The first half of the year closed for Dimand with an increase in turnover and profits, and the firm dynamically continues to invest in new projects.

Purchase of 35.6 hectares in Northern Greece

Four days ago the company proceeded to acquire land with a total area of 355,648.42 sq.m. in Northern Greece for a price of 6,000,000 euros.

Offices and residences in Faliro

In addition, in the coming days Dimand will increase its percentage to 55% in 3V SA, which owns real estate area of approximately 18,730 sq.m. in Neo Faliro, where the development of a mixed-use complex is planned.

This is the joint investment of Dimand and AVAX Development on the property of VELKA, right next to the Olympiakos Stadium.

The project for the construction of offices and residences is progressing with the design and permits, with the aim of starting the works after the first quarter of 2023.

New plans for Peania

At the same time, plans are changing for the 23-acre property located on Peanias – Markopoulou Street, within the Peania industrial park.

A biotechnology park was planned to be built on the said property, for which a 20-year closed lease preliminary agreement had been signed with the joint venture structure of the Greek regenerative medicine company Theracell Advanced Biotechnology and the American biotechnology company Orgenesis, which would be the operator and lessee of the relevant infrastructure.

But the park was never built, the preliminary lease agreement was terminated and Dimand returned the advance of 8 million, while selling 40% of the property to Premia for 3 million euros. The remaining 60% has been pre-agreed to be transferred to Dimand upon completion of the development of the property as a mixed-use complex and after its operation begins.

According to information, various proposals are on the table from data centers and logistics to office spaces, industrial facilities, etc.

Exit from Moxy

In addition, Dimand is planning to exit the investment in Moxy, the hotel it developed for Prodea on the site of Saroglio Megaron in Omonia.

In particular, it proceeded to sign an agreement for the sale of 55% of the participation it held, with the result that its participation now amounts to 10%. The price for the sale of 55% amounted to 7,570,210 euros.

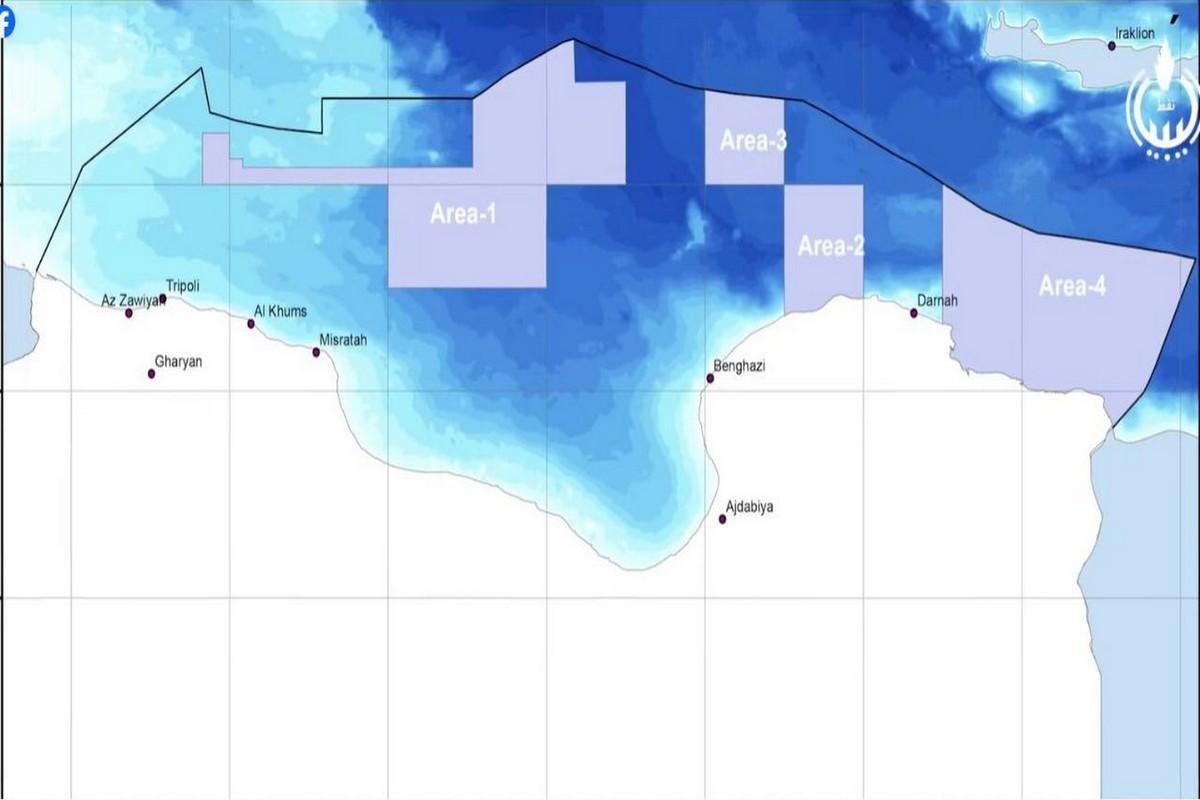

Project Skyline

At the end of July, the joint scheme of the Dimand and Premia Properties was declared the preferred investor in the tender process carried out by Alpha Bank for the selection of a strategic investor for Project Skyline.

Project Skyline includes a portfolio of privately owned properties of various uses with a significant concentration in Athens, Thessaloniki and other Greek urban centers.

Indicatively, the real estate portfolio includes independent commercial properties in the center of Athens, on Filellinon Street (Syntagma Square), on Stadiou Street (Korai Square), at the junction of Sofokleous and Aiolou Streets, etc., as well as a portfolio of 205 residences and apartments.

The parties have begun negotiations with the aim of finalizing the agreement within 2022.

Increase in pre-tax profits

Regarding the development of the group’s operations during the first half of the year, turnover reached 4.06 million euros from 2.59 million in the previous year, i.e. increased by 56%.

This increase is due to the increase in revenues from the provision of investment management services (Project Management), which is the main activity at the parent company level.

The group’s gross profits increased by 88% compared to the previous period (from 656,333 to 1,236,824 euros), mainly due to the aforementioned increase in turnover.

In the first half of 2022, the group’s Profits before taxes amounted to 1,089,655 euros against losses (5,829,757 euros) in the previous period.

The significant increase in the group’s profits is mainly due to the net profit from revaluation of real estate investments at fair value (8,039,445 euros against a net loss of 2,289,753 euros in the previous period) and partly to the increase in the Group’s gross profit value (1,236,824 against a gross profit of 656,333 euros in the previous period).

Property value over 660 million euros

As of 30.06.2022, the group’s total portfolio included 18 investment projects in various stages of completion, in urban areas throughout Greece, with uses of offices, residential and hotel complexes, luxury residences as well as mixed uses, with a total estimated gross value of gross domestic product (GDV) upon completion of approximately 666 million euros.

The effects of construction costs

With reference to the effects of the energy crisis and the increases in construction costs in the domestic real estate market, the company led by Dimitris Andriopoulos claims that in the real estate categories where it operates, it has shown defensive characteristics.

This is because in many cases, due to the high standards and limited supply of high energy buildings and rising inflation, appreciations were observed in the market values of such properties and related leases, which offset any negative effects due to increases in construction costs.

![Ευρώ: Ευκαιρία για Ευρώπη η στροφή των επενδυτών [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/07/15_07_ot_eyro_dol_EXO.jpg)

![Εξοχικές κατοικίες: Πόσο κοστίζει το τ.μ. σε Μύκονο, Σαντορίνη και Πάρο [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/07/14_07_ot_exoxika_EXO.png)