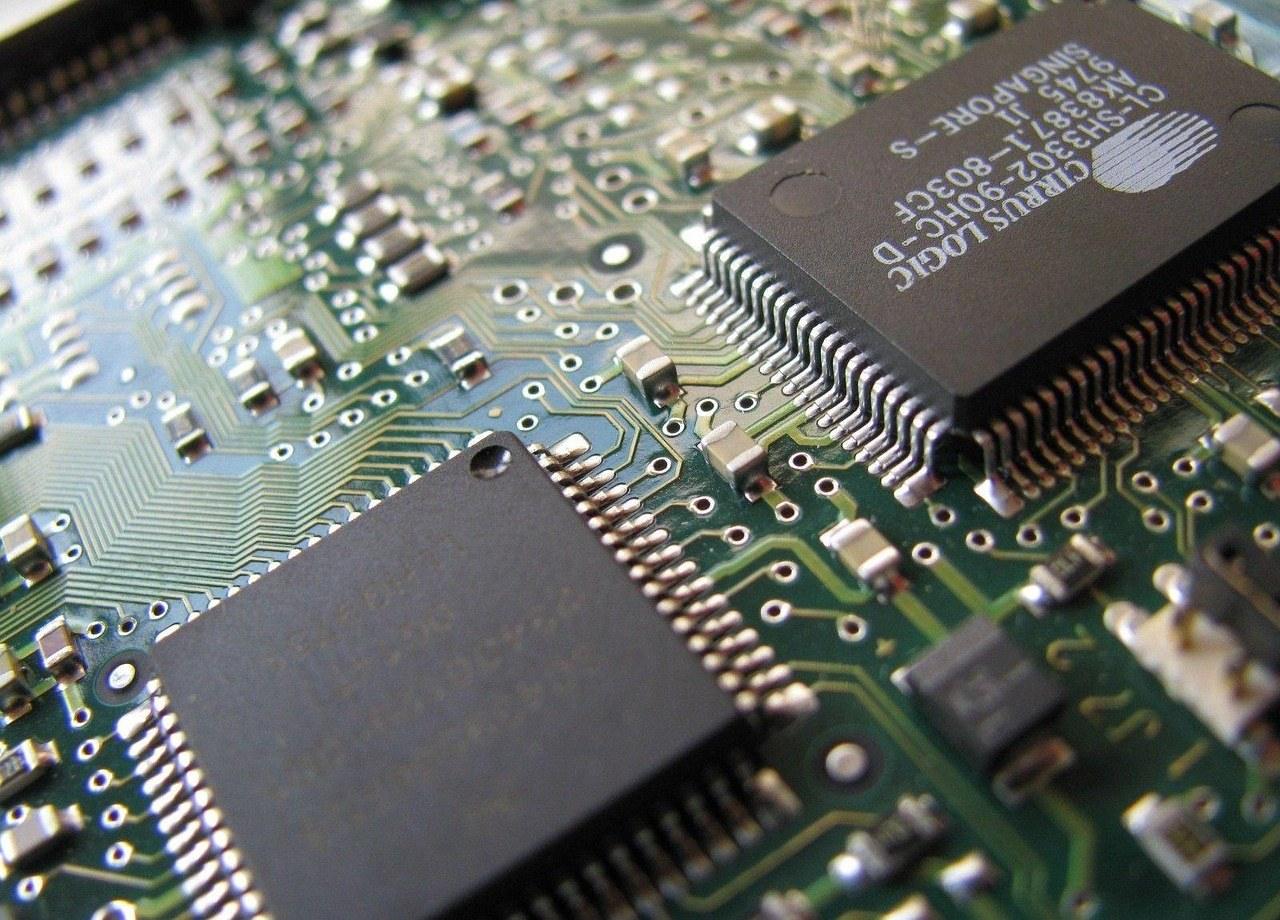

According to yesterday’s presentation, the total investment and restructuring costs will amount to 430 million euros, while 120 million euros will be allocated exclusively for the technological upgrade of the bank’s systems.

Through the transformation program, Alpha Bank will enhance its operations and profitability, while freeing time for its executives to promote its products and achieving significant cost savings.

Specifically, Mr. Psaltis expects the following:

• Productivity improvement by 25%, while reducing the average processing time and operational risk

• Net reduction of operating costs by 60 million euros annually by utilizing technologies, improving efficiency and streamlining the operating model.

• In Retail Banking, the goal is to achieve additional income of 60 million euros from interest and 65 million euros from commissions within 4 years.

• In Business Banking, the goal is to increase interest income by € 200 million and to increase commission income by € 35 million by 2024.

Contact with customers

The restructuring of the bank’s operating model will be immediately apparent to its clientele, as it will be able to process any work faster and easier, including the disbursement of loans.

In this context, more than 15 actions are foreseen to enhance efficiency, reduce the average processing time and operational risk by using robotic process automation (Robotic Process Automation).

More specifically, the new services to Alpha Bank customers are the following:

• Small consumer loans will be granted to alternative networks (myAlpha mobile, myAlpha, check-out digital retailers)

• Decisions to approve a loan will be made automatically, without the intervention of the human factor, at a rate of more than 50%

• Consumer loans will be approved in less than 1 day, while car loans in less than 1 hour

• A new way will be established for customer-store communication and for processing transactions through video calling

![Επενδυτικό κενό: Πόσο πρέπει να…τρέξουμε για να καλυφθεί [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/07/ot_greek_ecomomy555-1024x600-1.png)

![Ψηφιακά στοιχεία διακίνησης αποθεμάτων [Μέρος 3ο]](https://www.ot.gr/wp-content/uploads/2025/04/aade-1.jpg)

![ΦΠΑ: Τι θα συμβεί στο «ράφι» αν μειωθεί ο συντελεστής – Η ανάλυση της ΤτΕ [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/07/ot_taxes44.png)