The economic outlook is deteriorating throughout Europe, due to the aggressive increase in interest rates, as well as rising inflation (burdened by energy prices), Standard and Poor’s notes in its report, adding that in the current international environment, Greece is not unscathed, predicting a significant slowdown in growth in 2023.

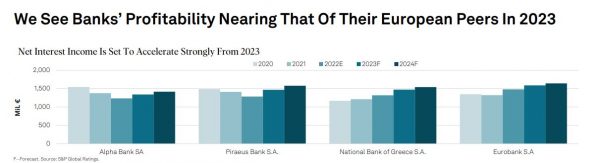

The international agency emphasizes, however, that Greek banks are better equipped than in the past to face a recession. In fact, it estimates that their profitability will continue to increase and this year will approach that of European banks.

By the end of 2022, banks had completed most of their transformation process and now have cleaner balance sheets, with an increased focus on core activities and a more balanced funding profile.

The Achilles heel

S&P analysts point out, however, that banks’ capital will remain the main weakness, due to the high share of legacy deferred tax credits.

Looking ahead, they foresee some upside for profitability, driven by an increase in asset margins and a continued lending expansion supported by European capital.

They also estimate that abundant liquidity in the system will limit deposit repricing, although market volatility and the ECB’s policy of withdrawing monetary stimulus (especially targeted longer-term refinancing operations [TLTRO] will make its long-term financial instruments market unattractively, burdening banks’ profitability.

In particular, building their minimum requirement for own funds and eligible liabilities (MREL) could prove challenging.

Bank assets

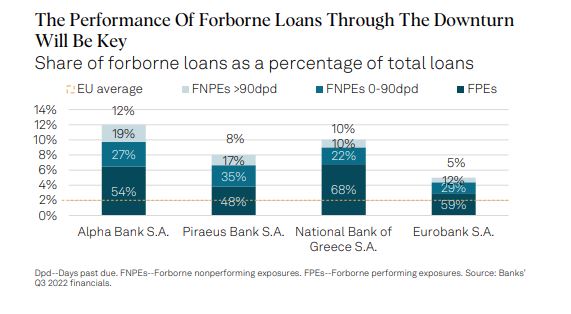

S&P also expects a limited deterioration in asset quality due to the structure of the banking portfolio. Banks disposed of the weakest loans in their portfolios during the crisis decade, and the high share of encumbered non-performing exposures (NPEs) suggests that default rates may be lower than in the past.

The economic prospects

The international house is revising downwards its estimates for macroeconomic figures, for the macro economy, with energy supply disruptions in Europe further clouding the outlook. Energy inflation soared in 2022, but they estimate that rising interest rates will contain inflation.

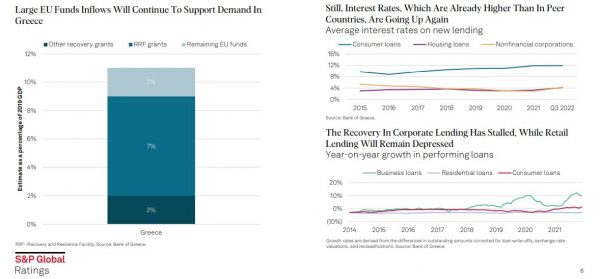

Greece is not “immune” to the economic slowdown and they estimate that economic growth will slow to 1.4% in 2023, however it will remain above that of its European peers. This is partly due to the EU’s NextGeneration economic recovery package.

Loan portfolios

“We believe that the loan portfolios of Greek banks have already been tested throughout the economic cycle, as current customers have survived many crises. However, these portfolios reflect the Greek economy and have a fair concentration in cyclical sectors such as tourism, real estate, construction and shipping, which may suffer more as the economy slows down,” notes the agency, adding that after a strong recovery in 2022, the tourism season this year will be a catalyst for the future asset quality of banks.

Home loans

According to S&P, mortgage credit has remained sluggish in recent years, which reduces the potential for portfolio imbalances.

It also stresses that the temporary subsidy scheme announced by the government for vulnerable mortgage borrowers will support the financial capacity of households despite rising interest rates and inflation. Overall, it expects the cost of risk for the entire Greek banking system to reach 80 basis points in 2023, after averaging over 300 bps in 2018-2021 as banks completed NPE sales/securitizations.

It also points out that loan growth will be boosted by EU capital inflows, but high interest rates and an economic slowdown will hurt the market’s recovery

The cost of financing

Regarding the cost of financing, it estimates that its increase will be limited, as Greek banks show low loan-to-deposit ratios compared to European Banks.