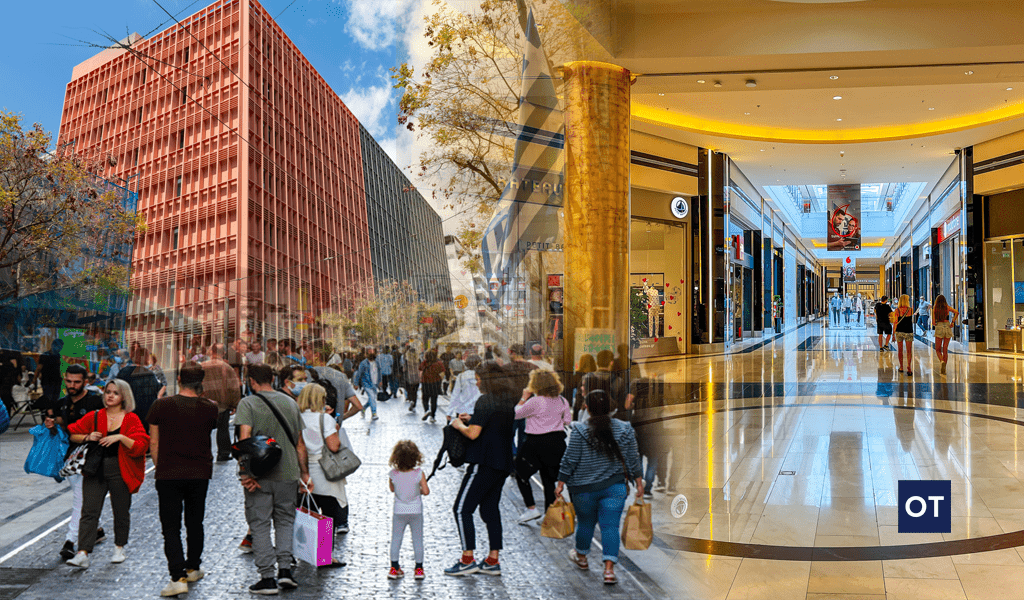

New tax incentives to boost electronic transactions and curb tax evasion will be sought by the new economic staff of the government that will emerge from the elections.

While the Bank of Greece figures show a further 14% increase in the value of card transactions in 2022, the Ministry of Finance finds that the “golden” receipts from 20 professional sectors, which give a tax deduction of up to 2,200 euros to taxpayers, id not make a significant dent in the fight against tax evasion.

Taxpayers continue to pay cash to professionals with a high rate of tax evasion such as electricians, plumbers, carpenters, refrigeration, hairdressers, hairdressers and other professionals.

The reason for the failure of “golden” receipts is that the reduction in income tax earned by the taxpayer who requests and receives a receipt from certain categories of professionals is much less than the discount the professional makes to the final price by not claiming the 24% VAT since the taxpayer agrees not to receive a receipt.

And in fact, the profit through not issuing a receipt is immediate for the taxpayer, while the profit from the income tax reduction appears many months later, specifically the following year when they submit the tax return.

With the aim of limiting tax evasion, the review of the tax-bonus to strengthen electronic transactions and the expansion of POS to all sectors of the economy will be high on the agenda of the new economic staff.

At the same time, the Financial Stability Report of the Bank of Greece records a new jump to 94 billion euros in the total value of debit and credit card transactions in 2022 and a 4% increase in the number of cards and 6% in the number of transactions.

The figures for 2022

In more detail according to the data:

– The total number of active payment cards in circulation at the end of 2022 amounted to 20.6 million, up by 4% compared to 2021. In individual card categories, the number of debit cards increased by 5% to 17 .6 million cards. A significant increase of 20% was recorded in the issuance of prepaid cards, which amounted to 2.3 million. The number of credit cards did not change and amounted to 2.9 million cards. Virtual 128 cards increased by 17% to 126,000 cards. The ever-increasing use of the internet for transactions appears to be a major reason for the continued growth in the issuance of prepaid and virtual payment cards.

– The total number of payment card transactions in 2022 was 1.93 billion from 1.658 billion in 2021, showing an increase of 16% compared to 2021. The number of debit card transactions was 1.775 billion from 1 , 523 the previous year, up 17%. Debit cards continued to be the main substitute for the use of cash, with a percentage share of 92% of the total number of transactions with all types of payment cards. The number of credit card transactions reached 154 million, up from 135 million in 2021, up 14%. Credit cards accounted for 8% of the total number of transactions.

– The value of transactions with payment cards amounted to 94 billion euros, increased by 14% compared to 2021.

– Average number of transactions per card increased by 12% to 94 transactions, up from 84 transactions in 2021. Looking at payment ratios by individual card categories, the change in average number of transactions per card is driven more by a significant increase in the average number of transactions per debit card to 101 transactions, from 90 transactions in 2021, and less to increase the average number of transactions per credit card to 52 transactions, from 46 transactions in 2021.

– The average value of transactions per card increased by 9% to 4,556 euros, from 4,186 euros in 2021. The increase in the average value of transactions per card is mainly due to the number and value of transactions with debit cards, given their higher volume. More specifically, the average value of transactions per debit card showed an increase of 8% to 4,898 euros, from 4,546 euros in 2021, while the average value of transactions per credit card increased by 18% to 2,501 euros, from 2,117 euros the previous year.

The average value per transaction continued its downward trend in 2022, decreasing to €48, from €50 in 2021 and €58 in 2020. The decline in average value per transaction was mainly recorded in debit card transactions, as it decreased to €49 from 50 euros in 2021. In credit card transactions, the average value per transaction increased to 48 euros, from 46 euros the previous year. The continued decline in average value per transaction over time is likely due to the increased use of debit cards for low-value goods and services.