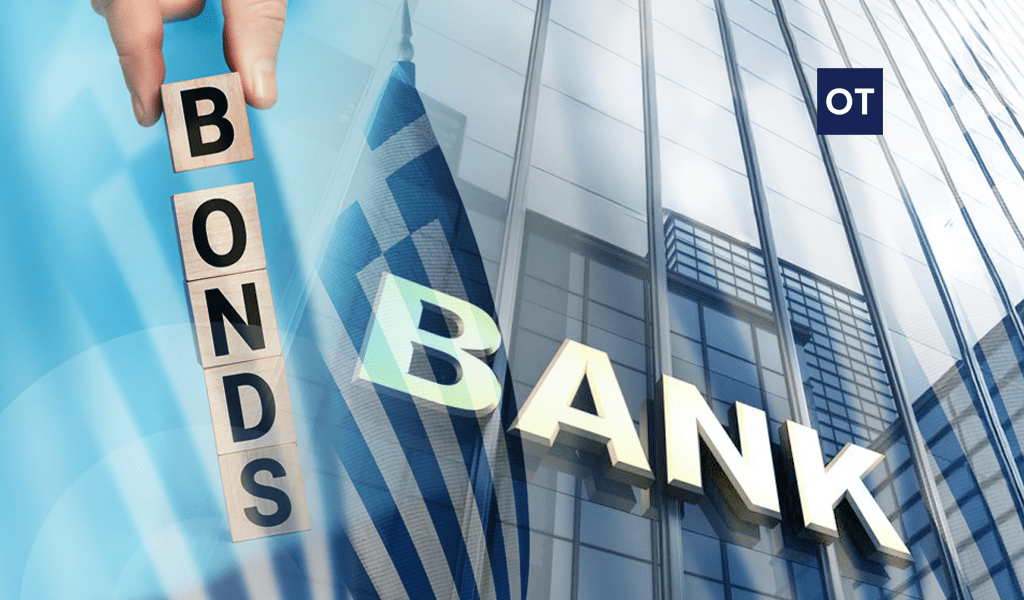

The immediate sale of securitized loans to third parties is driving those managing these NPAs, as the current environment of uncertainty and volatility creates significant difficulties in the execution of initial plans for recoveries.

A leading source from the sector, speaking to “OT”, pointed out that “nothing is the same compared to two years ago, when transactions were structured to consolidate the bank balance sheets”.

As he explained, “on the one hand, due to the pandemic and the suspension of courts, auctions stopped for a long time, and on the other hand, the energy crisis makes it difficult to collect the debts”.

In this context, he noted, “immediate actions are now required to achieve the goals of recoveries from non-performing loans that were included in the Heracles state guarantee scheme”.

According to the source, based on the specific market rules, in order for the guarantees of the program not to be activated, the managers in the first two years after a securitization should have achieved 80% of the recoveries provided for in its business plan”.

Plan B

Otherwise, he added, there is an imminent risk of a securitization collapse with everyone coming out a loser including the respective bank that holds the senior bonds, as it will be forced to register provisions, the investor of the transaction that will lose coupons, managers that will pay a penalty for the delay and of course the state that will be at risk of paying for losses through the guarantees it has provided.

For these reasons, servicers plan to directly sell packages of securitized red loans to third parties.

In this way, they hope to hit the target of the first two years’ recoveries with few transactions, so that they can then work to monetize the rest of the exposures over time, through restructuring, regulation and enforcement measures.

A banking source estimates that 20 billion euros worth of red loans will come under auction and that the proceeds from their sale could reach 2.5 billion euros.

The securitization road plan

According to data from the Bank of Greece, of all the securitizations that have been completed to date, for a total amount of 49.5 billion euros, 37.7% have been included in the “Heracles” program.

The total of the guarantees granted by the Greek State amounts to 18.6 billion euros with the end of 2021 as a reference date.

In total, the securitizations carried out include 62.6% denounced loans and 37.4% non-denounced.

Moreover, 44% of the exposures were in settlement status when they were sold. As regards the composition of securitizations, housing and business loans dominate, with percentages of 41.8% and 45.3% respectively.

![Βραχυχρόνια μίσθωση: Καλπάζουν τα καταλύματα τύπου Airbnb στην Ελλάδα [γράφημα]](https://www.ot.gr/wp-content/uploads/2022/11/airbnb-2.jpg)