The implementation of the – pre-announced – increase in interest rates by 0.25%-0.5% is expected at tomorrow’s meeting of the European Central Bank. At the same time, the details of a new mechanism to limit the widening of spreads in bond markets among eurozone countries, also known as an “anti-fragmentation tool”, are also expected to be clarified.

Moody’s economists expect Southern European banks to be the main beneficiaries of both of these awaited announcements tomorrow.

Read also: How Goldman Sachs views Greek banks

Furthermore, they express the assessment that tomorrow’s increase in interest rates, which is the first in the eurozone after 11 years, will be followed by another in September.

As the analysts note, “higher interest rates will significantly benefit the net interest margins and overall profitability of all European banks, but the effect will be gradual and vary across countries.”

They explain: “We expect banks in Spain, Italy and Portugal to reap greater benefits than their Northern European counterparts. Given that a higher proportion of bank loans in these countries have floating interest rates, an increase in interest rates by the ECB will lead to a larger and more noticeable increase in bank income.”

On the other hand, Moody’s predicts that the positive impact on revenues will be more gradual and moderate in banking systems with mainly fixed-rate loans such as France, Germany, Belgium and Sweden.

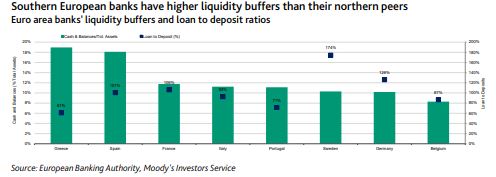

Southern European banks also generally have lower loan-to-deposit ratios and higher liquidity reserves than their Northern European counterparts. Therefore, they will benefit more in terms of income from higher returns on their liquid assets and will not experience significant increases in funding costs thanks to their large deposit bases, which are not particularly sensitive to interest rate movements.

According to the firm’s data, Greek banks have the highest “liquidity cushion” (cash and cash balances), at 19% of total assets, while the loan-to-deposit ratio is at 61%, the lowest in the region and in relation to the banks of northern Europe.

The new mechanism

On July 21, the ECB will also share details of the new “anti-fragmentation” tool designed to limit the widening of the yield gap among sovereign bonds in the eurozone.

The yield on government bonds of over-indebted euro zone countries such as Italy has risen in recent weeks against benchmark German bonds, fueling concerns about the economic impact of slowing growth and rising inflation, it said.

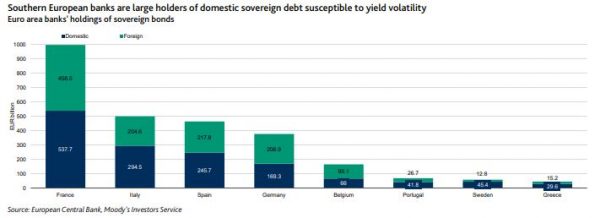

The anti-fragmentation mechanism will also primarily benefit southern European banks, which hold large volumes of government bonds that are particularly prone to spread volatility.

At the end of 2021, Italian banks held just under €300 billion of domestic government bonds, while Spanish banks held €246 billion, Portuguese banks €42 billion and Greek banks €30 billion.

The ECB argues that measures to limit widening spreads – which will likely include buying government bonds – are justified by the need to protect the effective transmission of monetary policy.

This is because without such a “transmission protection mechanism” a rise in government bond yields beyond the level justified by economic fundamentals could lead to higher interest rates for companies and households.

That could create distortions that would prevent the central bank from fulfilling its mandate to maintain price stability and fuel concern about the eurozone’s financial stability.

The ECB is also concerned that the high exposure of banks in some countries to volatile government bonds could potentially limit their ability to provide credit to the economy.

![ΤτΕ: Δυναμική ανάπτυξη με υψηλό πληθωρισμό για την Ελλάδα μέχρι το 2027 [πίνακας]](https://www.ot.gr/wp-content/uploads/2025/06/ot_greec_economy799-1024x600-1-300x300.png)

![Επενδυτικό κενό: Πόσο πρέπει να…τρέξουμε για να καλυφθεί [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/07/ot_greek_ecomomy555-1024x600-1.png)

![ΤτΕ: Δυναμική ανάπτυξη με υψηλό πληθωρισμό για την Ελλάδα μέχρι το 2027 [πίνακας]](https://www.ot.gr/wp-content/uploads/2025/06/ot_greec_economy799-1024x600-1.png)