Société Générale considers it unlikely that Greece will regain investment grade before the fourth quarter of 2022. It is reopening the trade of Greek bonds against Italian bonds in order to be prepared even for a possible surprise from S&P next Friday on the 21 of April, if it is the first ratings agency to put Greece in the investment grade category. The agency considers that the most likely scenario, due to the elections, is for this upgrade to come at the end of 2023 and the beginning of 2024, however… it keeps the possibility open. In fact, as he emphasizes, if the surprise does not happen, the trade will be closed again.

It is worth recalling that Société Générale had again recommended the purchase of Greek 10-year bonds against their Italian counterparts in November 2022, based on Greece’s strong fundamentals and the prospect of a return to investment grade in 2023. It closed this trade in February, after it had given good returns. The French bank closed the trade because it performed very well and Fitch’s upgrade of Greece in January did not surprise the markets. It explained that it refrained from re-entering the trade in March due to the turmoil in the credit market after the collapse of SVB, especially as Greece’s banking sector is still weaker than those of other EU countries.

Investment grade: Which sectors of the Greek economy will benefit

According to the bank, S&P and Fitch rate Greece with BB+ and a stable outlook, one step above the investment grade level. With fundamentals still supportive, it believes there is a significant chance Greece’s credit rating will be upgraded this year. The IMF, it adds, has again revised down its forecasts for Greece’s debt-to-GDP ratio, now expecting it to fall to 160% in 2024, the lowest level since 2010.

The elections and the example of Portugal

Moreover, while the May elections are not expected to reverse the reforms, the uncertainty could prevent rating agencies from moving too quickly, analysts note. Thus, the French house only expects an upgrade of the outlook to positive in the reviews of S&P in April and Fitch in June.

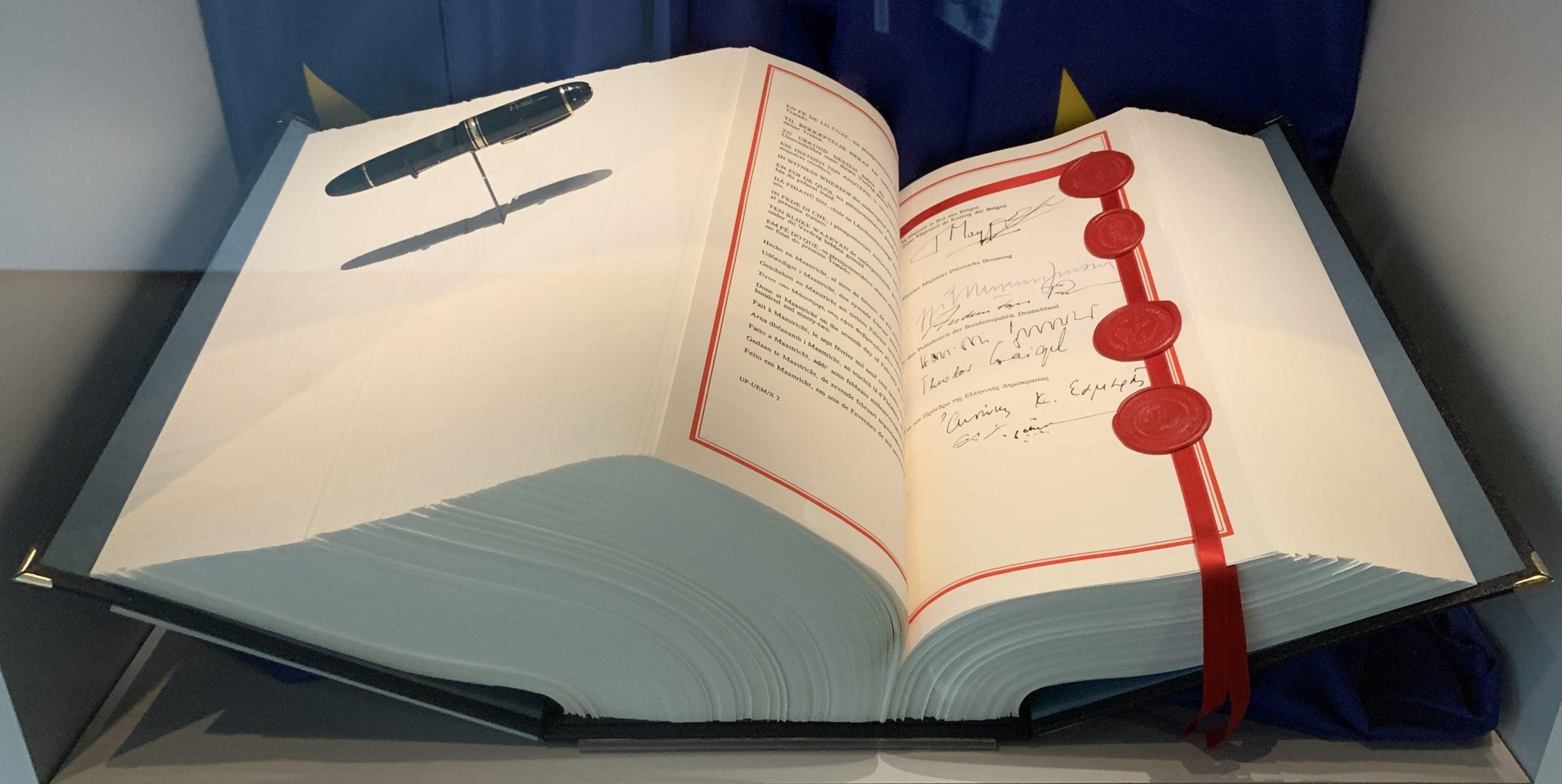

As analysts emphasize, an upgrade of the rating would have a very large effect. They recall that when S&P upgraded Portugal to investment grade in 2017, the spread between Portuguese and Spanish bonds narrowed by 36 basis points in one week, discounting the inclusion of Portuguese securities in bond indices. So far, such a surprise from S&P has not been discounted by Greek bond prices, notes Société Générale.

He also points out that Greece has already covered 6 billion euros of the 7 billion euro target for this year’s bond issues. In the case of the upgrade, the spread can go from 2 basis points today, to -30 basis points.

![Ακίνητα: Πόσα τ.μ. αγοράζεις με 250.000 ευρώ [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/12/akinita1-e1727899707686-1024x684-1-1-1.jpg)