By 2023, the Craft Beverage Modernization Act (CBMA) will take a new turn, with new restrictions, but also so many other opportunities for wine exporters.

Alison Leavitt, director of the Wine & Spirits Shippers Association, explained at ProWein how foreign operators can benefit from the unexpected financial gain provided by this law.

For exporters wishing to enter the US market, CBMA opens up interesting possibilities, Sectoral National Agricultural Cooperative Of Vineyard Products KEOSEO points out in a relevant post.

Unbeknownst to both exporters and importers, the Craft Beverage Modernization Act aims to put large entities and small entities on an equal footing by offering tax breaks to the latter. “This law, originally requested by breweries, went into effect on January 1, 2018. No one suspected it would have such a significant impact on the industry,” explained Alison Leavitt, director of Wine & Spirits Shippers Association (WSSA), which is responsible for facilitating the transportation of wines and spirits for its approximately 700 members, during the ProWein exhibition.

Until now, the law has been temporary in nature, undermining its effectiveness. American professionals, including the WSSA, pressured public authorities to make it permanent, a request that was now accepted, but with some significant modifications.

Saving thousands of dollars

From 1 January 2023, importers will have to pay the taxes due and then claim a refund. In addition, the order will no longer be under customs supervision, but will be administered by the US Alcohol and Tobacco Tax Bureau (TTB). The latter is in the process of setting up two management addresses, one for foreign suppliers and the other for importers. In particular, in order to benefit from the tax advantage, exporters must draw up a formal letter in the form of a letter of acceptance, granting the rebate to their importers. “The foreign supplier is the one who decides to whom he will allocate the largest amounts, knowing that we generally choose our main importer. Amounts are reduced depending on the volume of imported wines and spirits. For wine, for example, the discount is $ 1 per gallon (3.79 liters) for the first 30,000 gallons (113,700 liters). Savings on alcohol taxes is very important,” explains Alison Leavitt. “In one container they represent $ 36,000.”

An unknown law

The changes made for the beginning of 2023 will not change the foreseen amounts, except for the registration system in TTB. “There is a high probability that the two addresses that are being prepared will not be ready at the beginning of next year, but in any case the statements will be made from the end of the first quarter onwards.” Until then, WSSA will continue to raise awareness of the various actors in the supply chain about the existence of this tax advantage. “At least 25% of importers are not aware of this possibility. Some find it very complicated and even customs brokers do not necessarily want to bother. We have to assign the hard work to them!”

And yet, the consequences are obvious, especially in the context of price spikes. This tax cut could even encourage American entrepreneurs to relocate their branded wines to their advantage. Or the benefits could simply be shared between the two. ” Alison Leavitt sees another non-monetary benefit in this: “For producers who are aware of this, CBMA can help them penetrate the US market. It gives a clear advantage to foreign producers. Everyone should be aware of its existence, we need to convey this message loudly and clearly.”

Latest News

Greek PM Announces Sweeping Changes in 2025 State Budget

These measures aim to foster fairer banking practices and enhance the availability of affordable housing and credit

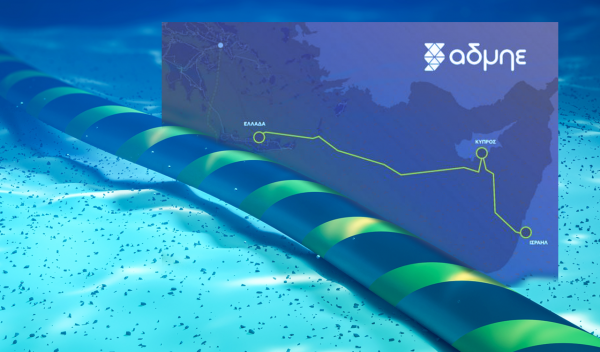

French Fund Meridiam Shows Growing Interest in Great Sea Interconnector

According to OT, the fund engaged in recent discussions regarding the Great Sea Interconnector with Greece’s Minister of Environment and Energy and the CEO of Greece’s Independent Power Transmission Operator (IPTO/ADMIE)

Everything to Know about Store Hours this Holiday Season

Stores and supermarkets across the country are operating extended hours, offering ample opportunities for holiday shopping

Greece Prepares for State Budget Vote as Debate Reaches Final Stages

Prime Minister Kyriakos Mitsotakis is expected to deliver his remarks late in the evening, shortly before the decisive vote that will conclude the session

DM Dendias: We talk With Turkey But We Always Bring Up Their Unacceptable Positions

Second and last day of closely watched conference, entitled 'Metapolitefsi 1974-2024: 50 Years of Greek Foreign Policy', also included appearances by PM Mitsotakis, Ex-PM Tsipras and PASOK leader Nikos Androulakis, among others

Rhodes Airport Tops Fraport Greece’s Regional Airports in 2024 Performance

According to Fraport's data, more than 35 million passengers (specifically 35.2 million) were handled by Fraport-managed airports during the 11 months.

European Central Bank Cuts Interest Rates by 25 Basis Points

It is the fourth cut of interest rates by Europe’s central bank, a move expected by the markets and financial analysts leading to the rate settling at 3%.

Airbnb: New Measures Add €600 in Extra Costs for Property Owners

Property managers face an immediate administrative fine of 5,000 euros if access to the inspected property is denied or any of the specified requirements are not met.

Economist: Greece Included in the Best Performing Economies in 2024

Meanwhile, Northern European countries disappoint, with sluggish performances from the United Kingdom and Germany.

EasyJet Expands Its Routes from Athens

The airline’s two new routes will be to London Luton and Alicante and they will commence in summer 2025.

![Φυσικό αέριο: Δυναμικό come back του LNG στην Ελλάδα [γραφήματα]](https://www.ot.gr/wp-content/uploads/2023/01/OT_naturalgas-90x90.jpeg)

![Fraport: Πάνω από 35 εκατ. επιβάτες στα αεροδρόμια το 11μηνο – Πτώση στη Μύκονο [πίνακας]](https://www.ot.gr/wp-content/uploads/2022/06/fraport-90x90.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433