PPC is making a sound investment move in the domestic electricity market, and it cannot be ruled out that this will take place in collaboration with private companies in the sector.

According to exclusive information of “Vima” newspaper, PPC is at an advanced stage of deciding on its entry into a joint venture for a modern power generation plant fueled by natural gas (CCGT).

Also read: Motor Oil, PPC finalize deal to jointly create consortium active in the hydrogen energy sector

Sources want the company’s management to be in an advanced stage of discussions with investors to build such a unit. Other information available to the newspaper indicate that this concerns one of the units being prepared in Northern Greece.

Conditions for moving ahead

The company’s move comes almost a year and a half after the share capital increase that resulted in filling PPC’s coffers and the reduction of Greek State shares through the Super Fund to just over 34%.

It is worth noting that part of the 1.350 billion euros raised by the company is intended to finance part of its investment program, which also has to do with conventional energy.

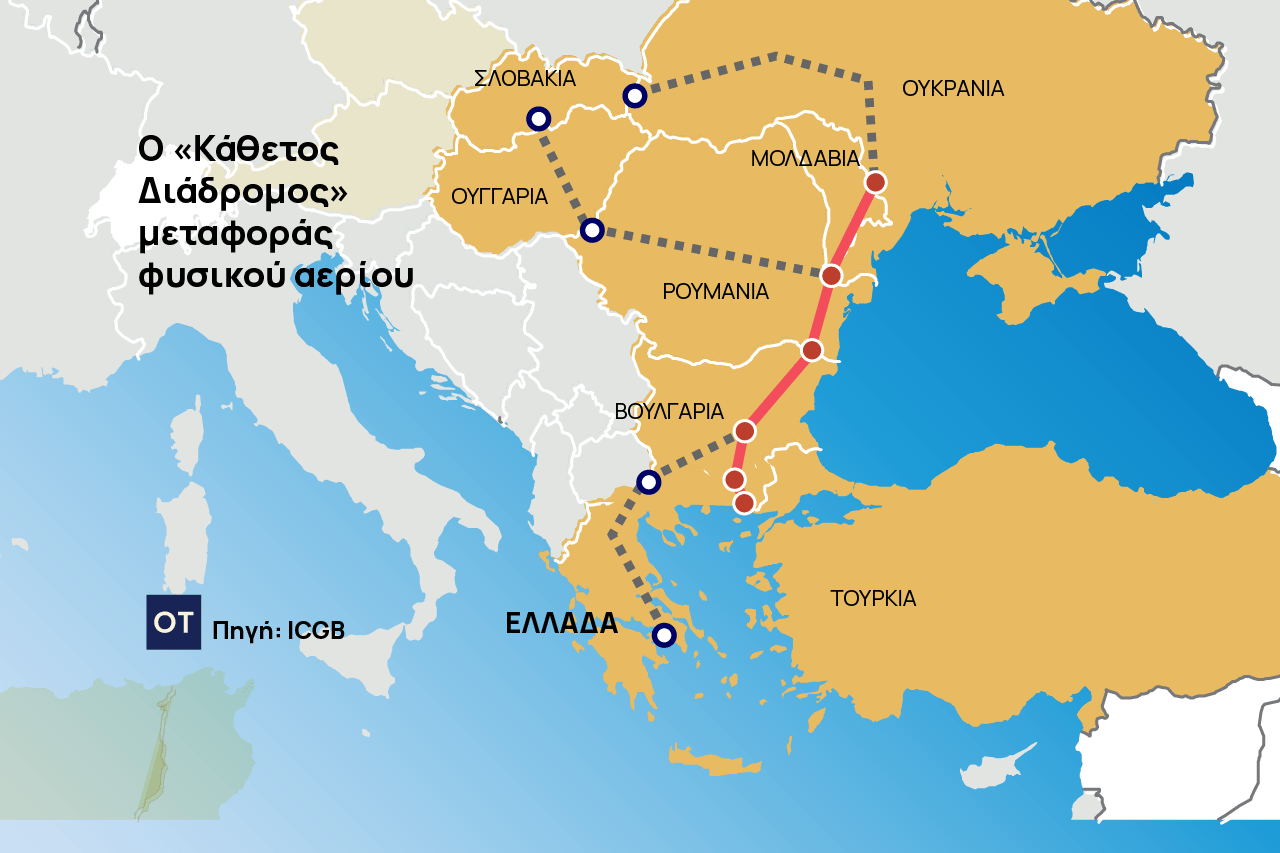

Competent factors who are in a position to know PPC’s strategic move attribute it to the future forecasts for a reduction in natural gas prices as well as to the multitude of options arising from the rapid penetration of LNG. The construction of several FSRUs, globally, as well as four to five in Greece, create conditions for the implementation of such an investment. At the same time, natural gas will be the transitional fuel in the climate-neutral era for the next 20 years, during which RES will gradually become dominant in the energy mix.

Cleaner power generation

Besides, as sources report, the need for cleaner electricity generation – such as provided by natural gas – are increasing in the Balkans and PPC’s joint investment with other private groups also creates prospects for increased profit margins.

The electricity produced will be exported to neighboring countries.

However, the PPC, despite proceeding with the increase of lignite production in order to cover emergency energy needs in the event of interruption of Russian gas flows, considers that de-lignitization efforts have only been delayed by one to two years at most.

“However, 2025 will be see the closure of the lignite units” competent sources told “Vima”, insisting on the company’s decision for large investments in RES as well as for participation in the construction of a natural gas unit. In any case, final decisions on the future of the new lignite unit “Ptolemaida 5” have been put off until next year. That is, what the fuel will be after lignite termination in 2025.

Business plan update

According to reports, PPC is currently working to update its business plan, so that in December this will be ready for presentation to institutional investors.

