Morgan Stanley “views” the disinvestment of the Hellenic Financial Stability Fund – HFSF from Greek banks in a positive way. The company estimates, in its report, that there will be a strengthening of the sector’s liquidity in the medium term, although in the short term there will be pressure on their share prices.

The HFSF announced the 2023-2025 strategy plan for the divestment of the shares it holds in Greek banks, following approval by the Ministry of Finance. The plan defines the framework that the HFSF will follow and will use in order to sell its holdings in the four Greek systemic banks (Alpha Bank, Eurobank, Piraeus and National Bank), with the HFSF currently holding corresponding percentages of 9%, 1, 4%, 27% and 40%.

Hellenic Financial Stability Fund: All eyes on Fin. Min. for disinvestment of state from banks

It is worth noting that Morgan Stanley notes that the approval of the divestment strategy indicates progress, but there is no further clarity on the timing, given the time frame that puts the end of 2025 for the completion of the divestments. Signs of progress towards the divestment of the HFSF share by the Greek banks may create an oversupply of banking shares in the market in the short term, as the ratings agency emphasizes. However, it believes that divestment will ultimately be positive for the sector, as it will help to strengthen liquidity in Greek banks.

The divestment models

Morgan Stanley also refers to the possible divestment models that the Fund will follow, such as the sale on the market and private sale, noting that the divestment will bring benefits to the Greek economy. This, in turn, will also help the efficiency of the Greek Stock Exchange, through more foreign direct investment opportunities in the banking sector.

The divestment process is due to be completed before the end of 2025. According to the HFSF, the decision to divest from the banks comes in the context of the progress the entities have made in “addressing weaknesses” and achieving sustainable profitability. In addition, divestment will provide benefits to the Greek economy by increasing the percentage of Greek banks’ free float, which will further strengthen the domestic capital market, liquidity and efficiency, through more opportunities for foreign direct investment in the banking sector. sector but also the demonstration of progress towards the restoration of the banking sector under fully private ownership.

Latest News

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

Tourist Spending in Greece Up by 14%, Visa Card Analysis Shows

Greece’s capital Athens emerged as the most popular destination, recording a 17% increase in transactions with Visa cards, surpassing even the cosmopolitan island of Mykonos.

Inflation in Greece Unchanged at 2.4% in Nov. 2024

The general consumer price index (CPI) posted a 0.4% decrease in November compared to the previous month

2024 Christmas Holidays: Extended Shop Hours Schedule

The 2024 Christmas Holidays extended shop hours schedule commences on Thursday, December 12 and runs until the end of the year.

ELSTAT: Seasonally Adjusted Unemployment Down in October

The number of employed individuals reached 4,284,694, an increase of 67,723 compared to October 2023 (+1.6%) and 22,002 compared to September 2024 (+0.5%).

Greek PM’s Chief Economic Adviser Resigns

In the post on his Facebook page, Patelis did not disclose the reasons that led him to step down.

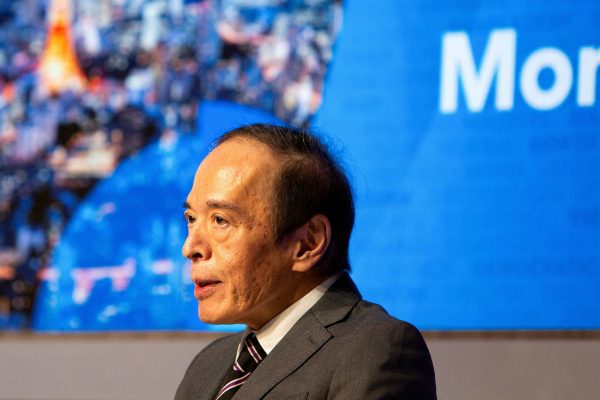

“Masdar Invests in the people of Greece and in the vision of TERNA ENERGY”

Four messages from the CEO of Masdar, the Arab renewable energy giant, after its acquisition of 70% of TERNA ENERGY

Lloyd’s List Greek Shipping Awards 2024: Honors for leading companies and personalities in the Greek shipping sector

20 awards presented at the 21st annual Lloyd's List Greek Shipping Awards

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433