The question of whether the 60% rally of Greek banks on the stock market will continue occupied the HSBC conference held in London over the previous days.

The answer is clearly positive, given that, as the bank points out, the analyst consensus does not seem to reflect a favorable outlook for net interest income (NII) due to continued ECB interest rate hikes, low deposit costs and growing title books.

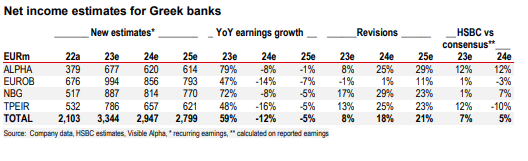

HSBC raises its 2023-2025 earnings estimates by 8%, 18%, and 21%, on average, adjusts price targets and reiterates Buy ratings for all four banks. These revisions place HSBC above the consensus of 7% and 5% for the years 2023-2024, with the highest difference being found in the case of Alpha Bank, which is emerging as a preferred choice.

According to Bloomberg, 70%-80% of sell-side analysts have Buy ratings on the Greek banks surveyed by HSBC, however, the average target price does not suggest a significant upside. This implies a wave of revisions from analysts in either direction in the short term, the bank believes.

Target prices

The target values are set as follows:

Alpha Bank at 2.20 euros per share from 1.45 euros before and an upside of 45%.

Eurobank at 1.95 euros per share from 1.60 euros before and an upside of 28%.

National Bank at 7.95 euros from 6.95 euros before and a 36% upside margin.

Piraeus Bank at 4 euros per share from 3.35 euros before and a 37% upside margin.

Strong earnings for the next two quarters, reviews and elections

The bank maintains its position on net interest income, which was expressed in recent rounds of earnings, and that Net Interest Income-NII is likely to peak in the second half of this year due to repricing of loans, but will decline in 2024 due to repricing of deposits. However, the 400 m.v. HSBC’s estimate of the ECB rate (previous estimate 350bps) suggests that the peak for the NII is higher. Also, lower-than-expected deposit betas so far and growing bond portfolios suggest the decline in 2024 will not be as steep.

Overall, it raises NII forecasts and now expects recurring earnings to grow 59% this year (from 47% previously forecast), followed by a 12% decline in 2024 (from 19% previously).

“We see further upside in Greek bank stocks despite a significant rise over the past six months amid NII storm, market-friendly outcome of first round election and hopes for an upgrade of the sovereign’s credit rating to investment grade. Despite these strong performances, however, Greece is still the only banking system in the Global Emerging Markets-GEM coverage to trade below book value for a positive risk-adjusted ROTE. Additionally, Alpha and Piraeus still appear to be undervalued in both GEM and Europe, although they no longer appear as the cheapest GEM stocks on P/BTV.”

“Alpha Bank is becoming our preferred choice. Its underperformance has put its valuation below domestic peers and at the lower end of our coverage of emerging market banks. However, we foresee a resilient NII outlook relative to domestic banks leading to some replenishment of the ROTE ratio. This does not appear to be reflected in analyst estimates, as we are 12% above consensus for both this year’s earnings and 2024. The plans for cost forecasts and operating expense (opex) targets set in the 2022 business plan -2025 are upside risks. We also highlight Alpha Bank’s relative value to Piraeus Bank, with the former having a 5% discount on P/TBV for this year, despite a similar capital-adjusted ROTE ratio and higher CET-1 capital ratio,” notes British bank.

Among other things, it believes that the strong momentum National Bank has in net interest income over the past two quarters has been underestimated.

Finally, he sees absolute value in Eurobank this year at a 0.79x P/TBV ratio for around 15% ROTE and reckons trading in line with European large-cap peers with similar ROTE but a lower cost of capital profile could to create some overlap for its valuation.