The same sources note in “Vima” that the company’s investment program will follow in the footsteps of… the renewed National Energy and Climate Plan (ESEK), which is also updated based on the new targets for the penetration of RES and the concerns for energy security brought about by the Russian invasion of Ukraine.

5 billion euros for the development of RES projects

According to the previous strategic business plan that accompanied the share capital increase, the company aims at investing 5 billion euros by 2024 for the development of RES projects, which together with its hydroelectric plants will give it green energy with a total power of 7, 2 gigawatts. Today, PPC only has 200 megawatts of RES, and with the completion of photovoltaic parks in Western Macedonia and Megalopolis, these are gradually increasing. By the end of the year, RES will reach 489 megawatts. For 2026, the threshold will rise to 9.1 gigawatts, as will the amount of investments to 8.4 billion euros.

90% of projects licensed

Management under president and CEO Giorgos Stassis insists on achieving the aforementioned goals, despite the difficulties caused by the pandemic and the energy crisis in the smooth operation of the supply chain. The key is the fact that 90% of the projected portfolio is already licensed, i.e. ripe for the start of construction processes.

DEPA Commercial contacts for investments in a natural gas plant

With a view to verticalizing activities, DEPA Commercial is staking a claim for a share of the pie in power generation.

According to “Vima” information, the company, after the freezing of its sale procedures by the shareholders of the Hellenic Republic Asset Development Fund and Hellenic Petroleum, is seeks to enter into electricity production as well. In this way, its management aims for greater capital gains as alternative scenarios for utilizing the State’s holdings are being explored. One of the things that have fallen on the table is its listing on the Stock Exchange.

licensed Sources state that DEPA Commercial is in discussions with domestic private investors who are ready to build natural gas fueled power generation units. These are already licensed projects and approved by shareholders. The “basket” of natural gas supply options the company already has is what it’s bringing to the table, sources told “Vima”.

The entail contracts with Gazprom, Sonatrach (LNG) from Algeria, the TAP pipeline consortium and quantities of LNG cargoes both from the spot market and from Egypt. A relevant memorandum of cooperation has recently been signed with Egypt. Among its strong negotiating cards is its stake (20%) in the Alexandroupolis FSRU, currently under construction.

Any decisions on its entry into a natural gas plant consortium are expected in the autumn, according to the sources, and in the meantime the company is proceeding with the “greening” of its portfolio through RES projects. The ultimate goal is “green” power generation of 1.5 gigawatts.

Recently DEPA Commercial acquired 100% of NEW SPES CONCEPT which manages 232 MW of photovoltaics. It is also moving for 100% of NORTH SOLAR with 500 MW solar energy projects. Today it owns 49% and has the option of acquiring the majority stake.