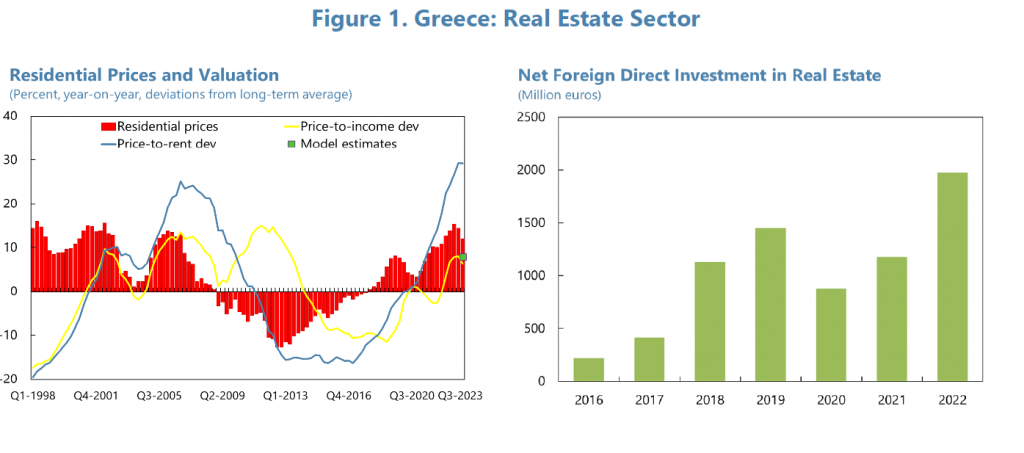

The Greek real estate market appears to have entered “bubble” territory, following its rally of six years that started in 2017, as the International Monetary Fund (IMF) observed in its Article IV Consultation report on Greece.

In the report, the IMF is also raising some concerns about the Greek banking system, urging Greek authorities to take measures, although it acknowledges the sector’s resilience.

As the report says regarding real estate: “Residential real estate prices have increased significantly across the board of indicators since its trough in 2017, exceeding 50 percent in nominal terms and 35 percent in real terms and not yet visibly decelerating, supported by strong employment and real disposable income growth.”

It is worth noting that, according to the IMF, demand in real estate has also come from non-residents who significantly increased their investments in the real estate market, leveraging the “Golden Visa” program. This program has added to structural issues indicating Greece as one of the countries with the lowest number of rooms per person.

As the IMF analysis shows, current property values pose a risk factor for the Greek banking system. Although systemic risk is relatively limited, according to the IMF, as there is low private sector leverage, it has increased since last year, and the banking sector faces significant challenges in its future.

Source: tovima.com