In its latest announcement the Bank of Greece asserts that the credit standards for loans to non-financial corporations (NFCs) remained unchanged, while the terms and conditions remained almost unchanged, in the second quarter of 2022. The overall demand for corporate loans increased.

At the same time, the credit standards as well as the terms and conditions for loans to households remained unchanged. The demand for consumer credit remained almost unchanged, while the demand for housing loans decreased.

Loans to non-financial corporations

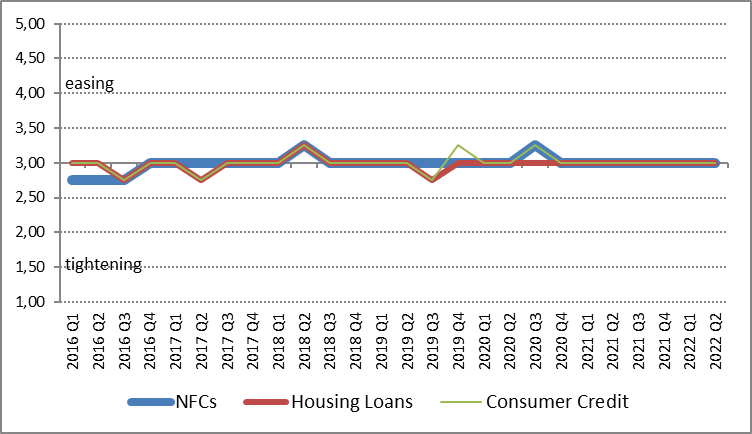

In the second quarter of 2022, the credit standards for loans to non-financial corporations (NFCs) remained unchanged (see Chart 1) compared with the first quarter of 2022, in line with the expectations expressed in the previous quarterly survey round. Moreover, banks expect that credit standards will remain unchanged during the third quarter of 2022.

The overall terms and conditions for loans to NFCs remained almost unchanged compared with the first quarter of 2022, even though banks’ margin on average loans slightly decreased.

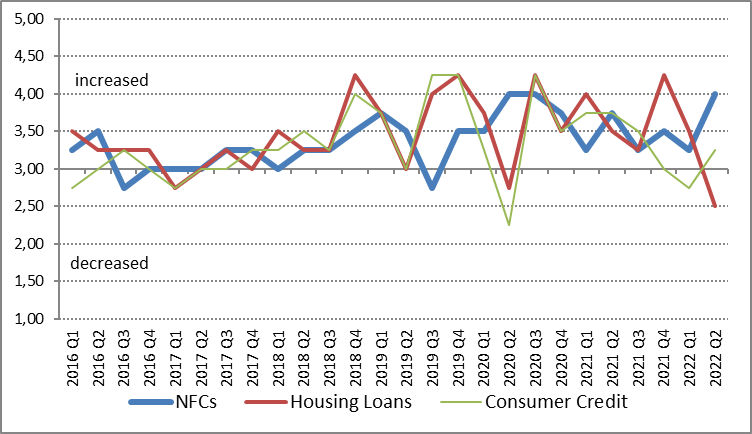

The overall demand for loans to NFCs, both for small/medium as well as large enterprises, increased (see Chart 2), due to financing needs for fixed investment and for increasing working capital. During the next quarter, the overall demand for loans to both small/medium and large corporations is expected to increase further.

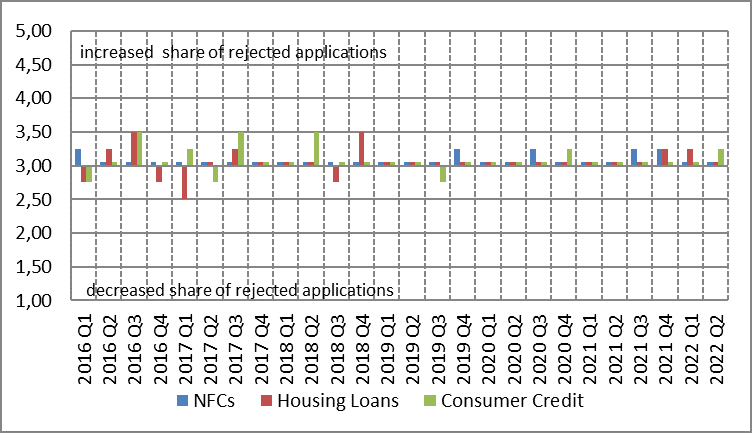

In the second quarter of 2022, the ratio of rejected applications for loans to NFCs remained unchanged compared with the previous quarter (see Chart 3).

