An artificial intelligence software helped tax authorities in France identify more than 20,000 undeclared private swimming pools and fine owners a total of €10 million. This system can identify swimming pools in aerial photographs and cross-reference them with the Land Registry databases.

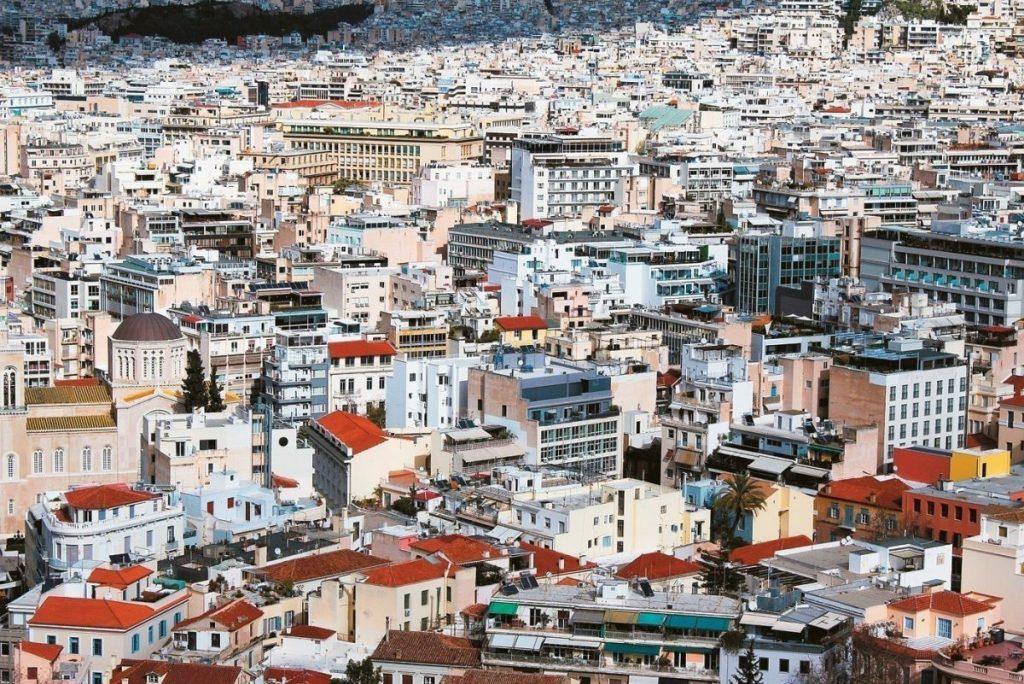

A similar AI tool is now in the hands of the AADE’s tax audit mechanism which has launched audits and cross-checks to find taxpayers who are hiding swimming pools in their homes from the IRS. As revealed by the commander of Independent Authority for Public Revenue-AADE, Giorgos Pitsilis, an algorithm scanned specific points of the satellite map and identified the blue points, while then the system distinguished which of them are indeed swimming pools and not something else, extracted the coordinates and followed a cross-reference through Land Registry . “Now we are in a phase where we are cross-checking the evidence. In the coming weeks we will know more so that we can then run it nationwide” said Giorgos Pitsilis to emphasize that the artificial intelligence tool will be used more widely to combat tax evasion.

To create the algorithm that reveals the undeclared swimming pools, aerial photographs were used through google maps, the declared data in E9 (in column 9, code 11 the swimming pools are declared) which are then cross-referenced with the Land Registry data.

The data collected by AADE on the swimming pools based on the algorithm will be compared with the data of the tax returns in order to identify the taxpayers who have “forgotten” to show them to the Tax Office in order to avoid the presumption of living and the ENFIA property tax or have constructed swimming pools without having the necessary permit.

In all cases where it is found that the taxpayer has not declared his pool, the procedures for imputation of fines and taxes will begin, reaching up to ten years back. Specifically, the ENFIA, the income tax, will be calculated and charged as they are a presumption of living, while at the same time a luxury living tax is imposed. The data will also be sent to the urban planning authorities, so that they too can impose the relevant fines provided for by law in case of illegal construction of the swimming pools.

ENFIA property tax

Swimming pools are charged with ENFIA as they are considered auxiliary areas of the residence and have the same tax treatment as warehouses and parking lots. It is noted that in the case of ancillary spaces, the ENFIA is calculated with a 90% discount.

Standard of living presumption

The presumption for swimming pools is activated from the first square meter and also applies to communal swimming pools located in residential complexes. As regards the luxury living tax for both indoor and outdoor swimming pools, it is equal to the product of the amount of the annual objective expenditure multiplied by a rate of 13%.

More specifically, the presumption of living for those who own swimming pools is defined on a scaled basis as follows:

– At 160 euros per square meter up to sixty 60 square meters and

– At 320 euros per square meter, for an area of more than 60 square meters.

The presumption is also applied when the tank is assembled since the law makes no distinction, while when it comes to an indoor swimming pool, the amounts are doubled. The objective living expense for swimming pools is calculated for the whole year without being limited to months of use whether it is a primary or secondary residence. In cases of death or transfer/acquisition of residence within the year, the objective expense is calculated in the months of use.

Shared swimming pool in an apartment building

For communal pools located in apartment complexes, the annual objective cost of living is apportioned to the owners and tenants of the properties based on the square footage of each apartment on the lot.