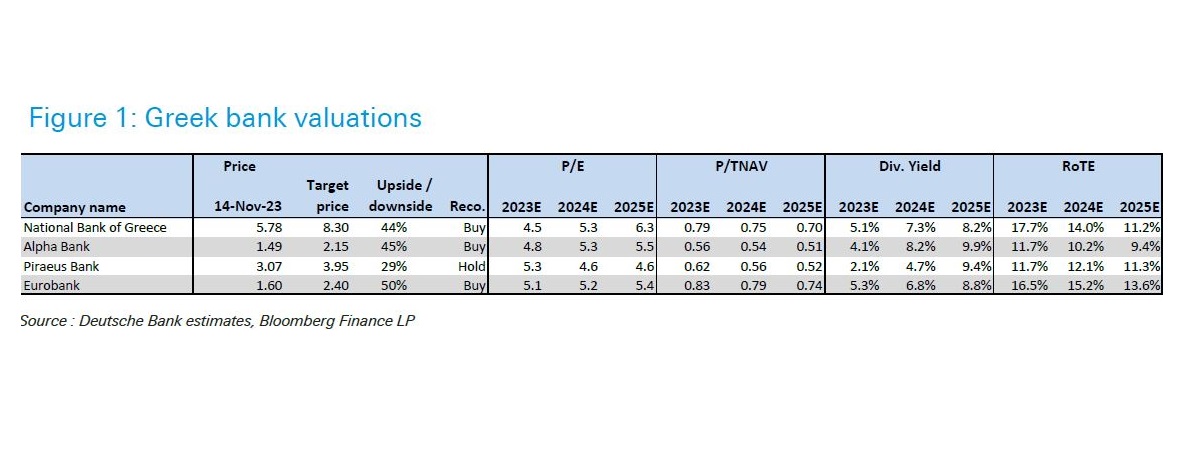

Positive prospects are opening up in the Greek banking sector after the latest moves by the Financial Stability Fund to allocate its stakes to Alpha Bank and National BAnk, according to Deutsche Bank, which even raised the target prices of the bank shares, in order to capture the new updated forecasts for interest income (IIR) and return on capital.

In particular, for National Bank, the target price is increased to 8.30 euros, from 7.10 euros previously, while the recommendation is also upgraded to buy, from neutral previously. For Deutsche Bank, the share of National Bank is its top choice among Greek banks.

Deutsche Bank continues with the buy recommendation on both Eurobank and Alpha Bank, with also improved target prices, to 2.40 euros (from 2.05 euros) and 2.15 euros (from 2 euros) respectively. For Piraeus, the recommendation is hold, but with an increased target price to 3.95 euros from 3.30 euros, as the stock has less room for upside after its excellent performance.

Balance sheets continue to improve

These returns will continue in the current quarter as the improvement in interest income is expected to peak in the fourth quarter of 2023 or the first quarter of 2024 due to European Central Bank interest rates. However, the levels will be maintained, while the contribution of credit expansion will also be important.

According to Deutsche Bank, the Greek banking sector will manage to keep costs under control, with the improvement of credit quality maintaining the downward trend of the provisions. Funds, especially Core Equity Tier 1 ratios are expected to reach 15% – 18% by 2024.

The valuations

The results of the Greek banks confirm the positive course of the sector, as reported by Deutsche Bank, as well as their strong (solid) capital position.

According to Deutsche Bank, the correction of the last interval is mainly attributed to the movements to secure the considerable profits from the beginning of the year, but also the concerns about the disinvestment of the Financial Stability Fund. These concerns are now lifted, especially after the placement for 22% of National Bank, with the shares trading at a Price/Earnings ratio of 5x, based on 2024 estimates and P/TBVs at 0.5x – 0.8x. Evaluations are made with a ROTE efficiency index of 10% – 15%.