Loans to households

In the second quarter of 2022, the credit standards as well as the terms and conditions for loans to households remained unchanged compared with the first quarter of 2022 (see Chart 1), in line with the expectations expressed in the previous quarterly survey round.

The demand for consumer credit remained almost unchanged (see Chart 2), while the demand for housing decreased, contrary to what expected from the previous survey round. The reduction in the demand for housing loans was due to the worsening of consumer confidence and to the general level of interest rates. During the next quarter, the overall demand for housing loans is expected to remain almost unchanged, while the demand for consumer credit is expected to increase somewhat.

Banks expect that, during the third quarter of 2022, credit standards for housing and consumer loans will remain almost unchanged.

The ratio of rejected applications for loans to households remained almost unchanged during the second quarter of 2022 (see Chart 3) compared with the previous quarter.

Chart 1 – Credit Standards (Average)

Chart 2 – Demand (Average)

Chart 3 – Share of rejected applications (Average)

Latest News

BoG Figures Confirm Banner Year for Greek Tourism in 2023

20.6 billion euros in related revenues topped the previous year’s figure by 16.5%

Piraeus Bank to Propose First Dividend in 16 Years

Piraeus Bank has forecast profits of roughly 900 million euros this year, rising to one billion euros next year

Eurostat: Inflation in Greece Eases to 3.2% in April; 2.4% in Eurozone

The rate of increase for food prices was up by 4.9% in April 2024, compared to 4.8% in the previous month

ELSTAT Feb. Retail Turnover Drops by 3.8%, Sales Volume Plummets by 9.8%

Additionally, the seasonally adjusted General Volume Index for Feb. 2024 experienced a 3.8% decrease compared to the previous month of the same year

Greek Buyers Lead Return to Vacation Home Market

In the last six months, Greeks have made a surge into the vacation home market, notably without relying on loans

NBG Receives BBB Investment Grade by DBRS

This makes NBG the first Greek bank to regain Investment grade status, nearly 15 years after the onset of the Greek financial crisis

Greek Gov. Budget: Primary Surplus 3bln in Q1 2024

Value Added Tax (VAT) revenues reached 5.876 billion euros, down by 16 million euros compared to the target

Athens’ Public Transport System Gets Green “Facelift”

The future of urban transport in Greece's capital city includes electrification, hydrogen, kinetic energy and even heighted security and monitoring through the use of drones

Athens Int’l Airport: 16.2% EBITDA Increase and 16.5% Passenger Growth in Q1 2024

Following the strong performance in the first quarter, the company revised its annual passenger traffic forecast for 2024 to 29.9 million passengers, a 6.3% increase (or roughly 1.8 million passengers) from 2023 levels.

Oxford Economics Report: Greek Economy is Just Below Risk Zone

However, the report points to a persistent challenge in the form of commercial credit risk, which remains high at 8 out of 10, ranking Greece 104th internationally

![Τουρισμός: Πόσα ξόδεψαν και πόσο έμειναν οι ξένοι επισκέπτες το 2023 [πίνακες]](https://www.ot.gr/wp-content/uploads/2024/02/ot_tourist_santorini2-90x90.png)

![ΤτΕ: Το top10 των περιφερειών με τα περισσότερα τουριστικά έσοδα [πίνακες]](https://www.ot.gr/wp-content/uploads/2024/04/02tourismos10-1-90x90.jpg)

![Τουρισμός: Πόσα ξόδεψαν και πόσο έμειναν οι ξένοι επισκέπτες το 2023 [πίνακες]](https://www.ot.gr/wp-content/uploads/2024/02/ot_tourist_santorini2-600x352.png)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433