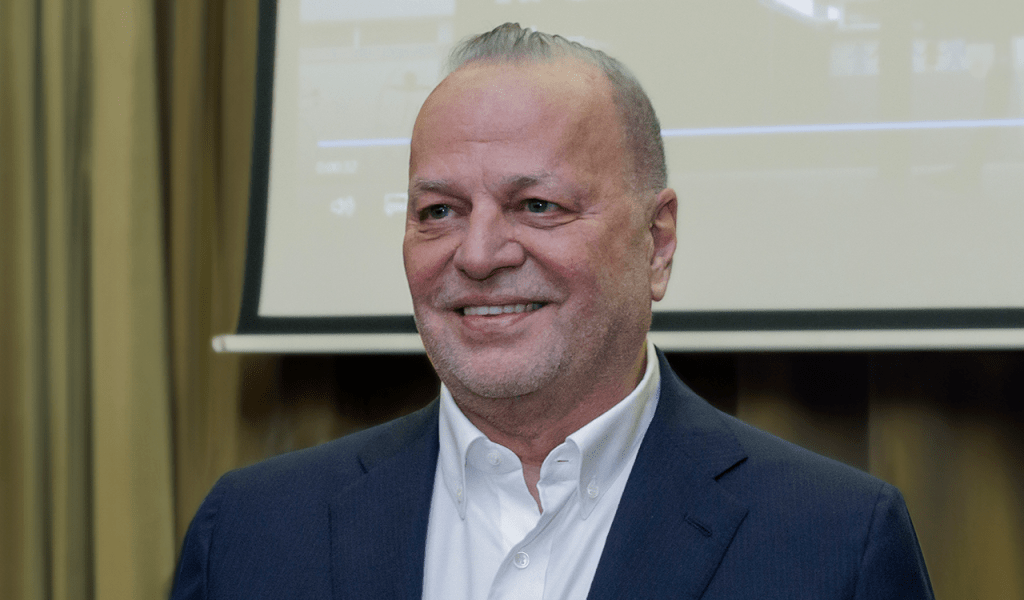

Giannis Vrentzos, CEO of Alter Ego Media, forecast an increase in the net profitability margins for the listed company in 2025 at the shareholders’ annual ordinary general meeting held today, June 17, in the Hermes Hall of the Athens Stock Exchange. He emphasized the management’s commitment to the uninterrupted implementation of the investment program aimed at further developing the Group’s presence in the media and entertainment sector and at its expansion into new activities.

“We are continuing to evolve Alter Ego Media into a large media tech group,” the Alter Ego CEO noted.

With a quorum of 82.79% of the total shareholders, a particularly high percentage given the Group’s high dispersion, all the agenda items were voted on, including the optional three-year dividend reinvestment program in the Company’s shares, up to €30 million.

Estimates for 2025

The CEO, Mr. Vrentzos, also shared the Group’s projected performance metrics for 2025 with shareholders, as these were extrapolated from the trends observed in the first five months of the year. He estimated that the Group’s turnover will continue to grow, primarily due to a projected increase in advertising service revenues.

As a percentage of turnover, the Group’s operating expenses for the 2025 fiscal year are expected to fall, resulting in improved operating profitability margins for the Group.

Investments in internally produced television programs and television program rights are expected to be lower year-on-year for the 2025 fiscal year, due to the completion in 2024 of investments in particularly high-value television programs (Maestro and Famagusta). As a result, the amortization of intangible assets is expected to be lower than in 2024.

Net financial expenses for the 2025 fiscal year are estimated to be lower year-on-year, due to significant cash reserves brought in by the Initial Public Offering.

The above trends are expected to significantly boost the Group’s net profit margin.

Allocation of Raised Funds

Mr. Vrentzos stated that the total net funds raised by the Public Offering, amounting to approximately €50.8 million, will be allocated by Alter Ego Media to finance the Company’s investment program, which includes:

Acquisitions and participations in third-party companies and investments in Alter Ego Ventures Monoprosopi S.A.

Investments in technology, facilities, and fixed assets.

Content production and the acquisition of intellectual property rights for audiovisual content.

The successful implementation of the investment plan is estimated to further strengthen the Group’s activity and results.

During his speech, Mr. Vrentzos mentioned that Alter Ego Media’s stock will be included in the FTSE Russell micro-cap and total cap indices, as well as the Athens Exchange’s General Price Index. He also noted that the rebalancing for the Russell indices is scheduled for the final auctions of June 20.

Dividend Distribution and SCRIP Dividend

The AGM approved the distribution of a total dividend of €5.7 million, or €0.10 per share, which establishes a dividend yield of approximately 2.2%, based on yesterday’s closing price.

The ex-dividend date will be June 23, 2025.

Allocation of Free Shares

The general meeting also approved the allocation of free shares in the context of acknowledging the contribution of the Group’s staff to its success and future development.

Specifically, the establishment of a long-term program for the free allocation of Company shares to its personnel was voted in, with the allocation corresponding to up to 3% of Alter Ego Media’s share capital over a five-year period. This amount will be covered either through the allocation of treasury shares or by issuing new shares.

![Ακίνητα: Σε ποια εξοχικά στρέφονται οι επενδυτές [ πίνακας]](https://www.ot.gr/wp-content/uploads/2026/02/property-scaled.jpg)