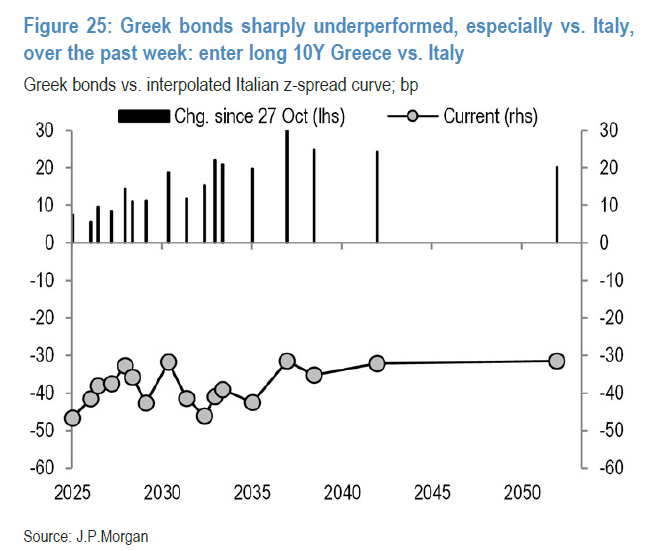

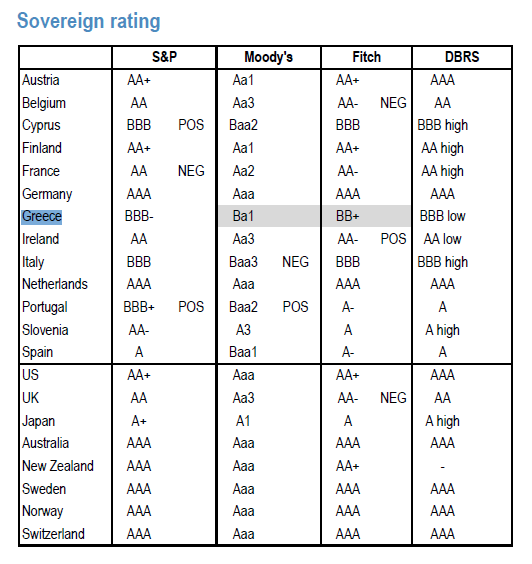

On the rating side, DBRS and S&P have already upgraded Greece to investment grade (IG) and Fitch ισ expectεd to upgrade Greece to IG in its December 1 rating. JP Morgan reminds that according to the inclusion rules for the EGB European bond indices, an IG rating from at least two of the three rating agencies (S&P, Moody’s and Fitch) is required for Greek bonds to start being included in them. Therefore, the assessment of Fitch’s rating for Greece on December 1st will be critical.

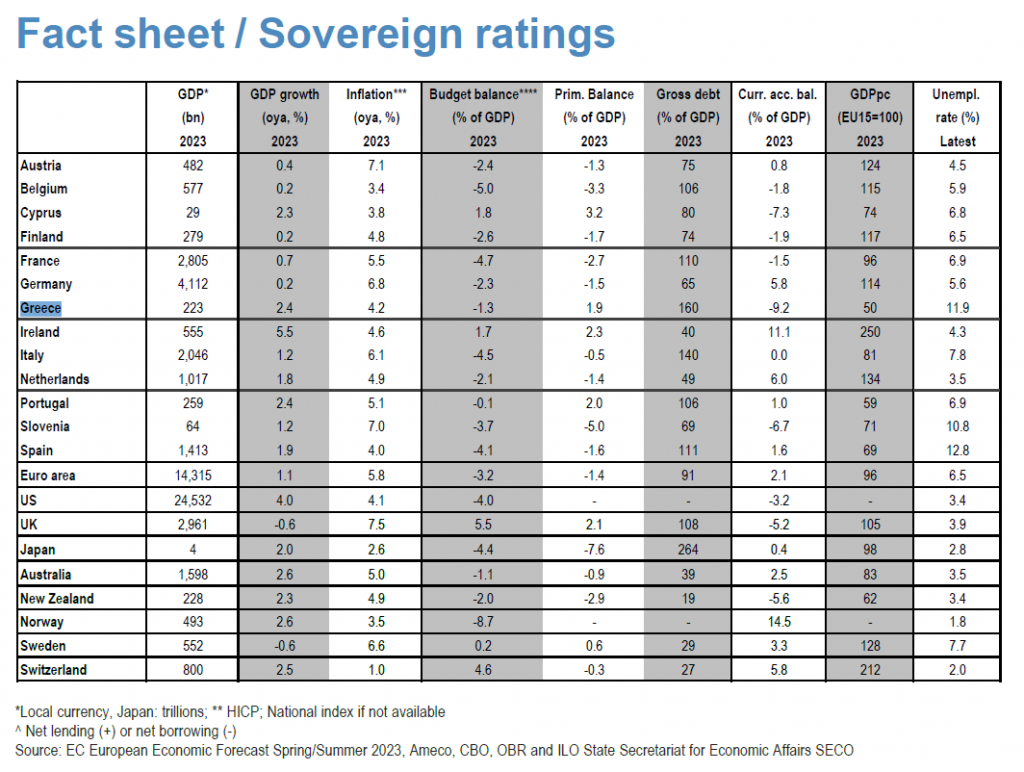

Against this background, JP Morgan concludes that the recent underperformance of Greek bonds has created attractive long entry points, with yields widening following Greece’s upgrade by Fitch and the potential flows generated by the inclusion of Greek bonds in European bond indices. It is worth noting here that JP Morgan estimates that Greece’s GDP will grow by 2.4% in 2023, with inflation at 4.2%. It also sees the primary surplus at 1.9%, with fiscal deficit at 1,3%.

Against this background, JP Morgan concludes that the recent underperformance of Greek bonds has created attractive long entry points, with yields widening following Greece’s upgrade by Fitch and the potential flows generated by the inclusion of Greek bonds in European bond indices. It is worth noting here that JP Morgan estimates that Greece’s GDP will grow by 2.4% in 2023, with inflation at 4.2%. It also sees the primary surplus at 1.9%, with fiscal deficit at 1,3%.