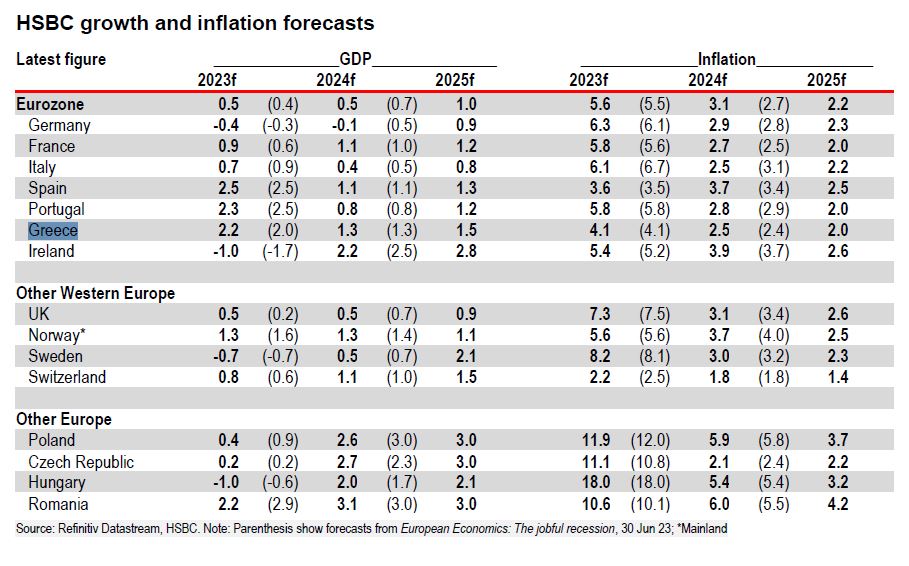

On the inflation front, price pressures will remain, with the index at 4.1% this year and 2.5% in 2023.

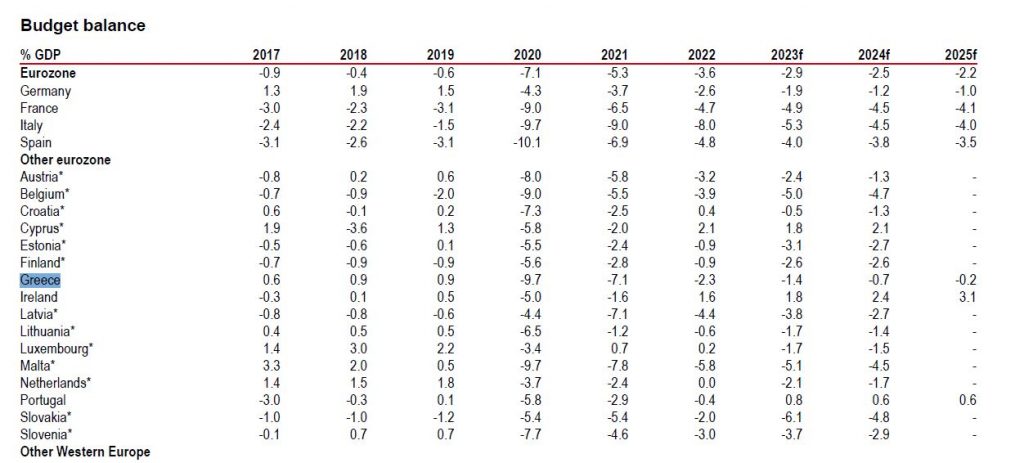

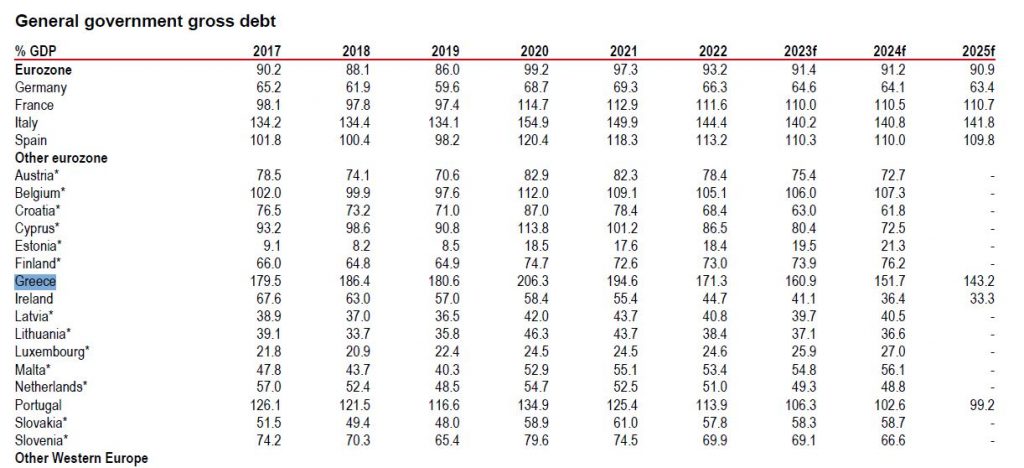

Fiscally, HSBC expects Greece to run a budget deficit of 1.4% this year, which will decrease to 0.7% in 2024, while on the debt front, the deleveraging will continue to 160.9% of GDP this year and 151.7% the following year.

The Greek economy will, along with Spain and Portugal, perform better this year at a difficult time, according to HSBC’s analysis of estimates for the last quarter of the year. As he points out, after the resilience shown earlier in the year, Europe’s leading indices have deteriorated.

While there was some stabilization in the Eurozone PMI in September, HSBC expects broad-based stagnation in the third and fourth quarters of this year. In particular, the manufacturing sector has been hurt for some time – and the “pain” of high interest rates is not abating. Global trade has been in a broad downward trend since the third quarter of 2022 and new export orders remain extremely weak.

To date, the “pain” for Europe’s corporate sector (as a whole) has been bearable. While gross corporate interest costs are rising, this is offset by higher corporate deposit yields, which have increased as a result of government support during the COVID-19 pandemic. The effect is so great in the UK that net business interest costs have actually fallen in recent quarters. However, the investment outlook is getting gloomier due to increasing overcapacity and higher capital costs.

![Ακίνητα: Σε ποια εξοχικά στρέφονται οι επενδυτές [ πίνακας]](https://www.ot.gr/wp-content/uploads/2026/02/property-scaled.jpg)