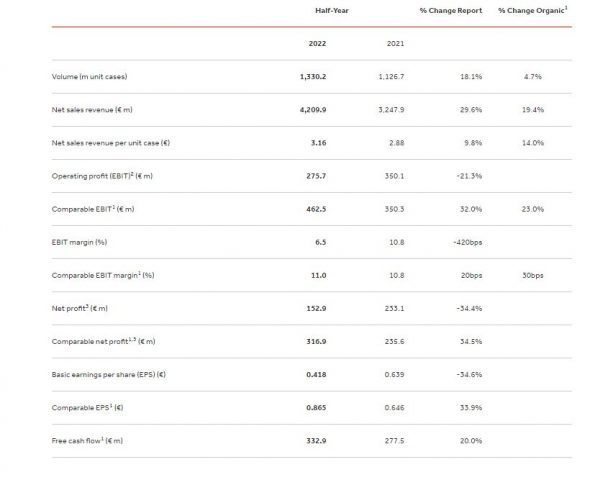

Coca Cola HBC showed an increase in comparable net profits to 316.9 million euros in the first half of 2022, registering an annual increase of 34.5%. Sales volume increased by 18.1% to €1.33 billion, while net sales revenue increased by 29.6% to €4.209 billion.

Net profits amounted to €152.9 million, down 34.4%, while operating profits amounted to €275.7 million, down 21.3% year-on-year.

Read also: Coca Cola HBC acquires Three Cents

Net sales revenue per case increased by 14.0%.

Notably, coffee sales volumes increased by 56%, with a growing contribution from out-of-home consumption.

Finally, as the company notes, investment in adult carbonated beverages resulted in continued strong performance with sales volume increasing by 18.7%.

STRONG VOLUMES, REVENUE, EBIT; INVESTING IN GROWTH

Coca-Cola HBC AG, a growth-focused Consumer Packaged Goods business and strategic bottling partner of The Coca-Cola Company, reports its financial results for the six months ended 1 July 2022.

Half-year highlights

- Execution of our strategy drove continued strong organic growth, well balanced between volume and price/mix

- Organic revenue +19.4%. Reported revenues +29.6%

- Excluding Russia and Ukraine organic revenue +25.2%, with volume +12.1%

- Organic revenue per case of 14.0% benefited from pricing and targeted actions to improve mix, further supported by out-of-home channel recovery

- Broad based volume momentum continues outside of Russia and Ukraine, with growth led by strategic priorities

- Integration of Egypt progressing well; 7 pp addition to reported revenue growth

- Further value and volume share gains in NARTD and Sparkling

- Organic EBIT up 23.0%, with margins up 30bps on an organic basis to 11%, benefiting from pricing, mix and cost discipline

- Quality of revenue growth driving underlying profit expansion

- Opex as a percent of revenue improved, driven by operating leverage and cost savings

- Marketing expenses excluding Russia and Ukraine increased by 9%

- Continued investment behind strategic priorities to drive profitable growth

- Consistent investment behind adult sparkling proposition driving continued strong performance, with volumes +18.7% excluding Russia and Ukraine

- Acquisition of craft adult sparkling business, Three Cents, expected to complete in Q3, strengthens premium brand offering

- Coffee volumes +56% with accelerating contribution from out-of-home

- Rapid digitisation of the enterprise – our proprietary B2B, Customer Portal now has more than 200,000 customers

- Deployment of our key revenue growth and route to market capabilities in Egypt

- Improved cash generation and continued strong balance sheet

- Comparable EPS +33.9%; free cash flow increased by €55.4 million to €332.9 million

- Strong balance sheet and liquidity remains after paying the €0.71 dividend in August

![Ληξιπρόθεσμα χρέη: 3,74 δισ. ευρώ «γέννησε» το πεντάμηνο Ιανουαρίου – Μαΐου [πίνακας]](https://www.ot.gr/wp-content/uploads/2025/07/ofeil-600x360-1.jpg)