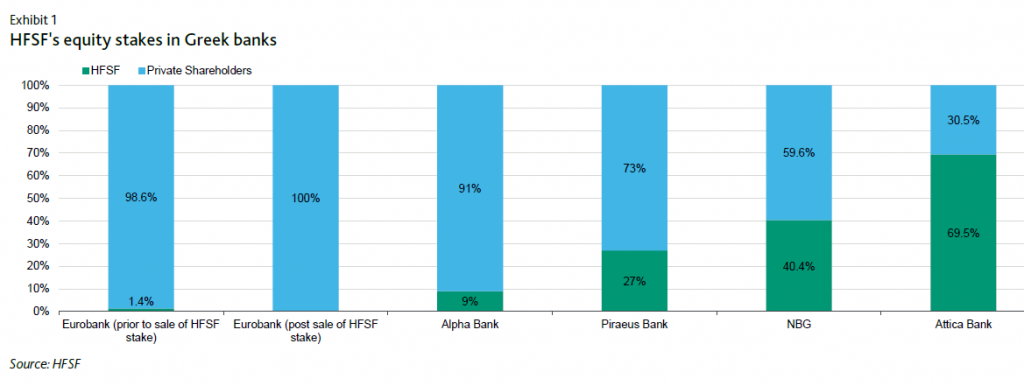

As Moody’s reminds, after the full disposal by the State HFSF of its shares in Eurobank, the bank will no longer be subject to Law 3864/2010 and the special rights it must grant to the HFSF, including the provision of its consent and monitoring of her business plans. Consequently, Eurobank will become the first domestic systemically important bank (D-SIB) without any government participation in its share capital.

In addition, Eurobank’s liquidity will improve, making it more attractive to potential private investors and allowing the bank to raise capital as needed. The new funds would support the bank’s growth and ability to provide new loans to the real economy. The deal also reflects the bank’s significantly improved financials over the past three years, Moody’s said.

The role of the HFSF

According to the rating agency, the HFSF played a vital role in recapitalizing the banking system and restoring financial stability following Greece’s 2012-15 fiscal and financial crisis. Over the past decade, the HFSF has invested new capital in all four systemic banks – as well as the much smaller Attica Bank.

HFSF made a strategic decision earlier this year to divest all of its current holdings in the four systemic banks by the end of 2025. Although HFSF is fully committed to achieving this goal, in the event that it is unable to sell these shares until that time, it will have to agree with the government and the European Stability Mechanism to create a successor entity to take over these holdings.

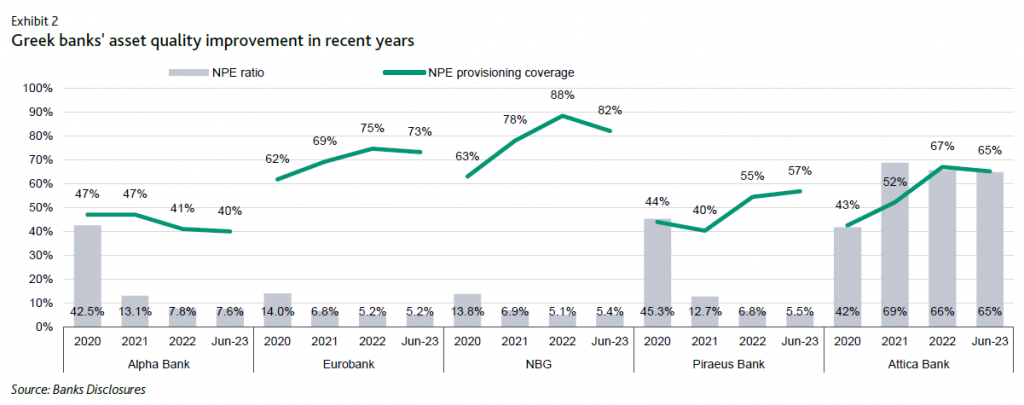

The four banks’ improving asset quality, reduced non-performing exposures (NPEs) and increased NPE provisions in recent years, combined with recent improvements in recurring earnings and bottom line profitability will help the HFSF implement its divestment strategy , according to Moody’s.

Although the HFSF accumulated fair value losses of €38.6 billion in September 2022, Moody’s estimates that it could recover €3-4 billion based on current share valuations, reducing the bank’s overall recapitalization and stabilization costs government system.

The challenges

According to Moody’s, the sale of the HFSF shares to National Bank and Piraeus Bank could be more difficult than the Eurobank transaction, because it has significantly higher holdings (40.4% and 27%, respectively), while its stake in Alpha Bank (9%) would be easier to divest.

But he reckons the HFSF favors strategic investors for these important equity stakes, such as internationally recognized financial institutions and long-term investment funds – including any credible existing shareholders – that could help improve the banks’ ability to adapt and deal with new market challenges.