The Athens Stock Exchange, which continues to perform lower this year in relation to European markets (+ 8% vs. + 20%), is being tested again after the appearance of the “Omicron” mutation, which adds an additional source of concern, given the early indications. for higher transferability than “Delta”, according to Eurobank Equities estimates. The crucial question is whether or not existing vaccines are effective against the new mutation, which will take two weeks to increase market volatility.

The cost to the economy

According to the stock exchange, despite the assurances of government officials that a complete closure of the economy should be ruled out, however, according to its calculations, a complete two-week lockdown would cost the Greek economy 1-1.2 billion euros, which translates into a slowdown of 0.6% – 0.7% of GDP.

On the other hand, as it estimates, with growth at 7% – 8% in 2021 and 4.5% – 5% in 2022, the general framework seems quite supportive for Greek stocks, despite the well-known international challenges. According to Eurobank Equities, Greek stocks are trading at a 25-30% discount compared to Europe, while “seeing” any correction as an opportunity for placements and an interesting entry point into the market.

Eurobank Equities recommends placements in shares with high and sustainable dividend yields, with limited effects from cost inflation (eg OPAP), shares that offer exposure to the “green transition” (eg PPC, Mytilineos), banks, in view of “Great consolidation” of NPEs, credit expansion and even more attractive valuations (National Bank is top choice) and cyclical shares and securities that benefit from the opening of the economy (OPAP, Mytilineos, Motor Oil).

Latest News

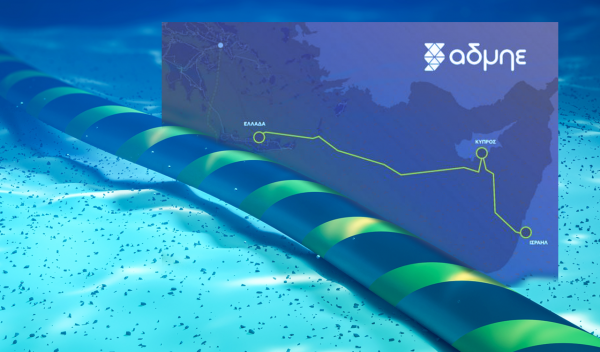

French Fund Meridiam Shows Growing Interest in Great Sea Interconnector

According to OT, the fund engaged in recent discussions regarding the Great Sea Interconnector with Greece’s Minister of Environment and Energy and the CEO of Greece’s Independent Power Transmission Operator (IPTO/ADMIE)

Everything to Know about Store Hours this Holiday Season

Stores and supermarkets across the country are operating extended hours, offering ample opportunities for holiday shopping

Greece Prepares for State Budget Vote as Debate Reaches Final Stages

Prime Minister Kyriakos Mitsotakis is expected to deliver his remarks late in the evening, shortly before the decisive vote that will conclude the session

DM Dendias: We talk With Turkey But We Always Bring Up Their Unacceptable Positions

Second and last day of closely watched conference, entitled 'Metapolitefsi 1974-2024: 50 Years of Greek Foreign Policy', also included appearances by PM Mitsotakis, Ex-PM Tsipras and PASOK leader Nikos Androulakis, among others

Rhodes Airport Tops Fraport Greece’s Regional Airports in 2024 Performance

According to Fraport's data, more than 35 million passengers (specifically 35.2 million) were handled by Fraport-managed airports during the 11 months.

European Central Bank Cuts Interest Rates by 25 Basis Points

It is the fourth cut of interest rates by Europe’s central bank, a move expected by the markets and financial analysts leading to the rate settling at 3%.

Airbnb: New Measures Add €600 in Extra Costs for Property Owners

Property managers face an immediate administrative fine of 5,000 euros if access to the inspected property is denied or any of the specified requirements are not met.

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

Capital Link Forum Highlights Greece’s Economic Resurgence; Honors BoG Gov Stournaras

Capital Link Hellenic Leadership Award recipient, Bank of Greece Gov. Yannis Stournaras, an ex-FinMin, was lauded for his pivotal role during Greece’s economic recovery

![Φυσικό αέριο: Δυναμικό come back του LNG στην Ελλάδα [γραφήματα]](https://www.ot.gr/wp-content/uploads/2023/01/OT_naturalgas-90x90.jpeg)

![Fraport: Πάνω από 35 εκατ. επιβάτες στα αεροδρόμια το 11μηνο – Πτώση στη Μύκονο [πίνακας]](https://www.ot.gr/wp-content/uploads/2022/06/fraport-90x90.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433